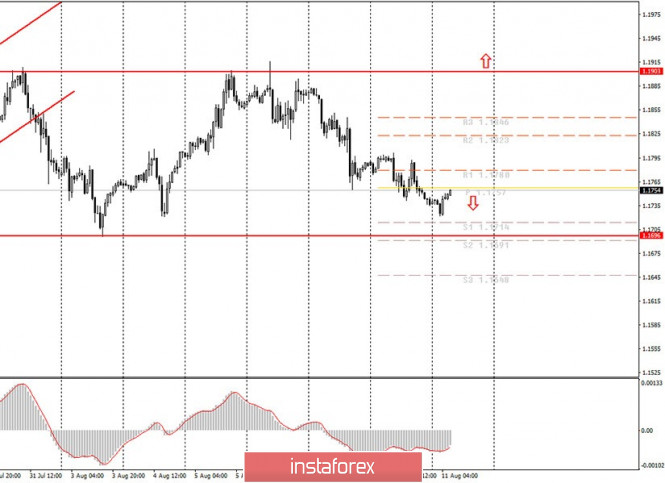

Hourly chart of the EUR/USD pair

The EUR USD pair did not continue its strong downward movement at night trading on Tuesday. However, the same night also started an upward movement, which may be a simple upward pullback. Unfortunately, at this time, novice traders do not have a trend line or a trend channel that can help determine the trend. On the other hand, if these technical patterns do not exist, then there is no trend at this time. Thus, for the time being, we do not expect the pair's quotes to move further down below the 1.1696 level. In general, the side channel is already being viewed, if not flat, then just limited by the levels of 1.1903 and 1.1696, marked in the illustration. Thus, we are waiting for a new approach to reach the 1.1696 level on Tuesday, and then we will see after that.

The European Union and America do not have any important macroeconomic releases on Tuesday, August 11. Thus, the tone of trading is not likely to change today. Yesterday's volatility (the number of points passed from the high to the low) was at 66 points, which is lower than the average in recent months (usually the pair passes 90-100 points a day). Therefore, the activity of traders leaves much to be desired. Traders do not have anything to pay attention to when it comes to fundamental topics, since all the most important are of a general nature, which does not momentarily affect the pair. We would say that now the future of the pair depends more on overcoming or not overcoming the 1.1696 level. After all, in fact, even the upward trend has not yet been broken. The illustration clearly shows that the previous fall from 1,1903 to 1,1696 (that is, by two hundred points) was replaced by a rise back to 1.1903 the next day. In other words, bears are not dominating the market right now. This means that the fundamental background does not support the US dollar, which cannot show strong growth even after a three-month fall. Accordingly, you need to wait. You need to wait for changes in the fundamental background, or in the mood of traders, or macroeconomic data.

The following scenarios are possible on August 11:

1) Buying the pair is still not relevant, since the price left the ascending channel and was unable to overcome the 1.1903 level. There are no technical structures like trend lines, channels or other patterns supporting an upward trend. Thus, we believe that it is not advisable to trade up at the moment.

2) Selling the currency pair is still more promising now. At the moment, the pair is correcting, which was signaled by the MACD indicator, once again turning up. Therefore, now we propose to wait for the completion of this correction and a signal from the same MACD to sell. In this case, we recommend reopening sell orders with targets at 1.1714 and 1.1696 on Tuesday. There are just about 60 points left to the final goal, so it can be reached today. Then everything will depend on whether traders will be able to go below this level.

What's on the chart:

Support and Resistance Price Levels - Levels that are targets when buying or selling. You can place Take Profit levels near them.

Red lines - channels or trend lines that display the current trend and show which direction it is preferable to trade now.

Arrows up/down - indicate when you reach or overcome which obstacles you should trade up or down.

MACD indicator is a histogram and a signal line, the crossing of which is a signal to enter the market. It is recommended to use in combination with trend lines (channels, trend lines).

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners in the forex market should remember that every trade cannot be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.

The material has been provided by InstaForex Company - www.instaforex.com