In theory, the single European currency was supposed to decline for almost the entire day, but it weakened only for a while, afterwards it began to steadily grow. It all started when European macroeconomic reports were released, which turned out to be completely different from what was expected. The rate of decline in producer prices, as expected, slowed down to -2.0%. But not -2.4%, but from -2.3%, since the previous data were revised. But the largest revision was made to the unemployment rate report. Not only was the data for the previous month revised from 8.3% to 8.5%, but all data for the last three months were revised. As a result, it turned out that all this time unemployment in Europe did not grow, but instead it decreased, and at the moment it has reached the level of 8.4%. Therefore, it turns out that the situation on the labor market in Europe is completely different from what was previously assumed, which was the reason why the euro started rising.

Unemployment rate (Europe):

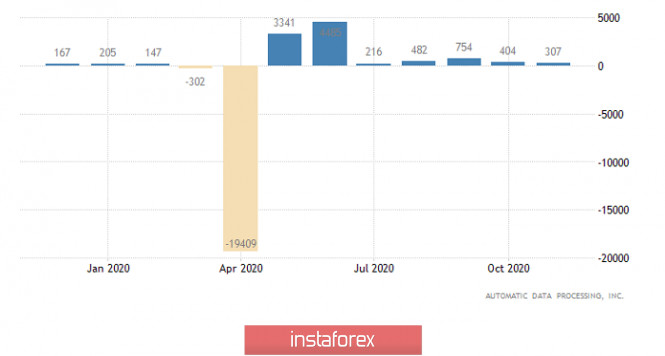

The dollar continued to lose its positions after employment data was released, since employment grew by only 307,000, instead of the expected 370,000. The previous data was revised upwards, from 365,000 to 404,000. However, that particular improvement does not compensate for the weak employment growth.

Employment Change (United States):

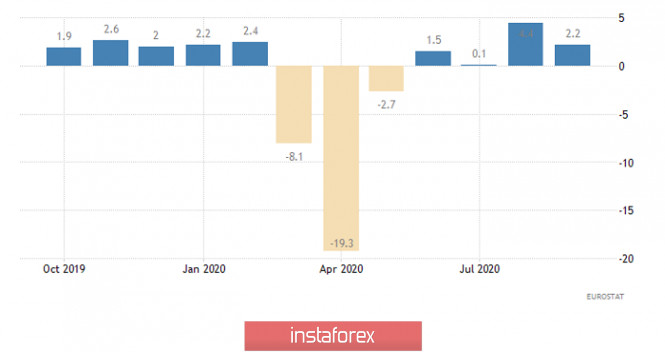

The final data on the index of business activity in the services sector, as well as the composite index will be published today. Preliminary data showed that the service sector index fell from 46.9 to 41.3, and the composite index, from 50.0 to 45.1. But here we need to recall the index of business activity in the manufacturing sector, which came out much better than the preliminary estimate. So it is quite possible that other indices will be slightly higher. But more importantly, the growth rate of retail sales in Europe should accelerate from 2.2% to 2.6%, which will somewhat compensate for the negative impact of prolonged deflation.

Retail Sales (Europe):

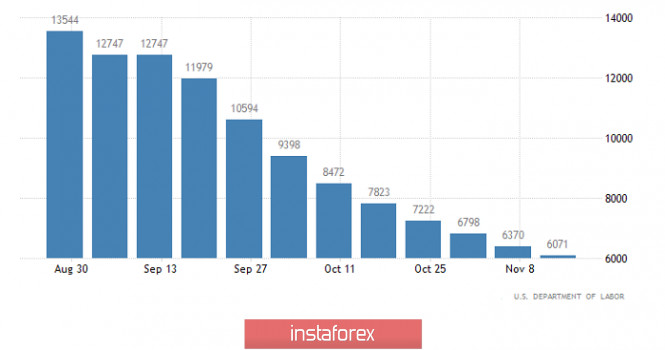

The US manufacturing PMI matched the preliminary estimate, so the same should be expected from the services index, along with the composite index. A preliminary estimate showed an increase in the business activity index in the service sector from 56.9 to 57.7 and a composite index from 56.3 to 57.9. But since the data should coincide with the preliminary estimate, then they will not affect the market in any way. In contrast to the data on applications for unemployment benefits, the total number of which should continue to fall. Thus, the number of initial applications may decrease from 778,000 to 774,000.The number of repeated applications should decrease from 6,071,000 to 5,890,000. What is important here is that the number of repeated applications may drop below the six million mark for the first time since the beginning of the coronavirus pandemic. This could have a psychological impact and investors will begin to look with renewed optimism on the dollar's outlook.

Repetitive Unemployment Insurance Claims (United States):

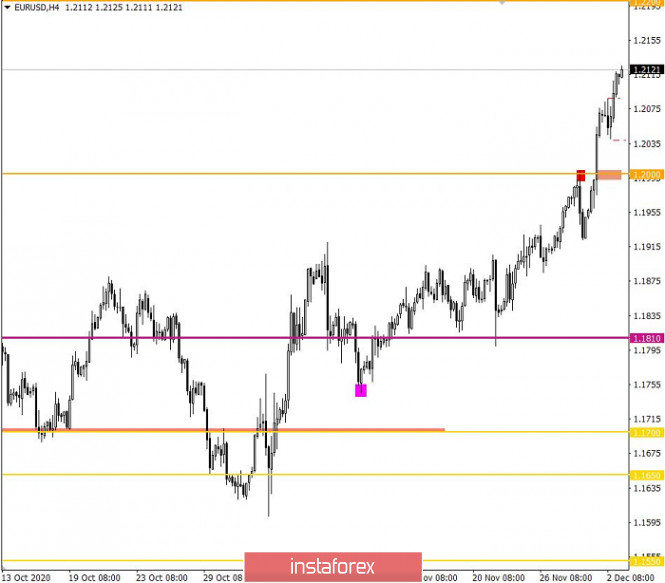

After a slight rollback, the EURUSD pair went back to moving up, which means that the quote is firmly above the psychological level of 1.2000. The European currency has strengthened by more than 200 points since the beginning of the trading week, which is considered a rapid price change in the market, where the overbought factor should not be excluded from consideration.

Volatility is high, as evidenced by the growing speculative ratio in the market.

Based on the quote's current location, you can see the price move at the peak of the inertial move.

Considering the trading chart in general terms (daily period), we can see that taking the recent price surges into account, we ended up at the levels of the spring of 2018.

We can assume that long positions are already overheated, which leads to an overbought status in the market, but the inertial move may locally stay, directing us towards the level of 1.2200, where a correction will occur.

From the point of view of a comprehensive indicator analysis, we see that the indicators of technical instruments unanimously signal a buy, due to the rapidly growing euro rate.