Bitcoin is down 20% from all-time highs reached earlier this month as many investors begin to take profits as a new variant of the coronavirus is causing panic and sell-off of risky assets.

Coronavirus has reached Bitcoin

The world's largest cryptocurrency fell 8.9% to 53,624 on Friday, while Ether, the second largest digital currency, fell more than 12%. A new variant of the coronavirus strain was recently identified in southern Africa, which led to the closure of a number of long positions. The option of quarantining European countries and introducing stricter restrictions up to a lockdown now does not seem as ghostly as it used to be.

This week, many European politicians talked about such a need if the situation with the spread of the virus gets worse, and then a new more infectious, and rapidly spreading strain only adds to the nervousness and uncertainty. Frankly speaking, the correction has been asking for a long time, but many expected that it would not be as fast and aggressive as in May of this year.

Currently, the rate is near its 100-day moving average of $53,940, which served as support during the pullback at the end of September this year. But, judging by the mood, the matter will not be limited to it. We will talk about the technical picture a little below.

Some traders expected a different development of events and looked at the market rather optimistically, hoping for a Santa Claus Rally, but now the chart suggests that the weekend will be rather tense.

Keep in mind that Bitcoin has been out of favor lately due to US tax reporting requirements for digital currencies and China's fierce regulatory constraint. Surely, this will continue to affect the risk appetite in the speculative sector.

However, don't panic. Let's take a look at a few graphs:

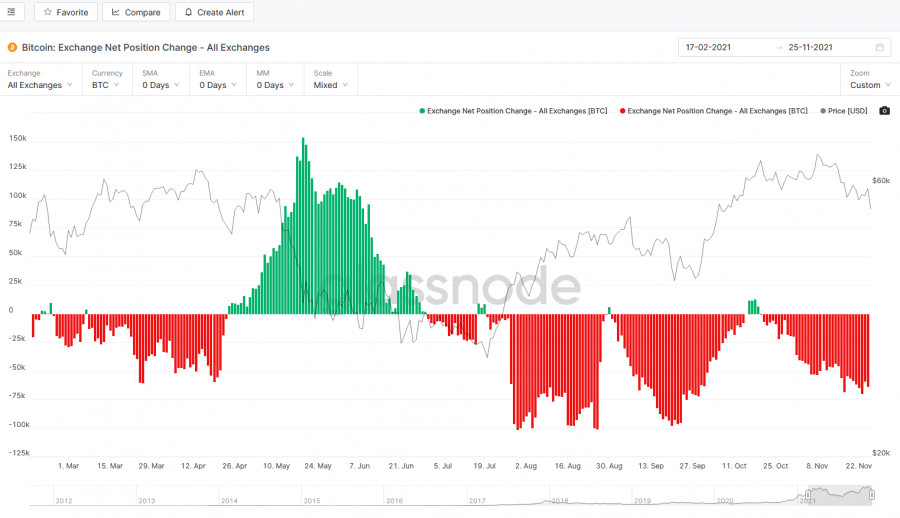

It can be seen that coin holders are not yet rushing to exchanges, which will be additional evidence of the growing hysteria in the cryptocurrency market.

The Exchange Net Position Change - All Exchanges chart shows no significant influx into exchanges, which confirms the wait-and-see attitude of many players and their belief in the future of cryptocurrencies.

There are no major changes in Bitcoin: Reserve Risk. On the contrary, the attractiveness of cryptocurrencies only grows as the rate depreciates - this suggests that traders will actively buy coins using lower prices. Many expect such a market decline to be nothing more than a correction in an upward trend. Do not forget that today our options for bitcoin and ether are expiring, which can only heat up the markets and lead to a surge in volatility.

Governor of the Bank of England Andrew Bailey

In conclusion, I would like to say a few words about a recent interview with the Governor of the Bank of England, Andrew Bailey, who said that El Salvador's decision to make bitcoin equal to the national currency is worrisome because consumers will clearly be affected by its volatility.

"I am worried that a country might choose bitcoin as its national currency," Bailey said, answering a question during a speech at the University of Cambridge's student union. "What worries me the most is whether the citizens of El Salvador understand the nature and instability of the currency they own." He added that the International Monetary Fund, which monitors risks to global financial markets, is unhappy with El Salvador.

The Bank of England is currently exploring the possibility of creating its own digital currency system to simplify online payments and provide consumers with a secure way to store cash that will keep up with blockchain technology. "There is a strong case for digital currencies, but we think they need to be stable, especially if they are used for payments," Bailey said.

As for the technical picture of Bitcoin

The failure of the $55,700 support creates a lot of trouble for traders. Ahead is the test of the $53,190 level, which is located exactly behind the 100-day moving average. Going beyond this range will increase the panic, which will push the first cryptocurrency into the $50,200 and $47,200 areas - that's where you really should be afraid of what is happening, since below this level we have only a 200-day moving average. Its breakdown will be a signal for the formation of a bearish trend. It will be possible to talk about the stabilization of the situation only after the bulls manage to return above $55,700 and gain a foothold in this range with the prospect of recovery to the $60,000 area.

As for the technical picture of the Ether

At the moment, its pullback is not as significant as that of Bitcoin, for the reason that the cryptocurrency has grown significantly in the past few days. Now they are actively buying ether around the level of $3,900, which is generally not surprising - I have repeatedly drawn attention to this support. Its breakdown will not be a catastrophe either, as the 100-day moving average passes below, which is slightly above the support of $3,680. But the breakdown of this area will significantly worsen the prospects for ETH recovery in the near future, which will add panic to the market and bring it down to the $3,400 area. It will be possible to talk about the stabilization of the situation only after the bulls manage to return above $4,140 and consolidate on this range with the prospect of recovery to the $4,360 area.

In any case, the weekend is pretty hot. As long as the whole world is happy to spend money on Black Friday, the markets will do their dirty work.

The material has been provided by InstaForex Company - www.instaforex.com