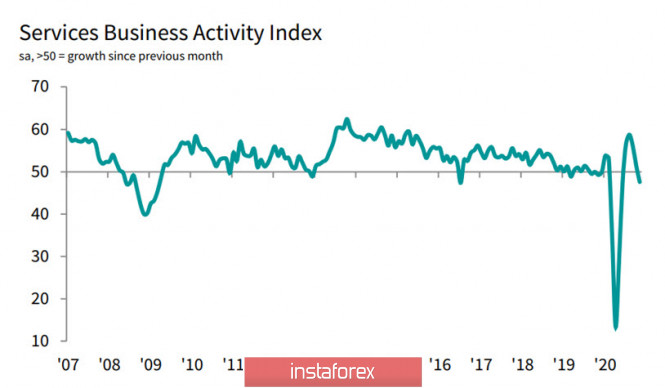

The ISM report on November's business activity in the US services sector was better than expected, which is growing for the six consecutive months. It should be noted that the number of new orders increased by 57.2p, although it was expected to decline by 49.6p. The employment sub index also rose by 51.5p against 50.1p a month earlier.

Before today's NonFarms, the Ministry of Labor added slight optimism – growth of unemployment claims slowed down during the reporting week, which can be considered an indirect sign of a faster-than-expected recovery in the labor market.

On another note, Congress' negotiations for a new stimulus package are getting more intense and will continue over the weekend. In connection with which, Democrats are ready to agree to a package of 908 billion, while Republicans are still insisting on 500 billion. However, there is a rising pressure on Senate Majority Leader Mitch McConnell, so there are good chances that an agreement will be reached soon. If the Democrats manage to convince the majority of the need for a larger package, the markets will perceive this news as positive, which will lead to the decline of the US dollar and growth of commodity currencies.

OPEC+'s decision to increase oil production, but not by 2 million barrels, is also in favor of increasing demand for risk per day, but only by 0.5 million since January. This decision will keep production within the contractual framework and will not allow uncontrolled growth, which will keep quotes at the achieved levels. The market reacted positively, with Brent close to the level of $ 50 per barrel, which is near to a comfortable level for all market participants.

Today, we expect increased volatility after the publication of Payrolls & Unemployment for November, as growing likelihood of uncertainty about the pace of recovery in the US labor market remains. Commodity currencies will take advantage of this, while the dollar remains under pressure.

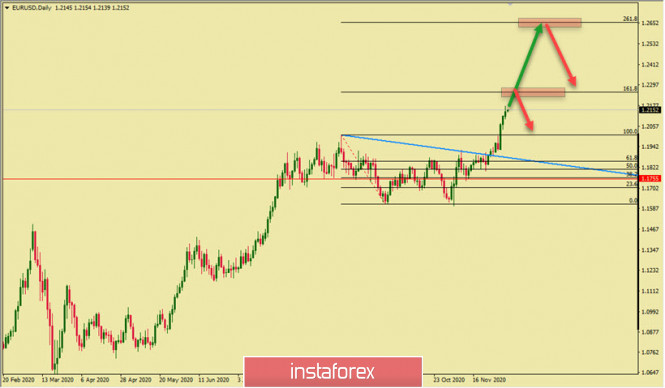

EUR/USD

The euro continues to sharply rise. In the futures market, the net long position is increasing again after several weeks of contraction, while the fixed income markets also recovered from declining for several days.

The continuation of euro's growth is very likely. The current momentum is still strong, although the risk of correction increases with each new point of growth.

The current resistance at 1.2010 has turned into strong support that will limit any bearish activity. The nearest support is located at 1.2035/45, but continued growth is still highly possible than the correction. In this view, Brexit negotiations or inside information from the US where intensive consultations in Congress on the volume of the new stimulus package continue, will contribute to the growth.

The target can be noted at 1.2240/60, in case of such a positive signal.

GBP/USD

Brexit negotiations between the UK and the EU are taking place almost everyday, but there was no news of possible progress this morning. Despite this, the pound is trading as if there is already a successful trade deal. Yesterday, there was an unsuccessful attempt to break through the resistance level of 1.3480, and it is highly likely that another attempt will be made today.

In the past, the pound would certainly have responded with a decline on the return of the PMI in the services sector below 50p, but not this time. A drop below 50 points means that the UK economy is starting to contract again amid new restrictive measures.

Perhaps, the pound is reacting not so much to the expected success in the negotiations, but to the fact that UK regulators have allowed the use of Pfizer's vaccine and the first vaccinations are expected next week. However, a similar permit for the use of the Pfizer vaccine in the EU has not been received – EMA promises to give its opinion within a few weeks.

Technically, the pound is in an upward channel. The resistance at 1.3480 coincides with the middle of the channel, which makes it especially valuable to break through.

If the positive trend develops and the pound breaks upwards, there will be no strong resistances up to the level of 1.4350/4400. In this case, we can expect growth to the border of the channel 1.3900/50, where consolidation is possible.

The material has been provided by InstaForex Company - www.instaforex.com