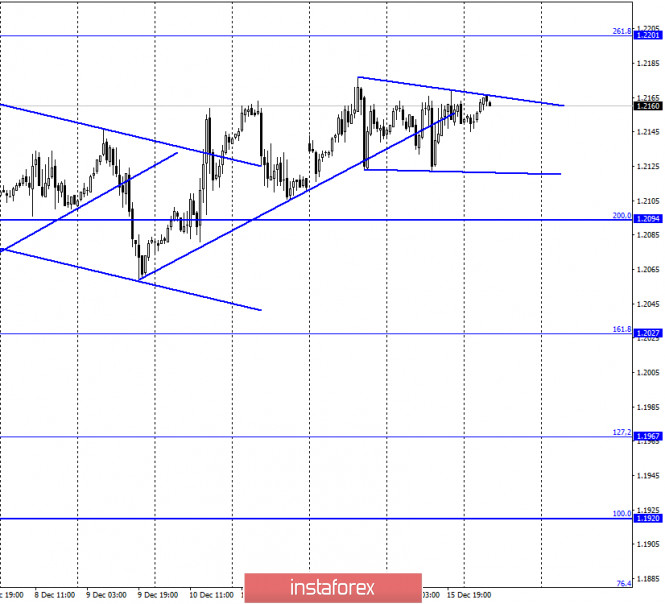

EUR/USD – 1H.

On December 15, the EUR/USD pair attempted to start falling, and then an attempt to continue growing. Both failed. The pair also performed a consolidation under the upward trend line, which did not give any support to bear traders. Now, instead of a trend line, we have a narrowing corridor, in which the pair is also unlikely to spend much time. Nevertheless, there are no other landmarks now. Just like there is no news. During the past day, there have been one or two not-so-important reports, and that's it. Perhaps the most important news of recent days can be called the official victory of Joe Biden in the election. Now the electoral college of each state has voted for it, and the result has fully coincided with expectations. Trump, however, is not giving up and intends to continue the fight for "fair and just elections". However, most experts are inclined to believe that the train has already left and the current president will not be able to change the results. At the same time, many experts believe that by the end of the year, a $ 900 billion package of assistance to the American economy can be adopted. It is still difficult to say what effect this decision will have on the pair, given that the US currency continues to fall. Formally, this aid package will have to weaken the dollar even more. However, now everything depends on the mood of traders. And perhaps from the decisions that the Fed will announce tonight after its last meeting in 2020.

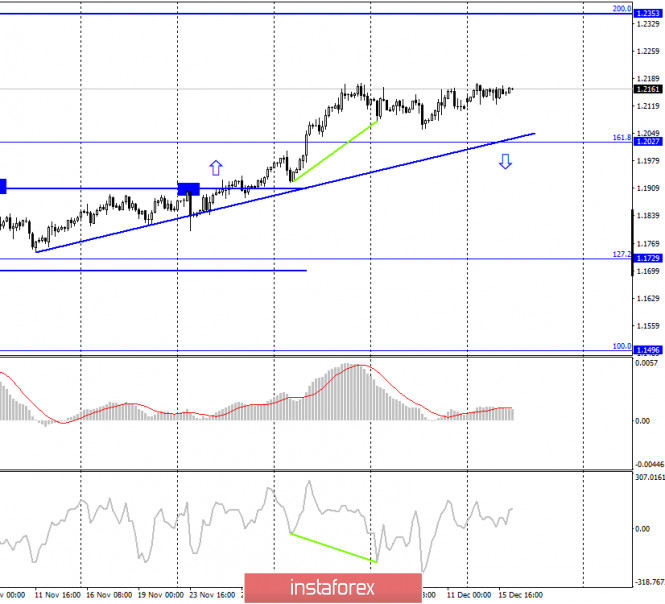

EUR/USD – 4H.

On the 4-hour chart, the pair's quotes continue a weak growth process in the direction of the corrective level of 200.0% (1.2353). The upward trend line still characterizes the current mood of traders as "bullish" and increases the probability of further growth. As long as the quotes do not consolidate under the trend line, you should not expect a strong fall in the pair.

EUR/USD – Daily.

On the daily chart, the quotes of the EUR/USD pair performed a consolidation above the Fibo level of 323.6% (1.2079), which allows traders to expect continued growth in the direction of the next corrective level of 423.6% (1.2495). And until the pair makes a consolidation under the level of 323.6%, there are still high chances of growth.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair performed a consolidation above the "narrowing triangle", which preserves the prospects for further growth of the pair in the long term.

Overview of fundamentals:

On December 15, the calendar of economic events in the European Union was empty. In America, a report on industrial production was released, which turned out to be only slightly better than expected, but did not help the US currency.

News calendar for the United States and the European Union:

EU - index of business activity in the manufacturing sector (09:00 GMT).

EU - index of business activity in the service sector (09:00 GMT).

US - retail trade volume change (13:30 GMT).

US - index of business activity in the manufacturing sector (14:45 GMT).

US - PMI for services (14:45 GMT).

US - FOMC decision on the main interest rate (19:00 GMT).

US - accompanying FOMC statement (19:00 GMT).

US - FOMC economic forecast (19:00 GMT).

US - FOMC press conference (19:00 GMT).

On December 16, the EU and US will release the index of business activity in the areas of services and production, and later in the evening, will summarize a two-day Fed meeting and press conference.

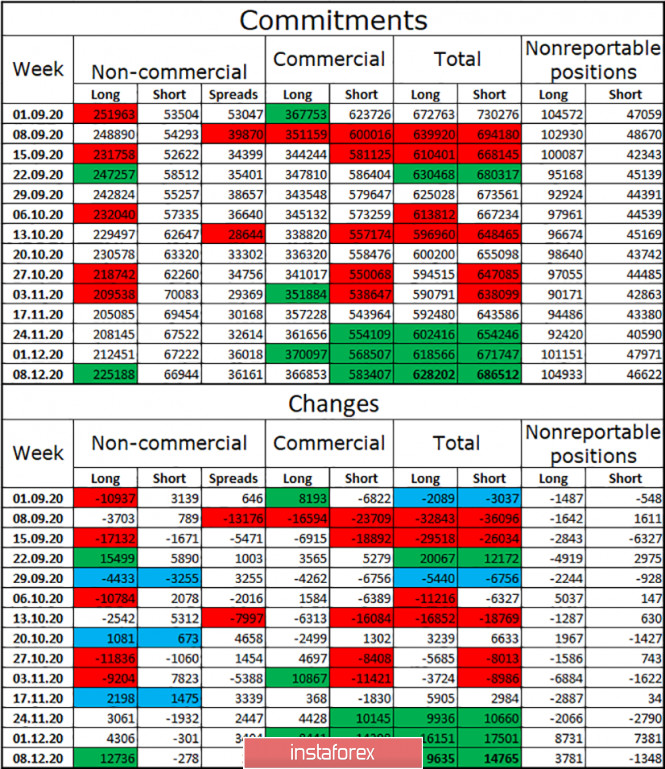

COT (Commitments of Traders) Report:

For the fourth week in a row, the mood of the "Non-commercial" category of traders has become more "bullish". This is indicated by COT reports and it coincides with what is happening now for the euro/dollar pair. In the reporting week, speculators opened as many as 13 thousand new long-contracts (more than in the previous three weeks), and also got rid of 300 short-contracts. Thus, they significantly increased their "bullish" mood. The gap between the total number of long and short contracts in the hands of the "Non-commercial" category is growing again. Therefore, the European currency now continues to maintain high chances of continuing growth, although a month ago it was preparing for a powerful fall. The "Commercial" category of traders, on the contrary, opened short contracts, however, it always trades against speculators. And we pay attention first of all to them.

EUR/USD forecast and recommendations for traders:

Today, I recommend selling the euro with the targets of 1.2122 and 1.2094, if the rebound from the upper line of the narrowing corridor on the hourly chart is performed. Purchases of the pair can be opened by fixing quotes over the narrowing corridor with the target of 1.2201.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

The material has been provided by InstaForex Company - www.instaforex.com