4-hour timeframe

Technical details:

Higher linear regression channel: direction - sideways.

Lower linear regression channel: direction - sideways.

Moving average (20; smoothed) - sideways.

CCI: 246.3812

On Thursday, April 30, the EUR/USD currency pair perked up. Trading was very boring for a few weeks, however, both the euro/dollar and the pound/dollar synchronously soared up yesterday. Thus, the fall in the US currency can not be linked to the Fed meeting, which was the day before, to the publication of weak US GDP, which was also the day before, as well as the meeting of the European Central Bank, its results and the publication of data on unemployment, inflation and GDP in the Eurozone, because this news is not related to the British pound. There are only two reports that could hypothetically cause the dollar to fall. These are applications for benefits, which this time was not as failed as 5 weeks in a row before. It could not have caused such a strong fall in the US currency. There remains a report on the personal income and spending of the American population, which fell record-breaking. Judge for yourself, as far as possible, so that the report, to which there is no reaction even in normal, quiet times, could provoke a total fall in the US currency when all the other much more important data were ignored.

At the end of the trading week in the European Union, no more important events and reports are planned. This week, however, there were plenty of them. The day before, reports on GDP for the first quarter, unemployment and inflation were published. And also yesterday, the results of the ECB meeting were summed up, which in the last article we covered very superficially due to the fact that at the time of writing, the press conference with Christine Lagarde had not yet ended. However, all the key decisions of the ECB are already known and the market has taken them into account. Accepted and ignored. The European currency during the penultimate trading day of the week simply did not know what to do. Only at the end of the day, the markets seemed to break loose and began to get rid of the US currency. And this is hardly related to the results of the meeting. However, this event needs to be analyzed in detail.

First and most importantly, the ECB left key rates unchanged. However, none of the market participants expected that the regulator would change them. Also in the final statement was the already well-known wording that "rates will remain at ultra-low values until inflation returns to the target levels of the Central Bank." Given that these target levels are about 2%, and inflation in the European Union continues to slow down and is unlikely to accelerate during the crisis, the European regulator will raise rates for a very long time. And what kind of increase can we talk about if the EU economy needs help in the amount of several trillions of euro currency? And this is at a time when the epidemic has not ended, that is, it will continue to have a negative impact on the economy. The European Central Bank announced the launch of a new lending program for banks, lowered the rate for the target long-term lending program TLTRO III and announced that it was ready to increase the scale of the Pandemic Emergency Purchase Program, which currently stands at 750 billion euros. Thus, the European Central Bank is ready to resort to any monetary measures to save the economy, and these measures are really needed. Also in May, a new program for short-term lending to banks in the context of the epidemic will be launched, which will be designed to provide the necessary levels of liquidity and promote the normal functioning of markets. The Central Bank of the Eurozone, in an accompanying statement, also announced its readiness to continue buying bonds until the crisis ends and, at least, until the end of this year.

Christine Lagarde during a press conference of the European Central Bank said that the fall of the European economy may be unprecedented. According to ECB forecasts, EU GDP in 2020 will decrease by 5-12%, and the scale of economic contraction will depend on the timing of quarantines in different EU countries, which ensure the minimum spread of "coronavirus" infection. No one knows whether there will be new waves of pandemics or how long humanity will have to fight it. Thus, these forecasts are still optimistic, implying that the easing of quarantine measures will not lead to new outbreaks and the EU economy will begin to recover in the third quarter. As for the second quarter, according to Christine Lagarde, the EU economy will decline by 15%(recall that the United States is expected to contract in the second quarter by 15-25%). The European Central Bank expects that the economy will not start on the path of a confident and stable recovery until 2021. The Pandemic Emergency Purchase program may be extended to 2021, if necessary.

Well, in fact, all the efforts of the European Central Bank are reduced to buying government bonds of European countries, which in return receive cash, which the regulator simply prints or creates in bank accounts. The ECB still states that the main goal is economic growth, which will be realized through stable inflation. However, the methods of banal printing money and distributing it through debt mechanisms to EU countries are unlikely to lead the EU to grow. On the other hand, there is no question of any growth now. This is about saving the economy.

Meanwhile, Donald Trump made a new statement on the topic of "coronavirus", which again makes you think about what the American President meant. "We need to wait for the virus to go away. He will leave, and we will return to the old life," Trump said. When asked: "Why do you think that without a vaccine, the virus will go away?", Trump replied: "It will leave us, self-destruct." Recall that just a few days ago, Donald Trump advised doctors to study the possibility of delivering strong rays of light and disinfectants inside the body of patients with "coronavirus", which "can kill the virus in one minute". In addition, the US leader said that the Americans will have to wait, perhaps for several years, until the virus goes away.

At the same time, Donald Trump said that it is extremely unprofitable for China to win the presidential election in November. And in his opinion, Beijing will do everything to prevent him from winning the election and support Joe Biden. However, this information is not new and began to spread even at the time of the declaration of a trade war with China. On the other hand, what did Trump want? For China to idolize him and maybe finance his election campaigns? The American President himself has made a huge number of enemies in the three years that he has been at the helm of the country. Perhaps never in the history of the United States has a President had so many detractors, both inside and outside the country. And of course, Trump did not fail to once again accuse China of spreading the COVID-2019 epidemic around the world. Asked what options the White House is considering as compensation for the consequences of the epidemic, Trump replied: "I can do a lot." It really can. For example, cancel the trade agreement with Beijing, impose new duties on it, demand compensation, and impose various types of sanctions. But will there be enough time until November 2020 for the American President to further damage relations with China?

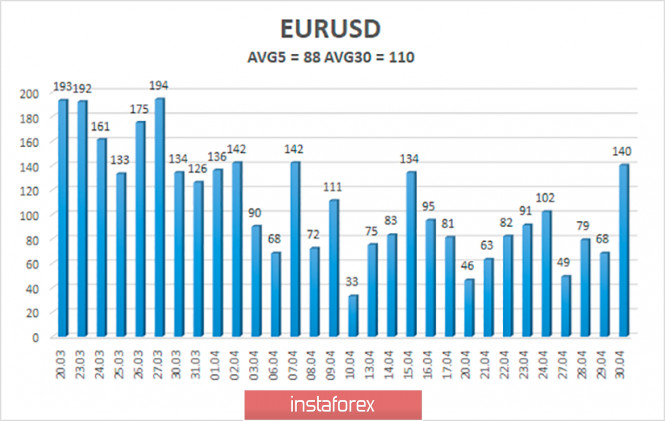

The volatility of the euro/dollar currency pair as of May 1 is 88 points. Volatility, therefore, remains average in strength, close to high, and there is still no reason to expect a new wave of panic. Today, we expect the pair's quotes to move between the levels of 1.0862 and 1.1038. Turning the Heiken Ashi indicator down may signal the beginning of a downward correction.

Nearest support levels:

S1 – 1.0864

S2 – 1.0742

S3 – 1.0620

Nearest resistance levels:

R1 – 1.0986

R2 – 1.1108

R3 – 1.1230

Trading recommendations:

The EUR/USD pair overcame the moving average and continues its upward movement. Thus, traders are recommended to stay in the purchase of the euro currency with the goals of 1.0986 and 1.1038 levels until the Heiken Ashi indicator turns down. It is recommended to consider selling the euro/dollar pair not before fixing the price below the moving average line with the goal of 1.0742.

The material has been provided by InstaForex Company - www.instaforex.com