Hello, dear traders! EUR/USD traded coolly on Monday. Despite an empty macroeconomic calendar, the price behaved the same way as on Friday when important data was released. The quote has been moving sideways for four days along the 127.2% retracement level of 1.1552. Until today, sentiment has been bearish because of two descending trend corridors. At the moment, however, the quote is located between them. Nonfarm payrolls were ignored by traders. Today, the macroeconomic calendar is empty. Tomorrow, the US will present its inflation report for September. Traders still expect the Fed to announce tapering at the November meeting. However, due to disappointing statistics, this is unlikely to happen in November. Although the US dollar has not been bearish for more than a month, it may well go down if the US keeps reporting disappointing data from time to time. Traders will not wait forever for decisive action from the Fed.

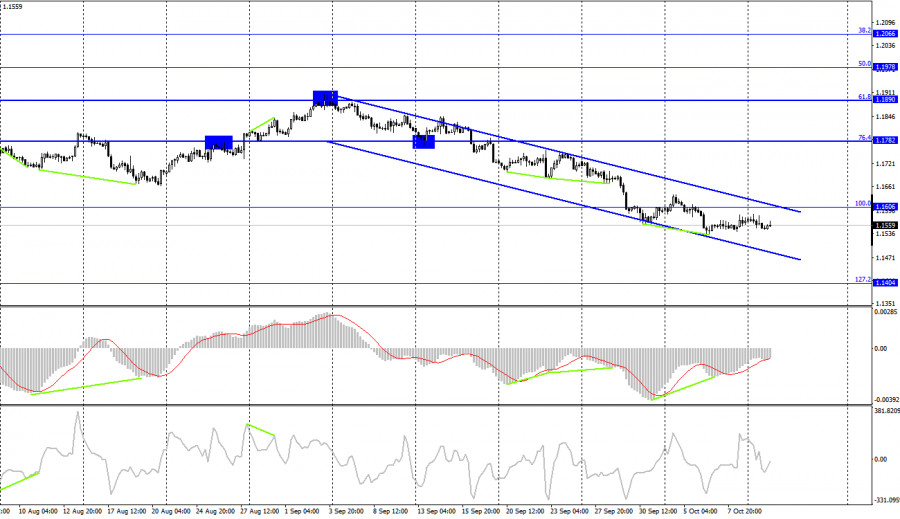

EUR/USD – 4H

On the H4 chart, the quote closed below the 100.0% retracement of 1.1606. The price is likely to fall to the 127.2% retracement of 1.1404. Bullish divergence allows us to assume that the pair may somewhat increase. In case of consolidation above the ascending trend corridor, sentiment may turn bullish. If so, the price may head towards the 76.4% retracement of 1.1782.

Macroeconomic calendar:

The macroeconomic calendar in both the US and the UK is almost empty on September 12. The eurozone's ZEW Economic Sentiment Index is the only interesting report today. However, traders are likely to ignore it as they did to Nonfarm Payrolls data.

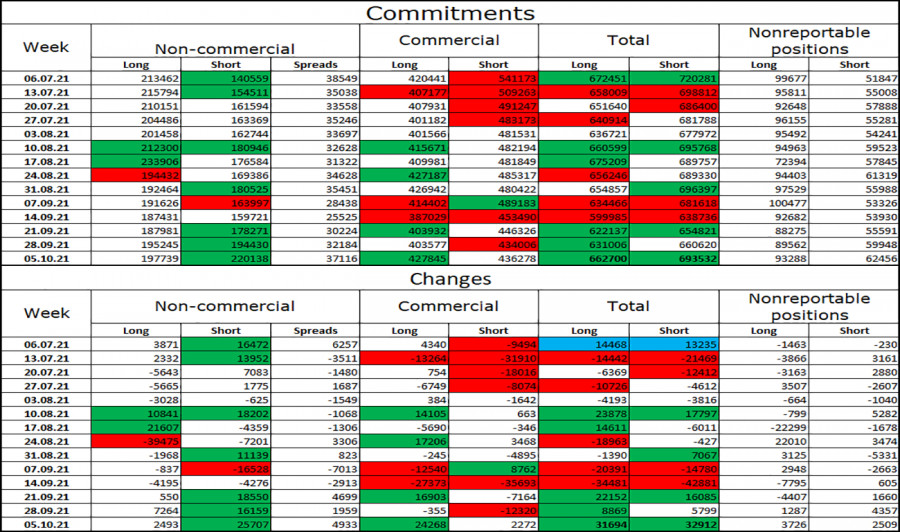

Commitments of traders:

Over the past few months, Non-commercial traders have been closing their long positions and opening new short ones. This trend is still ongoing. Meanwhile, the European currency continues edging down. Thus, the actions of speculators have an effect on the pair. The euro is expected to remain bearish. The latest COT report logged a change in sentiment among Non-commercial traders. During the reporting week, speculators opened 2,493 long positions and 25,707 short ones. The total number of long positions held by speculators increased to 198K and short ones to 220K.

EUR/USD outlook:

It is wise to buy EUR/USD after a bounce from the 127.7% retracement of 1.1552 on the H1 chart with the target at 1.1629. You should consider selling the pair in case of consolidation below 1.1552 on the H1 chart with the target at 1.1450. Remember that EUR/USD is now moving sideways. That is why it is also a good choice to stay outside the market for a while.

TERMS:

Non-commercial traders are major market players: banks, hedge funds, investment funds, private, and large investors.

Commercial traders are commercial enterprises, firms, banks, corporations, and companies that buy currency not to yield speculative profit, but to ensure current activities or export-import operations.

Non-reportable positions are small traders who do not have a significant impact on the price.

The material has been provided by InstaForex Company - www.instaforex.com