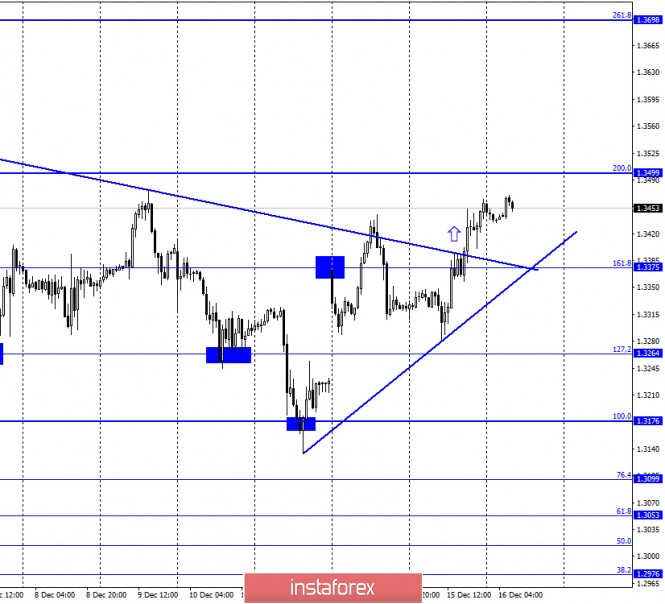

GBP/USD – 1H.

According to the hourly chart, the quotes of the GBP/USD pair still performed a consolidation over the downward trend line, thus, the mood of traders changed to an upward one. Almost immediately, a new upward trend line was formed. The pair's quotes continue the process of growth in the direction of the corrective level of 200.0% (1.3499), which is almost near 2.5-year highs. It remains a mystery why traders continue to buy the British. However, I have only to state the fact that economic reports continue to be ignored, and traders continue to believe that a deal between the UK and the EU will still be concluded. The most interesting thing is that traders continue to ignore even official information. In particular, it says that both the EU and the UK (their leaders) advise everyone to prepare for Brexit'y "No Deal", that is, without a deal. That is, the leaders of the EU and Britain themselves do not believe that Michel Barnier and David Frost will be able to break the deadlock in the negotiations. Thus, the negotiation process now continues "for a show". They say that while there is still at least a slim chance of a deal, we will continue negotiations. Although before the New Year, there are only 2 weeks left before the end of the transition period. However, traders are not at all confused by this fact. Therefore, the British pound continues to grow, which is very difficult to explain.

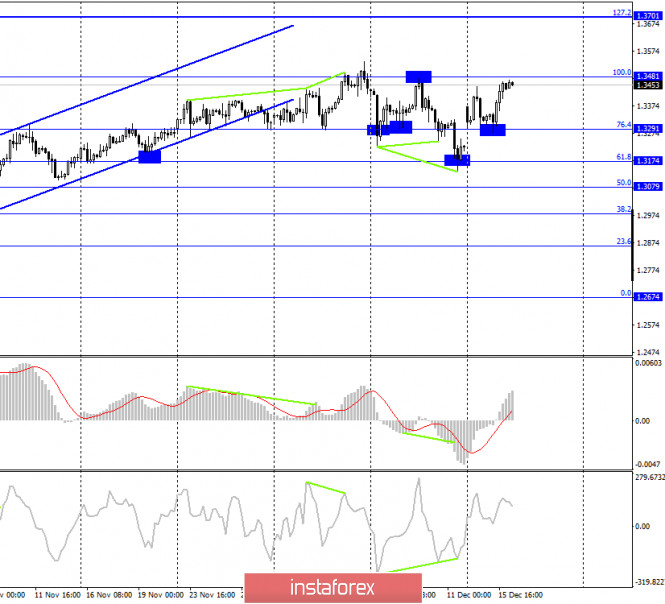

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair also continues the process of growth in the direction of the Fibo level of 100.0% (1.3481). The bullish divergence of the CCI indicator also worked in favor of the beginning of the pair's growth. The rebound of quotes from this level will work in favor of the US currency and some fall in the direction of the corrective level of 76.4% (1.3291). Fixing above it will increase the probability of further growth towards the next Fibo level of 127.2% (1.3701).

GBP/USD – Daily.

On the daily chart, the pair's quotes performed a rebound from the corrective level of 100.0% (1.3513). However, for now, they have begun the process of returning to this Fibo level. Fixing above it will cancel the option with a drop in quotes and return the pair to an upward trend.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed an increase to the second downward trend line. A rebound from it in the long term will mean a reversal in favor of the US dollar and a long fall in the British dollar's quotes.

Overview of fundamentals:

On Tuesday, the UK will report on the unemployment rate and applications for unemployment benefits. Both recorded growth, which is negative for the British. Only wages were slightly pleased, as they rose slightly more than expected. However, the British continued to grow.

News calendar for the United States and the United Kingdom:

UK - PMI for the manufacturing sector (09:30 GMT).

UK - Services PMI (09:30 GMT).

US - changes in the volume of retail trade (13:30 GMT).

US - manufacturing PMI (14:45 GMT).

US - PMI index for services (14:45 GMT).

US - FOMC decision on the main interest rate (19:00 GMT).

US - FOMC covering statement (19:00 GMT).

US - economic forecast from FOMC (19:00 GMT).

US - FOMC press conference (19:00 GMT).

On December 16, the UK and the US will release business activity indices in the service and manufacturing sectors. However, the evening summary of the Fed meeting will be more important.

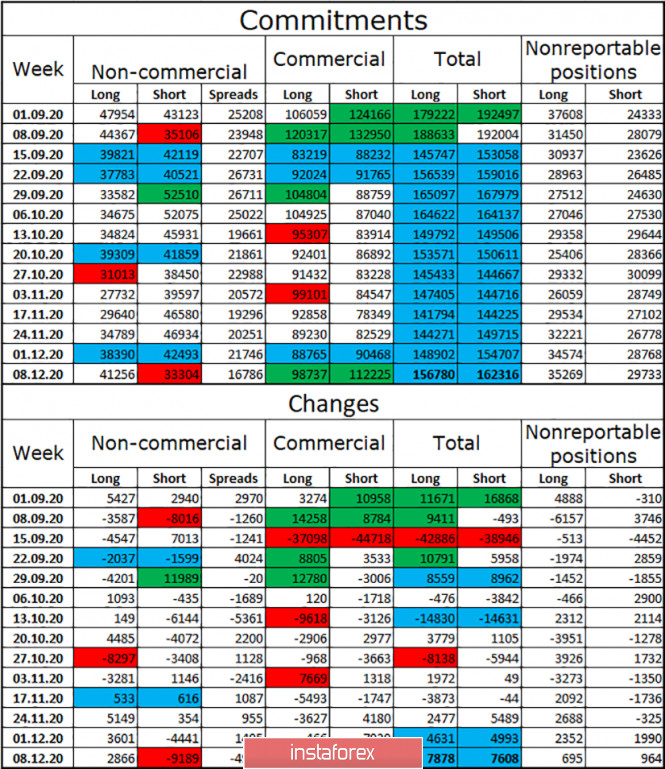

COT (Commitments of Traders) Report:

The latest COT report showed a new increase in the number of long contracts in the hands of speculators. This time, their total number increased by 2,866 contracts, and the number of short-contracts decreased by 9,189 units. Thus, the mood of speculators has become much more "bullish" and is becoming so for the third week in a row. Given this fact, the growth of the British is quite understandable, although the information background is not quite on the side of the British currency. However, given that speculators have again taken up quite large purchases of the pound sterling, we can assume its new growth. In this regard, I recommend that you carefully monitor the level of 1.3513 on the daily chart. Closing above it will confirm the intention of traders to re-open long contracts. The total number of open long and short contracts for all groups of traders remains approximately the same.

GBP/USD forecast and recommendations for traders:

At this time, I recommend that you be extremely careful with opening any deals on the British. The pair continues to move very raggedly and often changes direction. New purchases of the British dollar had to be opened, as it was fixed above the trend line on the hourly chart, with the target level of 200.0% (1.3499). I recommend selling the British dollar with the target level of 127.2% (1.3264) if the closing is performed under the ascending trend line on the hourly chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

The material has been provided by InstaForex Company - www.instaforex.com