To open long positions on EUR/USD, you need:

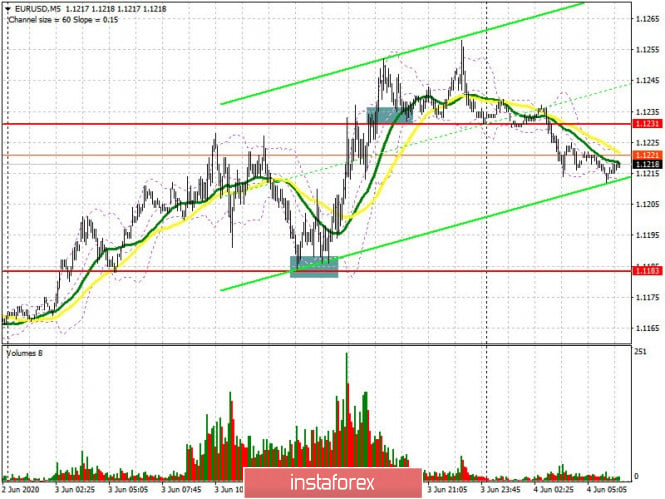

Yesterday, the bulls demonstrated strength and managed to keep the pair above the 1.1183 level, from which I recommended to open long positions. If you look at the 5-minute chart, you will see how the repeated test of this range at the US session led to a new sharp wave of EUR/USD growth, and then to a break and consolidation above the 1.1231 level, which buyers were not able to keep on today's Asian session. As for the current picture, the levels have slightly changed. Today, we are facing an important decision of the European Central Bank on interest rates, but the economic forecast from the regulator, which, as many expect, can put strong pressure on the euro, will be more interesting. If the bulls manage to stay above the 1.1195 level today in the morning, and also form a false breakout there, this will be a good signal to open long positions with the aim of returning and consolidating above the resistance of 1.1254, which will lead to the renewal of new highs around 1.1295 and 1.1344, where I recommend taking profits. If the ECB forecasts really will be too negative, then after breaking through support 1.1195 I do not recommend rushing to open long positions. It is best to wait for the low of 1.1139 to be updated, or to buy immediately for a rebound from the 1.1085 level with the aim of an upward correction of 30-35 points at the end of the day. In the meantime, the market remains on the side of buyers of the euro. In COT reports, a rather intensive growth of long positions was observed, which jumped from the level of 167,756 to 175,034. As a result, the positive non-profit net position also increased and reached 75,222, against 72,562, which indicates an increase in interest in buying risky assets.

To open short positions on EUR/USD, you need:

Sellers are still less active and the entire focus is now on the forecast of the European Central Bank, as well as on the speech of the head Christine Lagarde. If negative forecasts are given, then a breakthrough of support at 1.1195 will certainly increase pressure on the European currency, which will lead to a downward correction of EUR/USD to 1.1139, where I recommend taking profits. Bears will aim for the low of 1.1085, the test of which could be the start of a new downward trend in the pair. If the demand for the euro continues in the morning, then it is best to consider new short positions only after forming a false breakout in the resistance area of 1.1254, or to sell already at the rebound from the new highs of 1.1295 and 1.1344, and the higher the better. However, you should not count on more than a correction of 25-30 points from these levels.

Signals of indicators:

Moving averages

Trade is carried out in the region of 30 and 50 moving average, which indicates real problems for buyers of the euro with further growth.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differs from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger bands

A breakthrough of the lower border of the indicator in the region of 1.1195 will increase pressure on the European currency. A break of the upper border of the indicator in the area of 1.1254 will lead to new purchases of the euro.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit traders are speculators, such as individual traders, hedge funds and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long nonprofit positions represent the total long open position of nonprofit traders.

- Short nonprofit positions represent the total short open position of nonprofit traders.

- The total non-profit net position is the difference between short and long positions of non-profit traders.