4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - upward.

CCI: 122.7900

The EUR/USD currency pair as a whole continues to trade with an increase, absolutely not breaking the upward trend, which is supported by the moving average line and two linear regression channels. Thus, during the past week, absolutely nothing has changed, from a technical point of view. As for the macroeconomic background, there was very little of it last week. Almost all published macroeconomic reports were ignored, and market participants continue to be much more interested in the "coronavirus" epidemic in the United States and the scale of its spread than in economic figures.

The new trading week will be quite interesting. However, with the slightest analysis, it becomes clear that the macroeconomic background will again not be a priority for traders. Even the Fed meeting that will take place on Wednesday is unlikely to cause any market reaction, since it will most likely become completely passable. At least, no one expects the Fed to make a drastic change in the parameters of monetary policy. Several reports will be published immediately on Monday in the European Union, Germany and the United States. If European reports can be safely ignored, since they are unlikely to have any impact on the currency market, then American reports are extremely important. We are talking about changing the volume of orders for durable goods. In addition to the main indicator, three more derivatives will be published: excluding defense orders, excluding transport orders, and excluding defense and aviation orders. In fact, it does not matter what a particular indicator will be. It is important that overall forecasts are exceeded. Important for the US dollar. The US currency is now in such a state that it needs good reasons for traders to stop selling it. And it is unlikely that support for the US currency should be expected from macroeconomic reports. However, in the case of really strong numbers, the US currency can get some support.

While the US currency is stalling and can't find support, there are exactly 100 days left until the US presidential election. Perhaps never before in America has there been such a stir around this process. According to many publications, in a little over three months before the election, Trump is very much losing to Biden in the ratings. In general, voters are not satisfied with the work of the presidential administration in countering the pandemic and in the conditions of mass unrest. However, in the last election in 2016, Trump was also an outsider. As shown by more in-depth research that takes into account the specifics of the US electoral system, Biden wins about 100 "electoral votes" from Trump. To win the election, 270 such votes are required and Biden already has 222 at his disposal. Most importantly, states like Michigan, Wisconsin, Pennsylvania, Ohio, and Florida are now ready to give their votes to Biden, even though they voted for Trump in 2016. And this is the loss of 5 states at once and a huge number of "electoral votes". After all, for example, Texas is also changing its mind and is going to vote for Biden despite the fact that it is a native "Republican state". Nevertheless, the huge number of cases of "coronavirus" makes its own adjustments to the mood of the electorate.

Well, most of all, there are doubts about Donald Trump among people who systematically track his statements and follow his speeches. We have repeatedly listed almost the entire list of Trump's statements about the "coronavirus". This salad is absolutely opposite in meaning and essence statements can confuse just about anybody. However, these statements were made not by a mental patient, but by the president of the country with the largest economy in the world, who also says in the last two weeks that his main rival Biden will not be able to pass an IQ test. This is not a test that we all know that really measures IQ, but a test that simply shows that there are no abnormalities in development. In fact, any teenager can pass this test, since most of the questions in it are elementary, and we are left to wonder whether Trump tried to prick Biden as much as possible in this way, or did not see this test in his own eyes?

Wearing masks in a pandemic is also confusing, according to Trump's rhetoric. The President of the United States openly refuses to wear a mask, without setting any example to the Americans, then the president offers to wear a mask in public places, and he boasts that he looks like a hero of westerns in a mask. Everything is complicated for Trump and with protesters across the country. At first, Trump wanted to disperse all the rioters almost with the help of the regular army, which has not happened in the history of the country yet. Then Trump criticized the authorities of all cities and states where it was not possible to suppress the protests (which are generally allowed under American law), then he supported the protesters several times, and then sent several security forces to Portland. Now in Portland there are not just protests and rallies, now there are clashes with the police, security forces and even greater riots than there were before the arrival of Trump's special forces. Not surprisingly, protesters across the country had slogans calling for Trump's resignation.

The only really strong trump card in Trump's hands is the economy. Not surprising, given that Trump is a businessman. Most Americans would strongly trust the economy to Donald, not Joseph. Unfortunately, this is the only area in which Trump leads unconditionally. However, many experts also note that Trump is not going to win the usual way. Most likely, Trump's strategy will again be to win in those states where it is most likely, with a furious run with those states where voter opinion fluctuates. That is, Trump is not going to fight for victory in all states. Rather, he will try to win the states he needs, which will be enough for the overall victory. Plus, we should not forget that America is currently in chaos, crises, unrest and discord. That is exactly the element in which Trump feels like a fish in water. Therefore, it is absolutely possible that we will witness a huge number of surprises in the elections.

The US dollar remains under market pressure. And it can only count on support either due to technical factors (the markets will simply get enough of the pair's purchases), or due to a strong fundamental background (which is not even looming on the horizon yet).

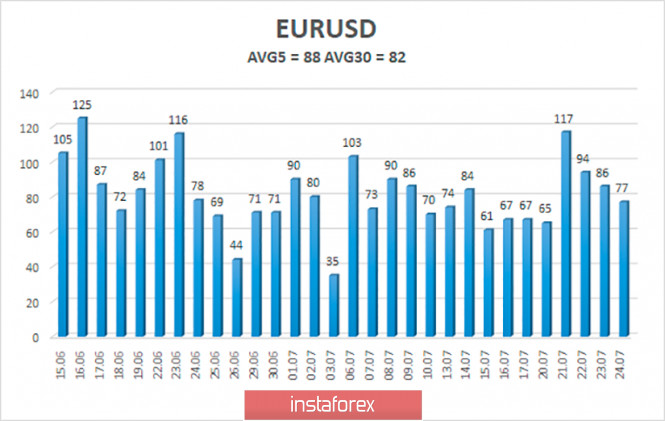

The volatility of the euro/dollar currency pair as of July 27 is 88 points and is still characterized as "average". Thus, we expect the pair to move today between the levels of 1.1567 and 1.1743. The reversal of the Heiken Ashi indicator downwards signals a turn of a downward correction within the framework of an upward trend.

Nearest support levels:

S1 – 1.1597

S2 – 1.1475

S3 – 1.1353

Nearest resistance levels:

R1 – 1.1719

R2 – 1.1841

R3 – 1.1963

Trading recommendations:

The EUR/USD pair continues to strengthen its upward movement. Thus, it is now recommended to stay in purchases of the euro currency with the goals of 1.1719 and 1.1743, until the Heiken Ashi indicator turns down (1-2 bars of blue color). It is recommended to open sell orders no earlier than when the pair is fixed below the moving average line with the first target of 1.1353.

The material has been provided by InstaForex Company - www.instaforex.com