To open long positions on GBP/USD, you need:

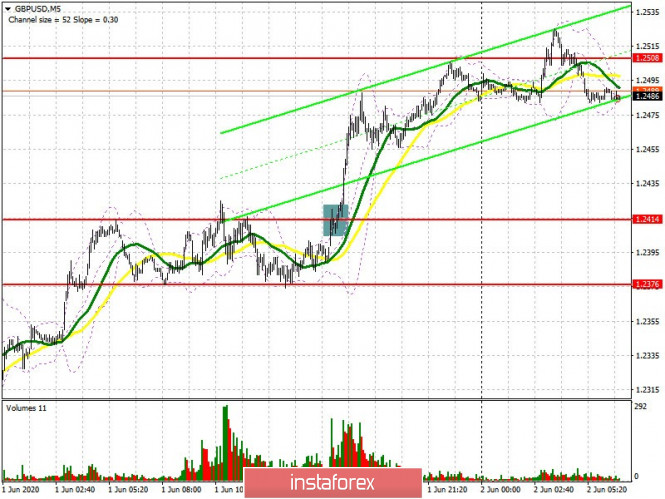

The British pound continued to grow against the US dollar yesterday, while traders wait for good news on the conclusion of a trade transaction between the UK and the EU. The next round of negotiations will begin today. If you look at the 5-minute chart, you will see how yesterday, the buyers did an excellent job with the second test and consolidated above the resistance of 1.2414, from which it was possible and necessary to sell yesterday morning. A break of this range in the afternoon led to a powerful bullish momentum and updating resistance 1.2508, near which the main trade is now conducted. However, if we look at the Commitment of Traders (COT) reports for May 26, we will see that a very large increase in short positions was recorded, while long non-profit positions showed a slight increase, which indicates a gradual return of interest of British pound sellers to the market at current highs. The preponderance remained on the side of the sellers even despite the pair's large growth since mid-May of this year. The COT report indicated that short non-profit positions increased from 54,799 to 61,449 during the week, while long non-profit positions also increased from 35,810 to 39,192. As a result, the non-profit net position became even more negative and turned out to be at the level of –22,257, against –18,989, which so far indicates that the medium-term bearish trend has remained in GBP/USD. As for the intraday strategy, the bulls need to defend support 1.2439, a return to which can happen very quickly today in the morning. Moving averages are also visible at the same level, from which the pair can rebound. Forming a false breakout in this range will be a signal to open long positions in order to grow to resistance 1.2508. An important task for the bulls to maintain an upward momentum will be to break and consolidate above this range, with the test already upside down on the volume, which will lead to forming a new buy signal based on updating the highs of 1.2557 and 1.2597, where I recommend taking profits. If the pressure on the pound persists, and there is no major movement upward from the 1.2439 level, it is best to pause with long positions and buy for a rebound from the lows of 1.2376 and 1.2290, counting on a correction of 35-40 points inside the day.

To open short positions on GBPUSD, you need:

Pound sellers urgently need to return the market to their control, and this can only be done after consolidating under the support of 1.2439, where the moving averages are held. This will then increase the pressure on the pair and lead to a test of larger support at 1.2376, where I recommend taking profits. However, it will only be possible to talk about resuming the downward trend after breaking through the low of 1.2290. A very important task for sellers is to prevent the breakout of resistance 1.2508, forming a false breakout there in the first half of the day will then be a signal to open short positions in the pound. A lot will depend on negotiations between the UK and the EU. If at least minimal progress is achieved, then it is best to return to short positions after updating the high of 1.2557, or from larger areas 1.2597 and 1.2638, counting on a correction of 30-40 points within the day.

Signals of indicators:

Moving averages

Trade is conducted above 30 and 50 moving averages, which indicates a possible continuation of the bull market in the short term.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differs from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger bands

In case the pair grows further, the upward movement will be stopped near the upper border of the indicator at 1.2550. A break of the middle border of the indicator in the area of 1.2470 will increase pressure on the pound.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit traders are speculators, such as individual traders, hedge funds and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long nonprofit positions represent the total long open position of nonprofit traders.

- Short nonprofit positions represent the total short open position of nonprofit traders.

- The total non-profit net position is the difference between short and long positions of non-profit traders.