4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - upward.

CCI: 172.3765

The EUR/USD currency pair continued to rise in price on Monday without the slightest sign of a correction. In principle, what is currently happening in the currency market is called a "collapse". Just on the chart, the pair is moving up, however, the US currency continues to collapse against its main competitors. Needless to say, on Monday, when the dollar began to fall immediately from the opening of trading, there was still no news, reports, publications or anything at all that could cause such a strong sell-off in the US currency? And do traders need any economic or political news at all? We have repeatedly written that the United States is experiencing almost all possible types of crises. We don't remember such a nightmare in America, which is considered a "superpower", a country with the strongest economy in the world, for a very long time. The epidemiological crisis in general goes beyond the borders of reality. This weekend, it became known that US doctors wrote a collective letter to the White House calling for the resumption of the quarantine. Doctors believe that the best decision of the government should not be to "open the economy", but to "save lives". Health officials believe that by November 1, the number of victims from the "coronavirus" may reach 200,000 people. And if the quarantine is not tightened, then even more. However, despite the monstrous scale of the epidemic, people in the United States continue to go to bars, hairdressers, restaurants, tattoo salons, and so on, doctors complain. That is, they do not do very important things in times of a global pandemic. Well, Donald Trump at a time when 60-70 thousand Americans are infected every day, decided to once again brag to the whole world, saying that in America, a total of 55 million tests have already been conducted since the beginning of the pandemic. "We do far more tests than any other country in the world," the US president said. The American president did not forget to once again criticize the "false TV companies and media", in particular the CNN company for absolute bias in covering the problems of the pandemic. Trump accused CNN that the TV company just wants Joe Biden to win the election in November, so in any case, it will criticize him, even if the country will be conducted 10 times more tests for "coronavirus". Well, the news that the country's chief epidemiologist, Anthony Fauci, has started receiving life-threatening letters looks absolutely incredible. To him and his family. Of course, no one knows who the letters come from, but we remind you that it was Fauci who warned both the White House and Donald Trump personally from the very beginning that the "coronavirus" is not a runny nose and, if we do not take appropriate measures, the United States can reach 100,000 infections a day. Now - 60-70 thousand, and the US government continues to ignore Fauci. Despite the fact that in words, Trump agrees with the chief epidemiologist, calling him a "literate person", but the head of state does not take any actions to curb the spread of COVID. The head of the White House believes that Dr. Fauci made several important mistakes, although what exactly Trump did not tell the public. However, this is not surprising. Earlier, Trump promised to present indisputable evidence of China's guilt "in a couple of weeks". It's been a couple of months. At the same time, the speaker of the house of representatives Nancy Pelosi, who has repeatedly openly clashed with Trump, gave the US president a new nickname. This time, Pelosi called Trump "Mr. Make-It-Worse". Thus, the Democrats and the speaker of Congress personally blame the mistakes in the fight against the "coronavirus" not on Fauci or China, but on Trump. By the way, we have rarely seen accusations of China's culpability in the epidemic not from Trump and his supporters. According to Pelosi, it is Trump who is to blame for the huge number of diseases and deaths from "coronavirus" in the United States. "Since the beginning of the pandemic, it has made things worse," Pelosi says. – At first he hesitated, then denied it, then said it was a hoax, then that it would magically disappear." In such conditions, how can the dollar be in demand in the foreign exchange market?

Well, do not forget that mass rallies and protests continue in the country, which are gradually reorienting from the death of George Floyd and the "Black Lives Matter" movement to the call for Donald Trump to resign. What is happening now in Portland, Oregon, can generally be called a war between the protesters and special forces of Trump, who were sent to this city, "where the authorities can not or do not want to suppress the rallies". And Trump's intention is to send the relevant units to other cities in America.

In general, against the background of all this chaos, traders are not interested in macroeconomic statistics at all. Yesterday, quite important reports on orders for long-term products were published in the United States. The main indicator increased by 7.3% m/m, the indicator excluding defense and aviation orders added 3.3% m/m, the indicator excluding defense – by 9.2%, and excluding transport – by 3.3%. Two and four indicators were only 0.1% better than the forecast values, and 2 out of 4 were worse than the forecasts. Thus, in total, we can conclude that this package of statistics could not support the US currency. Because of its weakness and unconvincing. Due to the fact that this week is expected to be a disastrous report on GDP (forecast -35% in the second quarter). Due to the fact that the epidemiological and social situation in the country completely overrides any weak economic optimism, which in turn is overlaid by the upcoming GDP report.

To date, the United States has not scheduled any important reports, as well as in the European Union. However, now traders do not need economic data to continue selling the US currency. Now this upward movement can only end when buyers are banal enough and begin to fix profits. First, this will lead to a correction, and then everything will depend on sellers and their desire to start investing in the dollar. At the moment, we see few fundamental reasons for the bears to become more active. Can everything change this week after the publication of the GDP report (unlikely) and after the results of the Fed meeting?

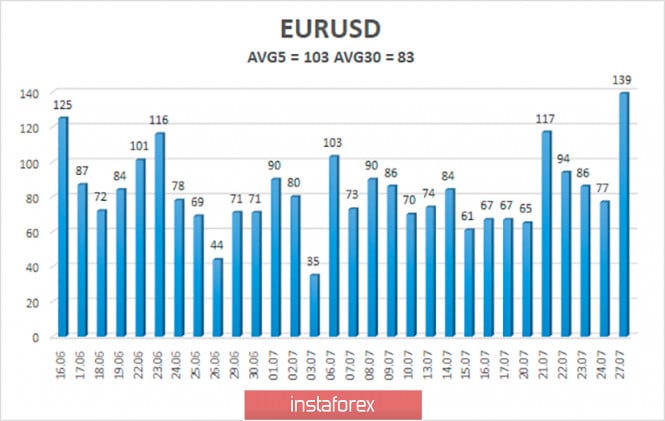

The volatility of the euro/dollar currency pair as of July 28 is 103 points and is still characterized as "average". Thus, we expect the pair to move today between the levels of 1.1660 and 1.1866. The reversal of the Heiken Ashi indicator downwards signals a round of downward correction within the framework of an upward trend.

Nearest support levels:

S1 – 1.1719

S2 – 1.1597

S3 – 1.1475

Nearest resistance levels:

R1 – 1.1841

R2 – 1.1963

Trading recommendations:

The EUR/USD pair continues to strengthen its upward movement. Thus, it is now recommended to stay in purchases of the euro currency with the goals of 1.1841 and 1.1866, until the Heiken Ashi indicator turns downward (1-2 bars of blue color). It is recommended to open sell orders no earlier than when the pair is fixed below the moving average line with the first target of 1.1475.

The material has been provided by InstaForex Company - www.instaforex.com