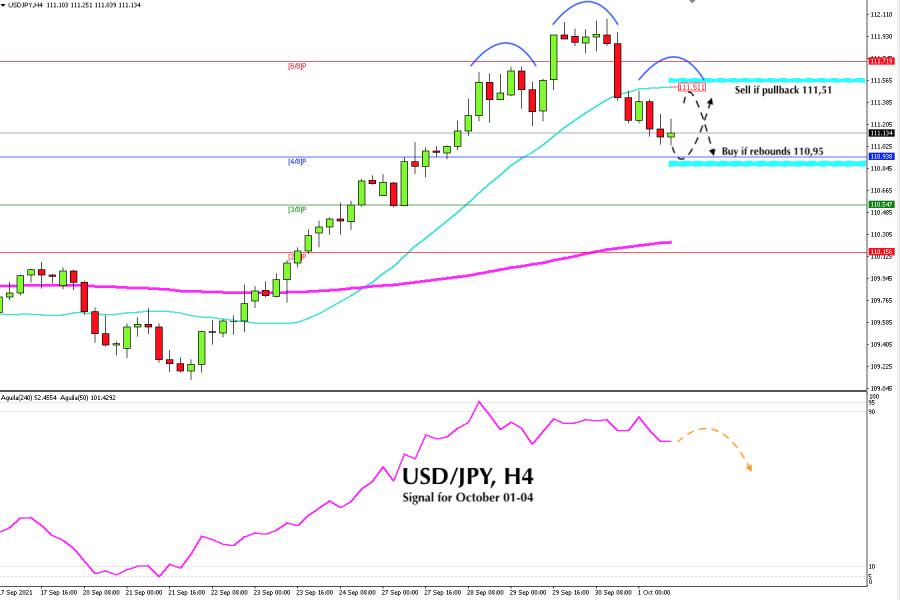

Since September 22, the Japanese Yen made a bullish rally from 109.10 until reaching a maximum of 112.06 on September 30. In 8 days, the pair has weakened almost 300 pips. It is likely that after all this upward movement, there will be a consolidation below the key level of 112.00 and correction towards support of 110.93. This zone represents a pivot point.

According to the 4-hour chart, we notice a formation of a head&shoulder pattern. The last right shoulder is likely to be in progress. We expect a pullback towards 111.51. If the pair fails to break, the formation of this pattern will be confirmed.

In addition, the 21 SMA located at 111.51 and the 6/8 Murray located at 111.71 have now become strong resistance for the pair. Any bounce towards these levels will be a sell signal, while USD / JPY remains below both levels, the downward pressure may increase and there could be a decline towards the 200 EMA located at 111.51.

The dollar seems to be consolidating gains after having risen to the one-year highs against its main rivals. After reaching +2/8 of murray at 94.49, the US dollar index is making a technical correction. In the 4-hour chart, it is trading around the 21 SMA. If the index breaks this level and consolidates below, it will be a sell signal for USD / JPY and the price may fall to 3/8 of a murray at 110.54. If the downward pressure prevails, the pair could reach up to 110.51 area of the 200 EMA.

According to the daily chart, the outlook for USD / JPY is still biased to the upside. This downward movement can be considered a correction. So, as long as the pair remains above the EMA of 200 and the psychological level of 110.00, a new upward movement cold resurface again that could take the price to 113.58, the high of December 12, 2018.

Meanwhile, the short-term range can be between 110.93 - 111.51. We believe that the 4/8 level of murray may offer some support for the Japanese yen. If it consolidates above 110.93, it will be a good opportunity to buy with targets at 111.51 (21 SMA).

Support and Resistance Levels for October 01 - 04, 2021

Resistance (3) 111,71

Resistance (2) 111,50

Resistance (1) 111,30

----------------------------

Support (1) 110,91

Support (2) 110,65

Support (3) 110,20

***********************************************************

Trading tip for USD/JPY for October 01 - 04, 2021

Buy if it rebounds at 110,95 with take profit at 111,51(SMA 21), stop loss below 110,60.

The material has been provided by InstaForex Company - www.instaforex.com