The new week is very full of macroeconomic publications, including for the US. Traders are waiting for data on retail sales, which most likely increased on the restart of the economy. At the same time, consumer sentiment may have suffered due to the recent tightening of quarantine measures.

The pandemic and the response from the US government will remain as the main driver of the currency market. The number of cases of coronavirus in the United States rose again over the weekend. Only Florida reported an increase of more than 15,000 per day. This is a record for any state, and it exceeded the peak level in April in New York.

The World Health Organization has warned that the coronavirus pandemic could get even worse if all countries do not comply with basic health precautions. "Too many countries are moving in the wrong direction," Director General Tedros Adhanom Ghebreyesus said at a virtual WHO briefing in Geneva.

According to Reuters, on Monday, the number of infected people in the world exceeded 13 million people, in just five days, the pandemic has claimed the lives of more than half a million people.

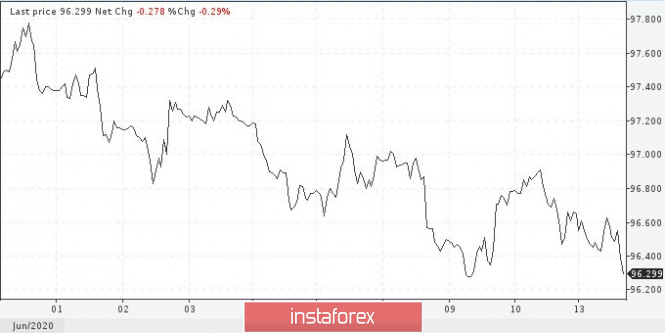

Meanwhile, the dollar is losing for the fourth consecutive week. The greenback sharply fell by 0.3% against a basket of competitors on Monday evening. Investors continue to bet that the worst of the pandemic is already over and buy risky assets. Most market players are waiting for the continuation of the broad fall of the dollar.

Today, traders also paid attention to the joint statement of the German biotech company BioNTech and the American pharmaceutical giant Pfizer. Two experimental vaccines against COVID-19 received accelerated review status.

However, the protective functions of the US currency may still prevail. It is not just the deterioration of the epidemiological situation that will slow down the pace of economic recovery. Relations between the US and China are gradually heating up. The day before, US President Donald Trump said that he was not even thinking about negotiations on the second phase of the trade deal, as the countries' relations were seriously damaged due to the situation with the coronavirus. This gave investors new ground to think about. Now they believe that the fragile trade truce that was signed earlier will fall apart before the end of the year. The prospect of a trade war may be the main fundamental trigger for the long-term growth of the US dollar.

Traders need to monitor the level of 95.70 on the dollar index. While it is trading higher, the dollar bulls have more chances to maintain the initiative.

USDX

If the macroeconomic environment deteriorates, the Federal Reserve, as promised, will resort to additional stimulus measures. New volumes of liquidity will appear on the market, which in the recent past have already provoked a sell-off of the dollar.

Now the interbank market in London and New York is experiencing a negative situation for the US currency. In London, the three-month Libor rate updated its low for the last four years and came close to the upper limit of the Fed's rate range – 0.25%. This suggests that European banks do not feel a shortage of dollars.

In New York, the regulator canceled REPO auctions, as there were no requests for refinancing from commercial banks. There is a lot of money, and bankers do not have problems with dollar liquidity.

The material has been provided by InstaForex Company - www.instaforex.com