The second attempt by US President Donald Trump to cancel some of the key provisions of the health insurance program, also known as Obamacare, once again failed. All democrats, as well as four representatives of the Republican party, voted against the amendment leading to the defeat of Trump. Opponents of the program cancellation explained their decision saying that they first need to develop an alternative before cancelling the old system, and not vice versa, as proposed by Trump.

The defeat turned into a fall in the dollar index because it indicates the weakness of the administration's positions.

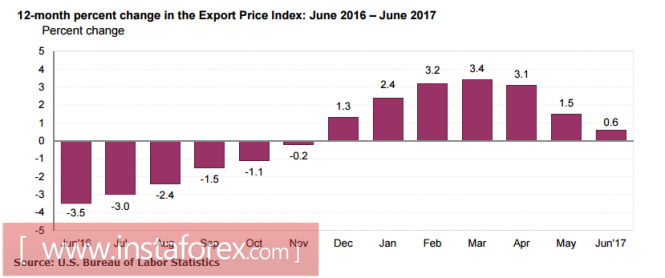

There is also no support from macroeconomic data. The Federal Reserve Bank's index of manufacturing activity grew by 9.8p in July, which is significantly lower than the 19.8p of the previous month. The Ministry of Labor's report on import and export prices also confirmed the general slowdown of inflation. At this rate, it is quite possible to expect the return of deflationary risks in a few months.

On Monday, US Treasury Secretary Steven Mnuchin said that the tax system facilitates the withdrawal of huge funds abroad because companies do not want to pay taxes at inflated rates. Mnuchin actually outlined the transition to achieve actions to promote the tax reform plan promised by Trump during the pre-election race. After the announcement of the main provisions in April, investors has since been waiting for a detailed plan which seems to be approaching.

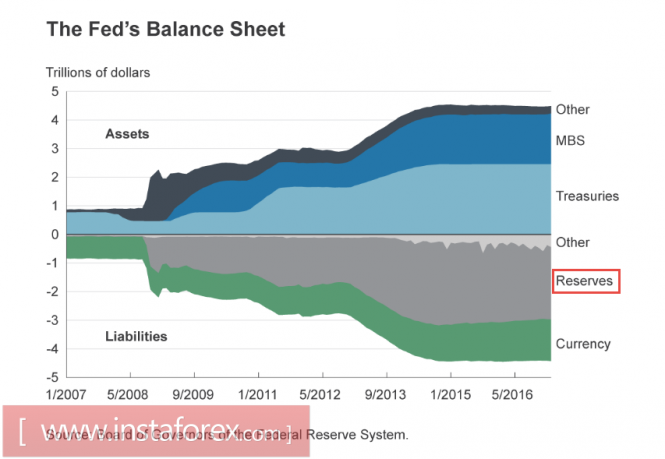

The Trump administration has very little time left to get a positive result before the end of the current financial year. As most experts believe, the Fed will continue the policy normalization even against the threat of slowing inflation and the impending September meeting where the Fed can announce the beginning of the reduction of balance sheets. This process should begin after the release of a detailed tax reform because the reduction of balance sheets by the Fed implies a simultaneous reduction on both assets and liabilities. And if everything is clear with the assets (the Fed presented a plan for gradual reduction of the balance sheets of MBS and Treasuries at the last meeting), then the only way to reduce liabilities is to return excess reserves to commercial banks.

This means that the method introduced in 2008 to raise funds for the implementation of quantitative easing of programs in the form of increased rate on excess reserves of commercial banks should be changed so that the banks can start withdrawing their resources from the Fed's corresponding accounts. And if the tax reform does not get a specific look by this time, then the commercial banks will simply withdraw their reserves into instruments with appropriate profitability and reliability instead of financing the US re-industrialization program. Who will guarantee that these funds, which they currently have more than 2 trillion of, will remain in the US?

Adding in a decrease in tax collection and rapid increase in budget deficit, which threatens the the new fiscal year beginning October 1, the administration will have to meet simultaneously with the onset of technical default. The limit of the national debt has been exhausted in the spring that's why financing the current activities of the government may be suspended in the next two months. To resolve the issue of the ceiling of borrowing, there must be a positive decision from the Congress which is likely to require a detailed plan for tax reform at the outset.

Thus, the second half of the summer promises to be hot. The dollar is under strong pressure which will persist until there is clarity on the issues mentioned above.

The material has been provided by InstaForex Company - www.instaforex.com