Eurozone

The euro ended the week on a positive note. In the absence of significant macroeconomic news, investors are beginning to shift their focus on the rhetoric of top ECB officials who are becoming more aggressive. The policy stimulus against the background of rapid economic growth is nearing the end, in this the market is almost sure.

On Monday, the Sentix investor confidence indicator will be released which is expected to confirm the positive changes in the euro area. On Wednesday, data on the industrial production will be published while on Thursday, the report on German consumer inflation will be announced. In general, the week is expected to be calm. Important publications of macroeconomic data are not planned and the favorite will still be the euro and dollar pair.

The attempt to overcome resistance at 1.1450 remains likely.

United Kingdom

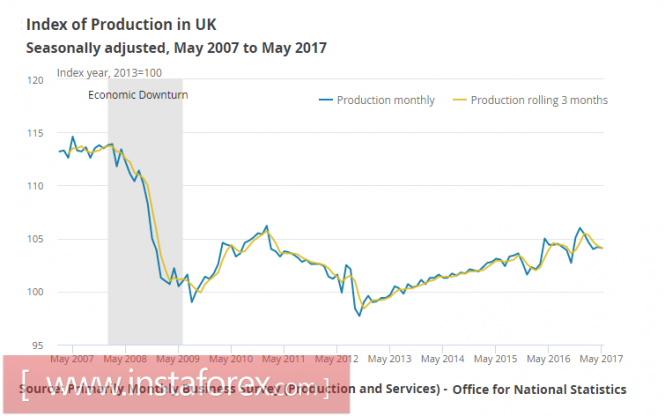

The British pound fell to a 9-day low after a number of macroeconomic indicators were published. Industrial production in May declined by 0.1%. Despite experts forecasting a 0.3% year-to-year increase, the index could not get out of the negative zone with a decrease of 0.2%. Meanwhile, the manufacturing industry lost 0.4% which surprised the market.

An additional blow was the trade balance report. The deficit once again rose in May, this time to 11.9 billion pounds, an amount that is well above the last month's 10.6 billion. The analysts forecast turned out to be too optimistic.

The National Institute for Economic and Social Research (NIESR) estimated the UK's GDP growth to be at 0.3% in the second quarter which is the same recorded growth rate in the first quarter. Thus, economic growth remains below the long-term trend goal of 0.6%, which may call into question the Bank of England's commitment in scaling back stimulus programs.

The pound was significantly hit. The data shows that the expected recovery in the second quarter did not happen and a strong depreciation of the national currency has not led to a surge in activity in the real economy. Of course, the industrial production growth rate is not the main factor in the economic stability in the post-industrial way of life with the level of consumer demand being much more important. The Bank of England may have to find arguments to start rolling incentive policies. At the same time, Mark Carney's activities in recent weeks where he repeated the likelihood of hiking interest rates earlier than expected can be regarded by the market as an attempt to slow down inflation in a weak economy. How investors will react and whether the pound will find the strength to return to its growth path are events that will show in the upcoming week.

The key data for the pound will be seen on Wednesday when the report on employment will be released. The rate of wage growth will also be published on this day. In light of recent data, wage growth rates can also be a key factor in assessing the pound's prospects. Prior to the data release, the pound did not have an explicit driver. It will start the week in search of a new idea.

Oil and ruble

Oil prices are in a downward trend. There are almost no factors capable of turning the market in favor of the bulls. The search for balance has obviously dragged on.

For the ruble, the situation worsens. Published on Thursday, the inflation report was a surprise to analysts, Inflation in June rose by 0.6% against the forecast of 0.4%. The annual growth was at 4.4%, surpassing the 4.2% prediction. According to analysts, the rising inflation is caused by the cold weather which led to an increase in cost of agricultural products, gasoline prices, and tariffs for passenger transport and tourist services.

Adding to this noticeable drop in stock market is the growing doubts that the Bank of Russia will continue to maintain the policy of reducing interest rates against the background of rising inflation and consistent lower-than-expected oil prices. These factors put pressure on the ruble which is finding it increasingly difficult to find reasons for further strengthening. Under the current conditions, the probability of moving to 61.00/08 followed by an exit to the growth trajectory of 64.50 which looks much higher than a week ago.

The material has been provided by InstaForex Company - www.instaforex.com