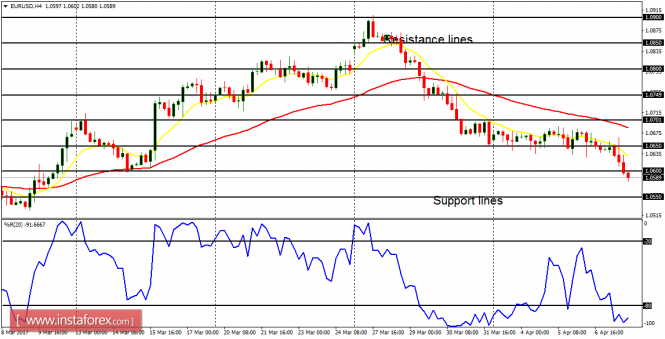

EUR/USD: The EUR/USD pair consolidated from Monday till Friday and then trended southwards on Friday. The outlook in the market (as well as other EUR pairs) is bearish. Further bearish movement is expected as the price goes towards the support lines at 1.0550 and 1.0500.

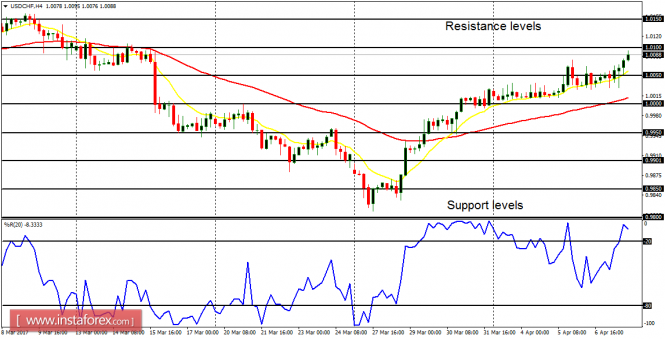

USD/CHF: This pair went sideways in the first few days of last week and then trudged upwards gradually in the last few days of the week. The price has moved close to the resistance level at 1.0100. Once that resistance level at 1.0100 is breached to the upside, the price would go towards other resistance levels at 1.0150 and 1.0200. The demand levels at 1.0050 and 1.0000 would try to hinder any pullbacks along the way. As long as EUR/USD is strong, USD/CHF would be weak.

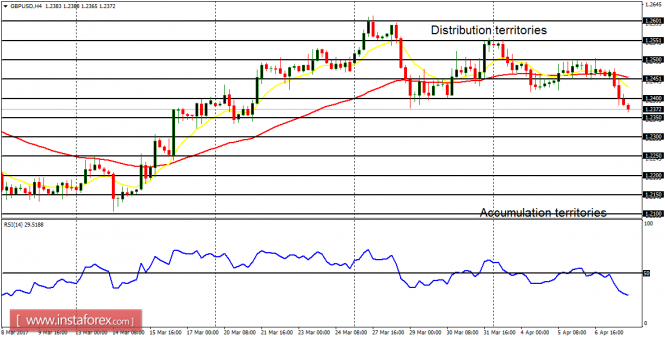

GBP/USD: This currency trading instrument moved sideways last week. The price has moved between the distribution territory at 1.2550 and the accumulation territory at 1.2350. A movement above the distribution territory at 1.2550 is more likely than a movement below the accumulation territory at 1.2350. The outlook on this currency instrument, as well as other GBP pairs, is bullish for this month. So when there is a breakout in the market, it would most probably be in favor of bulls.

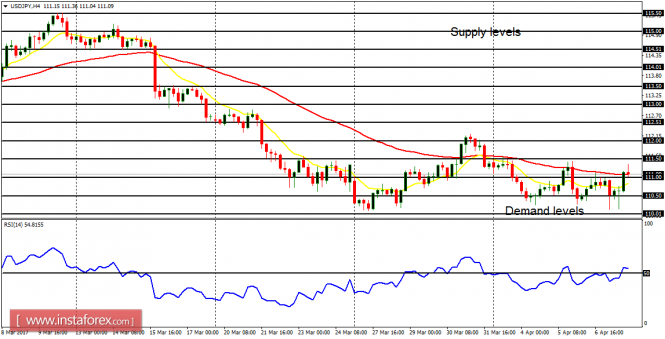

USD/JPY: Last week, this currency trading instrument consolidated between the supply level at 111.50 and the demand level at 111.00. A break above the supply level or below the demand level is anticipated this week. However, the most probable direction is towards the demand level at 110.00, and after it is breached to the downside, the price would move further downwards. It should be borne in mind that the outlook on JPY pairs is bearish for this week and this month.

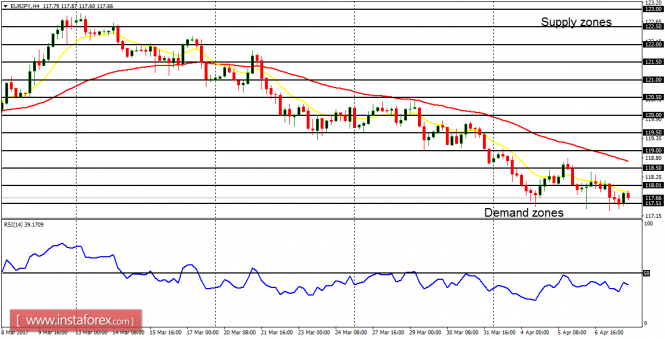

EUR/JPY: The EUR/JPY pair dropped 110 last week, testing the demand zone at 117.50 many times without being able to breach it to the downside. The price has dropped about 500 pips since March 13, 2017 and further downward movement is anticipated this week. One factor aiding the bearishness in the market is the weakness in EUR itself. The targets for this week are thus located at the demand zones at 117.00, 116.50, and 116.00.