Overview:

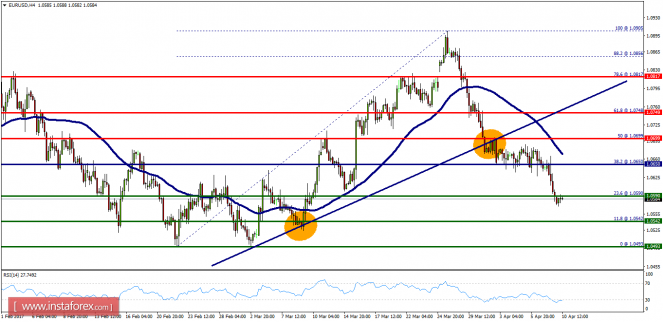

- The market opened below the weekly pivot point (1.0650). It continued moving downwards from the level of 1.0650 to the bottom around 1.0579. Today, the first resistance level is seen at 1.0650 followed by 1.0699, while daily support 1 is seen at 1.0542. The EUR/USD pair broke support, which turned into a minor resistance at 1.0590 this morning. The pair is trading below this level. It is likely to trade in a lower range as long as it remains below the resistance that is expected to act as a minor resistance today. This would suggest a bearish market because the RSI indicator is still in a negative area and is not showing any signs of a trend reversal at the moment. Amid the previous events, the EUR/USD pair is still moving between the levels of 1.0590 and 1.0493, so we expect a range of 97 pips in coming hours. Therefore, the minor resistance can be found at 1.0590 providing a clear signal to sell with a target seen at 1.0542. If the trend breaks the minor support at 1.0542, the pair will move downwards continuing the bearish trend development to the level of 1.0493 in order to test the double bottom on the H4 chart. Overall, we still prefer the bearish scenario, which suggests that the pair will stay below the zone of 1.0650 today.