To open long positions on GBP/USD, you need:

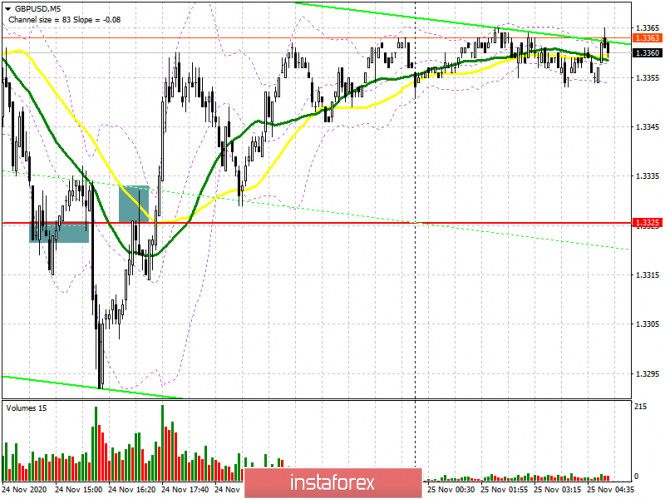

The British pound didn't do too well yesterday afternoon. If there were no signals to enter the market during the European session, then the US session was more productive, albeit with a negative sign. Let's take a look at the 5-minute chart and talk about what happened. The bearish momentum towards the middle of the day led to testing the 1.3325 level, where buyers managed to achieve a false breakout and made a fairly good entry point into long positions, which was not realized as the market continued to fall. Then, settling below 1.3325 and testing this level from the bottom up produced a signal to sell the pound, but even then we were in for a failure, since the market literally immediately turned around and went up again, which forced us to take losses. Well, there are days like this, let's hope that the market will compensate for these losses in the near future.

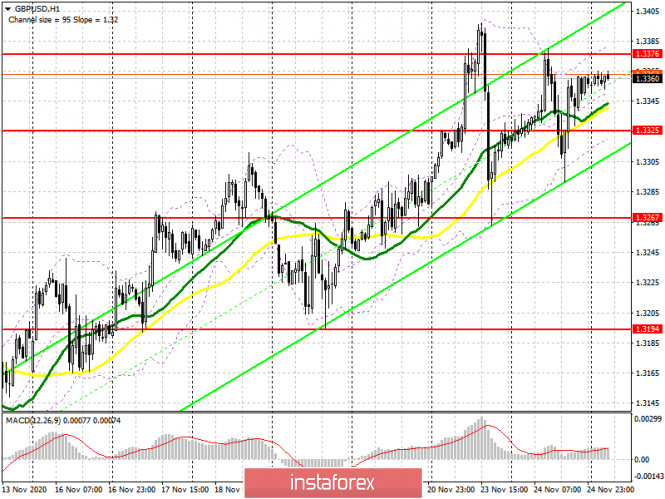

No important reports for the British economy in the first half of the day, so buyers will focus on a breakout of resistance at 1.3376. Testing it from top to bottom produces an excellent signal to buy the pound in order to continue the upward trend that appeared earlier this week. In this scenario, the nearest target will be resistance at 1.3453, where I recommend taking profits. A more serious task is to update the 1.3523 area, where it will also be possible to watch the bull market stop. But you need to understand that such an upward movement will appear only if we receive good news on Brexit and the trade deal. If bulls are not active above 1.3376, then we can expect the pair to fall. In this case, forming a false breakout in the support area of 1.3325, similar to yesterday, produces a signal to open long positions in hopes to bring back the bull market. I recommend buying GBP/USD immediately on a rebound from a low of 1.3267, counting on a correction of 20-30 points within the day.

To open short positions on GBP/USD, you need:

The bears are still fighting to maintain control over the 1.3376 level. Forming the next false breakout there will lead to a signal to open short positions in hopes to return to yesterday's support at 1.3325, on which a lot depends. A breakdown of 1.3325 and settling below it, similar to yesterday's entry point into short positions, is necessary to return new big sellers to the market, which will then quickly pull down GBP/USD into the area of the 1.3267 low, where I recommend taking profits. We can talk about bringing back the bear market only after the breakdown of 1.3267, which will lead to removing a number of stop orders of buyers and the rapid movement of the pair down to the 1.3194 area. If bears are not active in the first half of the day and the pair moves to the 1.3376 level, it is best to abandon short positions until a new high in the 1.3453 area has been updated, where you can sell the pound immediately on a rebound, counting on a 20-30 point correction within the day.

The Commitment of Traders (COT) reports for November 17 saw a reduction in long positions and a sharp inflow of short positions. Long non-commercial positions declined from 27,872 to 27,454. At the same time, short non-commercial positions increased from 45,567 to 47,200. As a result, the negative non-commercial net position was -19,746 against -17,695 a week earlier, which indicates that the sellers of the British pound retains control and also shows their slight advantage in the current situation. Lack of clarity on the trade deal, together with the lockdown of the British economy in November, clearly does not add optimism and confidence to buyers of the pound.

Indicator signals:

Moving averages

Trading is carried out just above the 30 and 50 moving averages, which indicates the likelihood of sustaining the bullish momentum.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakout of the upper border of the indicator around 1.3376 will lead to a new wave of growth for the pound. A breakout of the lower border at 1.3325 will increase pressure on the pair.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.