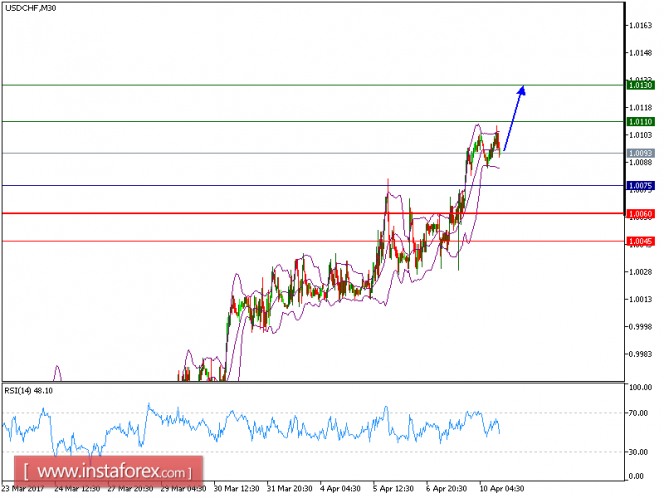

USD/CHF is expected to trade in a higher range. The pair is trading above its rising 20-period and 50-period moving averages, which play support roles and maintain the upside bias. The relative strength index is bullish above its neutrality level at 50 and calls for a further advance.

The U.S. Labor Department reported that only 98,000 nonfarm payrolls were added in March, the smallest growth since last May and much lower than +175,000 expected. However, the jobless rate dropped to 4.5%, its lowest level since May 2007, from 4.7% in February. Average hourly wages increased 0.2% on month as expected.

The U.S. missile strike on Syria following the chemical-weapons attacks in that country earlier last week impacted the financial markets most in Asian trading hours, helping to send gold and oil prices higher. Meanwhile, the summit between U.S. President Donald Trump and Chinese President Xi Jinping yielded no marked progress on issues of trade and North Korea.

The U.S. dollar experienced a selloff initially on an apparently-softer-than-expected U.S. jobs report. But it bounced back once investors noted that, apart from continued layoffs in the beat-up retail sector, snowstorms contributed to the weakness in job gains. They also saw a drop in the jobless rate to a near 10-year low of 4.5% as a sign of strength in the labor market.

Hence, as long as 1.0075 holds on the downside, a new rise to 1.0110 and even to 1.0130 seems more likely to occur.

Resistance levels: 1.0110, 1.0130, and 1.0165

Support levels: 1.0060, 1.0045, and 1.000

The material has been provided by InstaForex Company - www.instaforex.com