To open long positions on GBP/USD, you need:

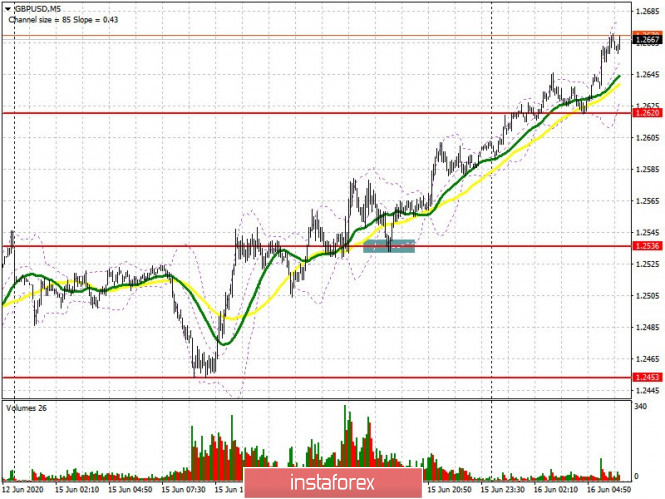

Despite gloomy fundamental statistics and the lack of progress in trade negotiations between the UK and the EU, the British pound continues to show strength and improves its position against the US dollar. Yesterday I paid attention to the purchase of the pound, both in the morning and in the afternoon. If you look at the 5-minute chart, you can see how the bulls, having taken the level 1.2536, managed to gain a foothold on it, and its repeated test closer to the middle of the US session led to the continuing the bull market, which made it possible to reach a new high of 1.2620, above which trade is now underway. The Commitment of Traders (COT) report for June 9 recorded a sharp reduction in short positions and an increase in long ones, which indicates a completely possible change in the market direction in favor of strengthening the pound. This once again indicates that traders are counting on progress in negotiations related to the trade agreement, and are reviewing their positions, preparing for a major rising wave of the pound in the second half of the year. The COT report states that over the week there was a reduction in short non-profit positions from the level of 63,014 to the level of 52,941. By the way, this is the first reduction in short positions since April 14 of this year. At this time, long non-profit positions sharply rose from 26,970 to 28,893. As a result, the nonprofit net position reduced its negative value to -24,048, versus -36,044, which indicates a possible market reversal and building a new bullish momentum in the medium term.

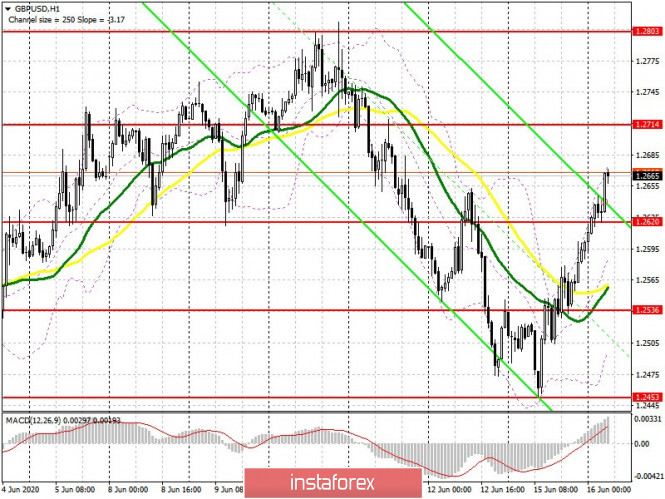

As for the intraday strategy, as long as buyers control the market above 1.2620 support, we can count on strengthening the British pound further. Forming a false breakout in this range after the release of a number of important data on the state of the UK labor market will be an additional impulse to open long positions in order to update and consolidate above the high of 1.2714. Such a scenario will open a direct path to resistance 1.2803 and 1.2906, where I recommend taking profits. If the pressure on the pound returns, and you can't expect anything good from the April indicators on the labor market, then after the GBP/USD returns to support 1.2620, it is best to postpone opening new long positions until the test of the low of 1.2536, or buy immediately for a rebound from the weekly low of 1.2453, where yesterday there was a reversal of the downward trend.

To open short positions on GBP/USD, you need:

Pound sellers already had problems maintaining a bearish momentum, and today it is very important how to quickly return the pair to the support level of 1.2620. This will be possible after the release of data on the state of the UK labor market. Consolidating below 1.2620 will be a signal to open short positions in GBP/USD, which will lead to a repeated decrease in the pair and updating the low of 1.2536, where the moving averages are held, as well as to the support test of 1.2453, where I recommend taking profit. If the demand for the pound continues in the first half of the day, I do not recommend rushing with opening short positions from the resistance of 1.2714. It is best to wait a false breakout forms there, and sell immediately for a rebound from a larger weekly high of 1.2803, based on an intraday correction of 30-40 points.

Signals of indicators:

Moving averages

Trading is slightly above 30 and 50 moving averages, which indicates an attempt by the bulls to take the initiative again.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differs from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger bands

In case the pair decreases, support will be provided by the average border of the indicator in the area of 1.2590, and you can buy the pound immediately on the rebound after testing the lower border of the indicator in the area of 1.2490.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit traders are speculators, such as individual traders, hedge funds and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long nonprofit positions represent the total long open position of nonprofit traders.

- Short nonprofit positions represent the total short open position of nonprofit traders.

- The total non-profit net position is the difference between short and long positions of non-profit traders.