Sometimes it is better for Donald Trump to be silent otherwise his words can plunge anyone into a tantrum. Moreover, against the background of ongoing protests, any careless statement can be comparable to an atomic bomb. And in a good way, this is exactly what happened. The harsh statement by the president of the United States that if the protests did not stop immediately, then he would use the national guard to put things in order and kill all the hopes of restoring the dollar. But the dollar has just begun to show attempts to grow. And the worst thing is that Donald Trump made this statement amid reports that clashes with the police killed two protesters in Chicago.

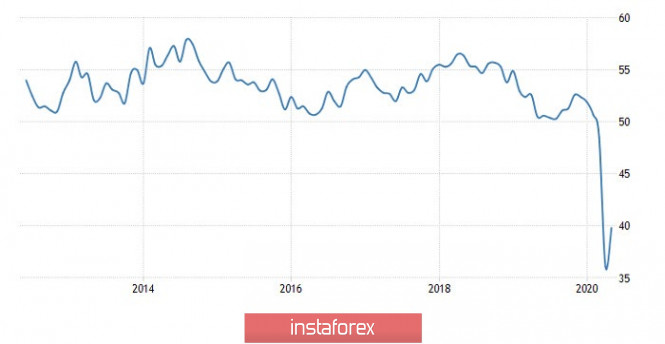

At the same time, the dollar had every reason to weaken against the pound during the European session. After all, the index of business activity in the manufacturing sector of the United Kingdom grew from 32.6 to 40.7. In other words, the British industry sees at least some hints of the possibility of improving the situation and hopes for a quick start to recovery. It is clear that this is a great reason for the pound's growth. Moreover, the index rebounded from its record low.

Manufacturing PMI (UK):

Nevertheless, the dollar began to make confident attempts to grow at the beginning of the US session due to the same index of business activity in the manufacturing sector, which in the United States grew from 36.1 to 39.8. That is, the US industry sees at least some signs of improvement. Which is not surprising, because the restrictive measures introduced due to the epidemic of the coronavirus still begin to gradually be removed. So there really is a reason for optimism.

Manufacturing PMI (United States):

Nevertheless, the pound clearly looks overbought, and any little things will be enough for it to begin to lose its position. And the reason for this could be data on the lending market, from which nothing good is expected. In particular, the number of approved mortgage loans should be reduced from 56,200 to 20,000. In addition, the volume of consumer lending may be reduced by another 4.2 billion pounds. So if Donald Trump does not bring the national guard to the streets of American cities, then the pound has no choice but to lose its position.

Mortgages Approved (UK):

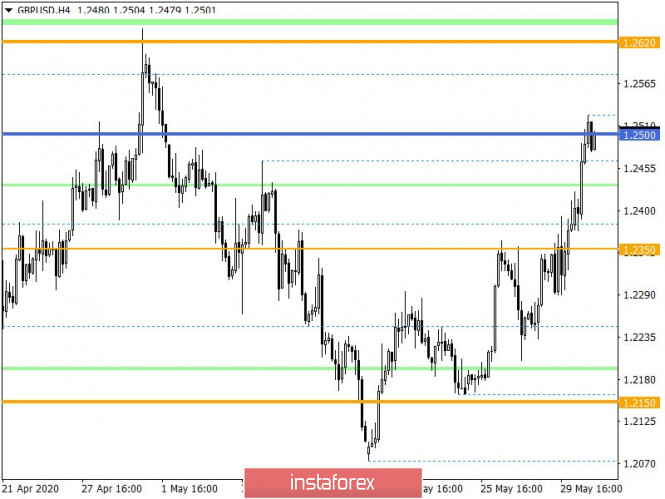

In terms of technical analysis, we see an intensive upward movement, where the quote was initially pinned above the 1.2350 level, and then accelerated in the direction of the subsequent coordinate 1.2500. The total move in two weeks reached more than 400 points, which means that the earlier downward measure of May 1 lost its influence. By detailing the last 10 hourly candles, you can see a clear slowdown within the boundaries of the fluctuation level of 1.2500.

Considering the trading chart in general terms, the daily period, it is worth highlighting the flat formation, within which the quote returned due to the upward movement.

We can assume a temporary price fluctuation within the 1.2500 level where the expansion of the amplitude to the scope of 1.2440/1.2525 is not excluded. Then you should use the method of trading for the breakdown of established boundaries.

We specify all of the above into trading signals:

- We consider short positions lower than 1.2470, towards 1.2440. Subsequent positions will be considered after a clear consolidation of the price below 1.2440.

- We consider long positions in terms of continuing the upward movement, in case of price consolidation above 1.2530, towards 1.2600.

From the point of view of a comprehensive indicator analysis, it can be seen that the indicators of technical instruments on hourly and daily periods signal a purchase due to the prevailing upward interest.