To open long positions on GBP/USD, you need:

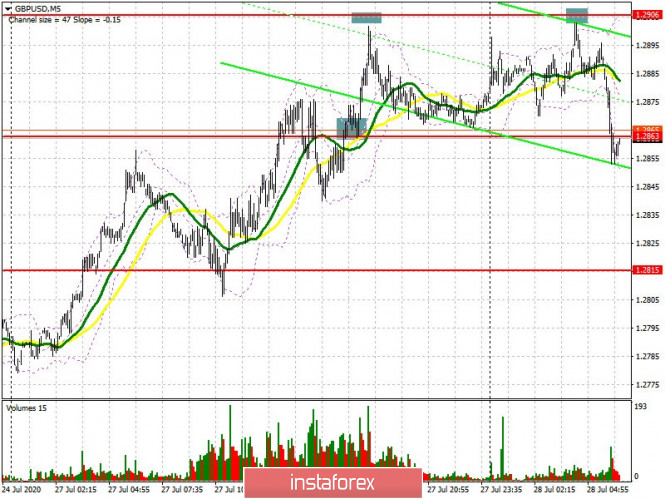

The British pound's rise to new highs from yesterday could stop today as there are signs of a market reversal and a slowdown in the bullish trend. The pound's strength is directly related to the dollar's weakness. If you look at the 5-minute chart, you will see how after yesterday's entry into long positions from the 1.2815 level, which I mentioned in more detail in yesterday's afternoon review, you can see that two more signals have formed for entering the market. The next entry point was created after returning to the 1.2863 level, which could not be pinned above the first time. Then, the bears were active in the resistance area of 1.2906, from which I advised opening short positions. Repeated sales from this level could be observed in the Asian session.

The Commitment of Traders (COT) reports for July 21 recorded another increase in short and long positions, and it is obvious that the number of bears are rising despite the active opposition of buyers of the pound. This suggests that the market's growth is not due to the British pound's strength, but because of the US dollar's weakness. Problems with Brexit and uncertainty about the prospect of economic recovery have not gone away. The COT report indicates that short non-commercial positions increased from the level of 56,761 to the level of 61,310 during the week. Long non-commercial positions rose from the level of 43,175 to the level of 46,230. As a result, the non-commercial net position increased its negative value to -15,080, against -13,568, which indicates the likelihood of a sharp fall in the pound after the US dollar recovers its strength.

As for the current technical picture, the bulls need to protect the support of 1.2852, since the further upward movement of the pair depends on it. Forming a false breakout at this level will be a signal to open long positions in GBP/USD in the expectation of a second, third, resistance test of 1.2899. Consolidating at this level will be an additional signal to buy the pound while expecting the bull market to continue rising to a high of 1.2961. The 1.3025 range is the long-term goal, where I recommend taking profits. If the bulls are not active in the support area of 1.2852, it is best to postpone long positions until the low of 1.2809 is updated, or buy the pound immediately on the rebound from the support of 1.2763 based on a correction of 30-40 points within the day.

To open short positions on GBP/USD, you need:

Sellers have a chance to stop the bull market and form a downward correction. To do this, you need to form a false breakout in the resistance area of 1.2899, and the emerging divergence on the MACD indicator will confirm the precision of entering short positions. If bears are not active at this level, it is best to postpone short positions until the update of the more powerful highs 1.2961 and 1.3025 and open short positions from there immediately on the rebound. An equally important task for the bears is to consolidate below the support of 1.2852 closer to the second half of the day. Along with the poor data on the US consumer sentiment indicator, the pound could plunge to the support area of 1.2809, where the 50-day moving average passes, but low of 1.2763 will be the long-term goal, where I recommend taking profits.

Indicator signals:

Moving averages

Trading is carried out in the area of 30 and 50 moving averages, which indicates the possibility of stopping the bullish momentum.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A break of the lower border of the indicator in the area of 1.2850 will increase the pressure on the pound. A breakout of the upper border of the indicator in the area of 1.2899 will lead to a larger rally in the pound.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Fast EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial traders are speculators, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- The total non-commercial net position is the difference between short and long positions of non-commercial traders.