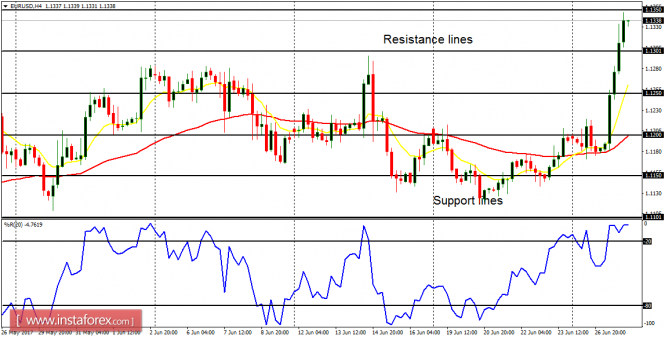

EUR/USD: The EUR/USD has gained about 150 pips this week, to continue the bullish movement that gradually started in the last few trading days of last week. Price is now between the support line at 1.1300 and the resistance level at 1.1350 (and the resistance level would soon be breached to the upside). There is a very strong Bullish Confirmation Pattern in the market, which signals further northward journey.

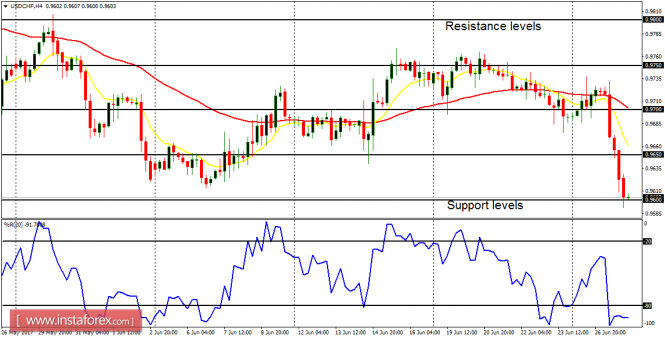

USD/CHF: This currency trading instrument went downwards yesterday, in what could be called an end to the gradual downwards movement that started last week. The market lost 120 pips, enabled by the rise of the EUR/USD. The support level at 0.9600 has been tested and it would soon be breached to the downside.

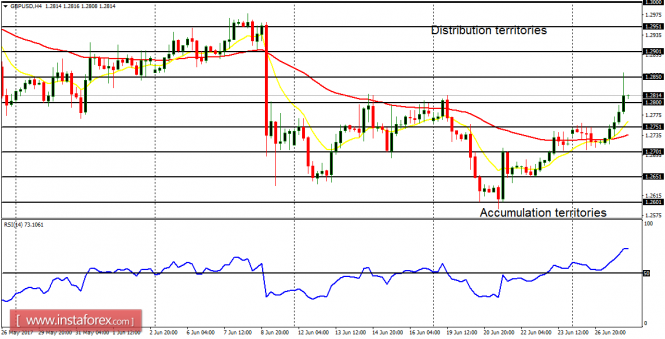

GBP/USD: The Cable also shot upwards yesterday, briefly testing the distribution territory at 1.2850 before the retracement we are seeing right now. Needless to say, there is a now a Bullish Confirmation Pattern in the 4-hour chart, and further upwards movement is anticipated as price goes towards the distribution territories at 1.2900, 1.2950, and the ultimate target, 1.3000. Price would first break the distribution territory at 1.2850, which was already tested yesterday.

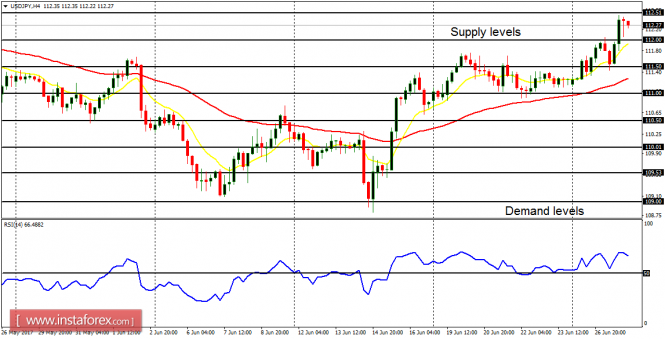

USD/JPY: The movement on this pair, which is also bullish, has not been as strong as that of the EUR/JPY. The EMA 11 is above the EMA 56, and the RSI period 14 is above the level 50. This means the market is supposed to continue going upwards, reaching the supply levels at 112.50, 113.00 and 113.50.

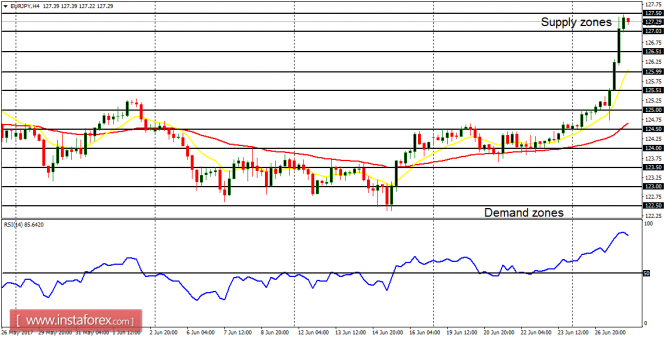

EUR/JPY: The EUR/JPY has gone upwards by 300 pips this week, ending the recent tight consolidation which happened last week. Price is now above the demand zone at 127.00, almost reaching the supply zone at 127.50. After that, the price would go towards the supply zones at 128.00 and 128.50.