To open long positions on EUR/USD, you need:

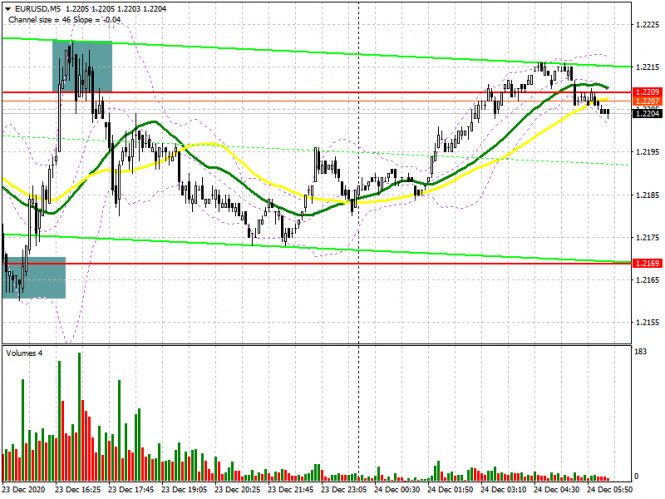

There were no deals in the first half of Wednesday. Several signals for entering the market appeared when fundamental reports on the US economy were finally published, which indicated a slowdown in growth. In my review, I repeatedly drew attention to the false breakout of support at 1.2169, which happened. On the 5-minute chart, you can clearly see how the bulls defended this area, bringing the pair back to this level quickly after the bears failed to settle below it. This creates the first entry point for long positions. Rising to the 1.2209 area brings around 40 points of profit. Then, by the middle of the US session, the bears did the same thing as the bulls, but at the 1.2207 level, which pushes the euro back to the support area of 1.2169. Falling from 1.2209 yielded around 30 points.

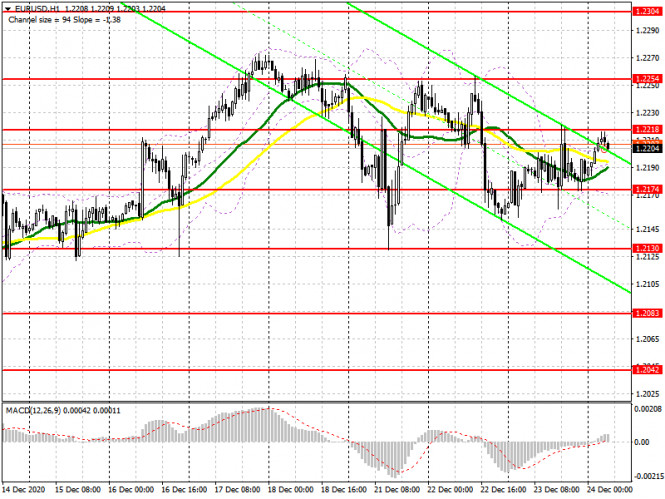

As of today, the technical picture has only slightly changed, since the nearest support and resistance levels were adjusted based on yesterday. Buyers are now focused on protecting support at 1.2174. Forming a false breakout there in the first half of the day, similar to yesterday's purchase from 1.2169, which I analyzed above, will result in forming a signal to open long positions in the euro. However, given the lack of important fundamental repor bts and since the markets will work less in connection with Christmas, then buyers are most likely not in a hurry to be active. In the absence of any action when EUR/USD returns to support at 1.2174, I recommend postponing long positions until the week's low has been updated in the 1.2130 area. It is also possible to buy the euro immediately on a rebound from a new local low in the 1.2083 area, counting on a correction of 20-25 points within the day. We can only say that buyers of the euro have managed to regain control of the market when the pair has finally surpassed and settled above resistance at 1.2218. Testing this level from top to bottom creates an additional signal to buy the euro with the main goal of returning to resistance at 1.2254, where I recommend taking profits.

To open short positions on EUR/USD, you need:

Sellers of the euro aim to regain control over the 1.2174 level. Getting the pair to settle below this range and testing it from the other side will raise the pressure on the pair, which creates a good entry point for short positions. In this case, the main target will be this week's low at 1.2130. It is difficult to surpass this area at the end of the week. However, if this happens, falling towards the 1.2083 area is not excluded, and the key target at the end of the year will be the 1.2042 area, where I recommend taking profits. An equally important task for the bears is to protect resistance at 1.2218, near which trade is currently being conducted. Forming a false breakout there, similar to the sale, which I analyzed above, creates a good entry point to short positions, as we aim to return to the support area of 1.2174. If bears are not active at the 1.2218 level, I recommend postponing short positions until a high at 1.2254 has been tested, or you can sell EUR/USD immediately on a rebound from the resistance of 1.2304, counting on a correction of 20-25 points within the day.

The Commitment of Traders (COT) report for December 15 showed an increase in short positions and a reduction in long ones. Although buyers of risky assets believe that the bull market will proceed, especially amid expectations of vaccinations in the eurozone, which will begin from December 25 to 27, however, the rush to buy at current highs has obviously decreased. Thus, long non-commercial positions fell from 222,521 to 218,710, while short non-commercial positions increased from 66,092 to 76,877. The total non-commercial net position fell from 156,429 to 141,833 a week earlier. The growth of the delta, which was observed for three consecutive weeks, has stopped, so one can hardly count on the euro's rapid growth at the end of this year. There will be no further major recovery until European leaders negotiate a new trade agreement with Britain.

Indicator signals:

Moving averages

Trading is carried out in the area of 30 and 50 moving averages, which indicates market uncertainty ahead of the weekend.

Note: The period and prices of moving averages are considered by the author on the H1 chart and differs from the general definition of the classic daily moving averages on the D1 daily chart.

Bollinger Bands

A breakout of the lower border of the indicator in the 1.2174 area will increase pressure on the euro.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.