4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward..

Moving average (20; smoothed) - upward.

CCI: 129.5589

The British pound continues its upward movement, although for some time it could not overcome the Murray level of "+1/8" - 1.2756. Nevertheless, on Friday, it still managed to do so, and traders continued to trade for an increase, despite the absolutely failed fundamental background from the UK. Because from the United States, it is even more failed. Thus, at the moment, we can draw approximately the same conclusions as in the case of the euro/dollar pair. Macroeconomic statistics are almost irrelevant for traders now. Only the most important reports can affect their mood and be reflected on the chart. Technical factors may have a greater impact on the pound/dollar pair. Or the general fundamental background, which has not changed in recent weeks.

The fundamental background will probably not change in the new week. We do not expect drastic changes in the negotiation process between London and Brussels, we do not expect to calm down at least one of the 4 crises currently raging in the United States. As for macroeconomic publications, there will be none in the UK. The US news calendar also contains potentially important news, which we will focus on in more detail now.

The first thing to note is the report on orders for durable goods in the United States. This indicator will be released on Monday and is quite important, since this category of goods itself has a high cost, respectively, in the aggregate, orders and sales of these goods strongly affect GDP. However, there will be more important events this week. For example, the Fed meeting, which is scheduled for Wednesday, July 29. We believe that this meeting will be absolutely passing, however, it is clearly not necessary to lose sight of such an important event. The key rate is unlikely to be changed, however, anything important can be reported by the head of the Federal Reserve Jerome Powell. Well, on Thursday, July 30, the United States will publish a preliminary value of the GDP indicator for the second quarter, which, according to experts, will be -34% compared to the first quarter. This value may well "finish off" the US currency. It can only rely on the understanding of market participants that approximately the same figures will be recorded in all countries of the world in the second quarter. Although, to be honest, none of the GDP figures planned for this week is expected to be reduced in this way. In Germany, only -9% q/q is expected, in Spain -16%, in Italy -13%, in the European Union -12%. Thus, after comparing all the figures for the fall in the economy in the second quarter of the EU and the US, the dollar may continue to fall on all fronts of the currency market. By the way, even in the UK, which objectively suffered the most in Europe from the "coronavirus crisis", the reduction in GDP, according to experts, may be 20% compared to the first quarter. True, this indicator will be published only on August 10, but nevertheless. Thus, quite unexpectedly, the United States becomes almost the main outsider in 2020 in economic terms. Earlier, we were wary of the words of Christine Lagarde and Andrew Bailey, who predicted serious cuts to their economies this year. However, it is really necessary to worry about America, and not for European countries.

Meanwhile, Boris Johnson gave an extensive interview to the BBC, in which he said that "some things his government could have done differently", answering the question of why 45 thousand people died from the "coronavirus" in the UK. The Prime Minister admitted that initially his government misjudged the COVID-2019 virus and failed to correctly assess the scale of the threat to the British. However, Johnson was not completely frank with the interviewer and did not clearly analyze the government's actions in the first months of the pandemic. According to Johnson, "there will still be time for this, but in the meantime, we need to focus all our efforts on a possible second wave of the disease this fall and winter". Well, as expected, Johnson was immediately criticized by the British opposition. "Boris Johnson has finally admitted that his government has done a poor job of responding to the coronavirus. It took too long to recognize the threat of the virus, too long to introduce lockdown, and too long to take the crisis seriously, " said health Minister Jonathan Ashworth. Asked specifically if it was too late for the government to impose a quarantine, Johnson said: "We didn't understand the virus enough in the first weeks and months. We didn't see how widespread it spread asymptomatically from person to person." In addition, Johnson is fiercely criticized for missing 5 meetings of the emergency government committee in January and February, after selling a batch of personal protective equipment to China, and in April, these very protective equipment was not enough in British hospitals.

Thus, this week, the first place will be taken by US GDP data, the Fed meeting and technical factors. The pound/dollar pair may well continue to grow, and only strong news from overseas or banal saturation of traders with sales of the US currency can stop the process of falling. By the way, at the moment, the quotes of the GBP/USD pair came close to the previous local maximum – 1.2812. This level can become a rather serious obstacle to further strengthening of the British pound. And vice versa. If buyers manage to push through this level, the upward movement can potentially continue to the next high of the past – 1.3199. And this is a serious strengthening of the British currency, which has not been observed since the fall of last year, when the pound grew on expectations of the imminent completion of Brexit, as first Boris Johnson won the election, and then the Conservative Party. Then the pound rose by about 15 cents, now - by 14.

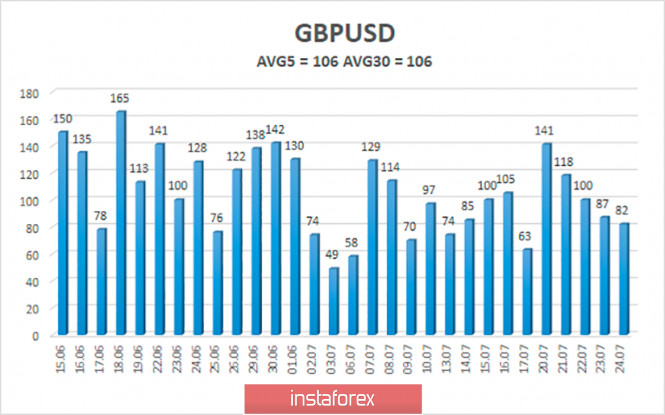

The average volatility of the GBP/USD pair continues to remain stable and is currently 106 points per day. For the pound/dollar pair, this value is "high". On Monday, July 27, thus, we expect movement within the channel, limited by the levels of 1.2684 and 1.2896. Turning the Heiken Ashi indicator downwards will indicate a new round of downward correction.

Nearest support levels:

S1 – 1.2753

S2 – 1.2695

S3 – 1.2634

Nearest resistance levels:

R1 – 1.2817

Trading recommendations:

The GBP/USD pair resumed its upward movement on the 4-hour timeframe. Thus, it is recommended to continue trading for an increase with the goals of 1.2817 and 1.2896 (the level of volatility on Monday), until the Heiken Ashi indicator turns down. Short positions can be considered after fixing the price below the moving average with the goals of 1.2634 and 1.2573.

The material has been provided by InstaForex Company - www.instaforex.com