According to the results of the meeting that ended on Wednesday, the US Federal Reserve left both the rate level and the QE program unchanged. The results of the meeting were in line with expectations and did not lead to noticeable market fluctuations.

There is growing confidence that rates will remain low over a long range until at least 2021.

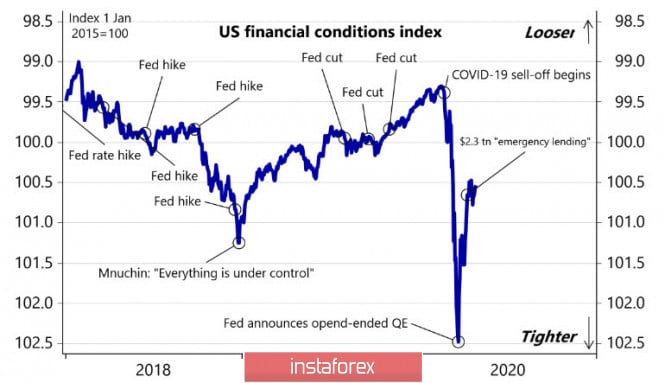

It should be noted that the Fed's measures, despite their ambiguity, are still yielding results. The financial conditions have softened significantly after the start of the pandemic, which has ensured the functioning of the market.

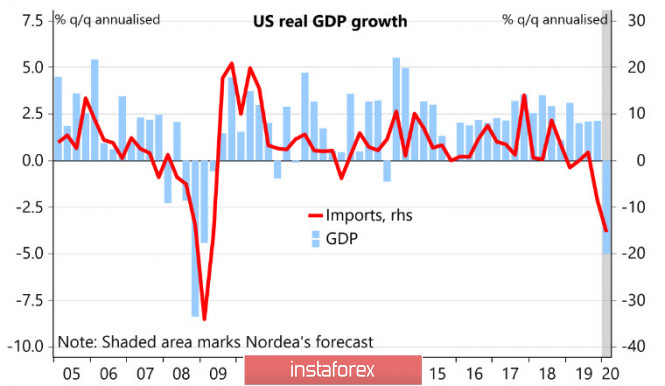

US GDP fell during the first quarter - 4.8% yoy, which is the worst figure since the fourth quarter of 2008.

Personal consumption declined by 7.7% q / q, which is not surprising given the weak data on car sales and retail sales, and this is the largest quarterly decline since 1980 - the very height of the energy crisis. Despite the fact that exports made a positive contribution to GDP, this was not due to the fact that exports increased, but because of the maximum decrease in imports since 2008.

All this is a sign of a sharp drop in demand. Therefore, according to preliminary estimates, the second quarter will be much worse than the first. A number of banks forecast a decline in GDP in the range of 20 - 30%; Nordea Bank is the most pessimistic - it expects a decline of 31%.

Given the development of the pandemic situation, it is hardly worth expecting its completion before June. This means that demand growth for risky assets until the second quarter is unlikely, global demand for oil will also remain weak, and another wave of falling oil prices is possible given the storage will be full in the coming weeks.

EUR/USD

The ECB meeting will be held amid worsening economic prospects. According to the European Commission, the mood in the services sector declined in April from -2.3p. up to -35p, the index of business optimism in industry - from -11.2p to -30.4p.

The Fed managed to maintain financial conditions due to a sharp increase in the balance sheet, but inflationary expectations in the US stopped falling. The ECB noticeably lags behind the Fed in terms of its impact on the economy, and if the market does not receive a clear signal of readiness to significantly expand stimulus today, this could lead to a sharp increase in the euro exchange rate, which is unacceptable for European business since it will reduce its competitive advantage amid a rapid recession.

Accordingly, markets expect the ECB to begin to act proactively, without waiting for a recession. A wave of lowering the credit rating of corporations is expected, which will cause a quick shortage of collateral, and, as a result, the credit activity of banks will decrease. Accordingly, the ECB may announce today the provision of significant credit resources on facilitated terms to prevent cyclic processes from taking place .

The euro did not respond to the Fed meeting, but the ECB is unlikely to ignore the result of the meeting. The most likely scenario is an increase to the 1.0940/70 zone, the technical bullish impulse is not over yet, as support for 1.0730 / 60 is stable and does not allow the euro to decline from the side range. If you try to go above 1.10, you can buy with the goal of 1.1130, but to implement this scenario, several conditions must be met that are not shown before the ECB meeting.

GBP/USD

The pound is the only currency that falls against the dollar. The pound is not supported by internal news, the situation with COVID-19 looks worse in the UK than in most countries, the Bank of England is silent, and macroeconomic benchmarks are not enough to get out of the range.

Today, we can count on an attempt to grow to 1.2520, this will be facilitated by both oil growth and the general positive mood of the market. If testing the level of 1.2520 is successful, the pound will try to develop success and move on to 1.2640, but strong movement is unlikely.

The material has been provided by InstaForex Company - www.instaforex.com