GBP/USD 1H

Lateral movement was observed with a low downward slope on the hourly chart for the pound/dollar pair on May 21. In recent days, traders have not been able to cross the Senkou Span B line, so further upward movement is called into question. However, the bears also failed to cross the Kijun-sen line yesterday, so the resumption of the downward movement is still in question. By and large, now everything depends on which of these two lines traders will overcome. The GBP/USD pair is moving in that direction in the coming days. We believe that a downward movement is more preferable due to the general fundamental background, which is not in favor of the British currency.

GBP/USD 15M

The higher linear regression channel showed the completion of the upward trend in the short term, turning down on the 15-minute timeframe. But the minor channel of linear regression already signals the completion of the downward movement, at least it turned up. In general, the readings of both channels can be interpreted as uncertainty. Everything will depend on two more significant lines Kijun-sen and Senkou Span B on the hourly timeframe.

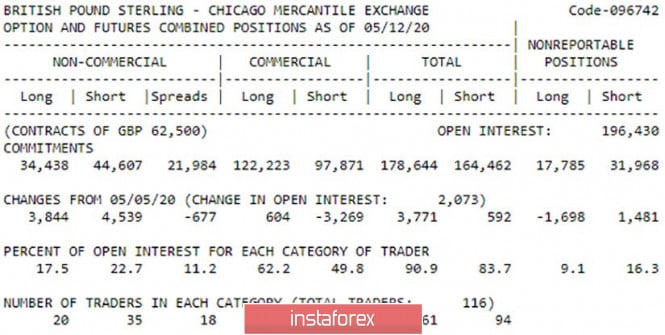

COT Report

The latest COT report for May 12 shows that the total number of buy and sell transactions among large traders per week increased by 4,000, mainly due to purchases. However, the total number of transactions for the purchase is still only 16,000 more than transactions for selling. Such an imbalance persists for a long period of time, and it was not enough for the pair to begin forming an upward trend. In the reporting week, professional traders opened more new deals for selling (4539), which means that most of them are waiting for a new fall in the British currency. A new COT report will be released today, according to which the mood of large traders is unlikely to change to the upward.

The fundamental background for the British pound remains sharply negative. Despite the fact that the macroeconomic background is equally disappointing both in the United States and in Great Britain we believe that the UK economy continues to experience much more serious problems than the American one. Moreover, general uncertainty is again associated with the British economy. No one knows how, by what rules and with whom London will trade after 2020. There are no trade agreements with the EUR and the US yet. But investors and traders really do not like uncertainty and try to invest in the economies and currencies of those countries where everything is more or less clearly, clearly and well predicted. Thus, paired with the dollar and the pound, traders prefer to buy the dollar. A retail sales report is scheduled for Friday in the UK, and it is unlikely to support the British currency, even if traders want to work it out.

We have two main options for the development of the event on May 22:

1) The initiative for the pound/dollar pair remains in the hands of the bears, despite the fact that the quotes have come out of the downward channel. Thus, we recommend buying the British pound not before consolidating the price above the Senkou Span B line - 1.2270 and, and, preferably, even the resistance level of 1.2325 with the first goal being the resistance area of 1.2404–1.2422. The next target, if this area is overcome, will be the resistance level of 1.2550. Take profit will be about 75 points in the first case and 120 points in the second.

2) Sellers are currently more likely to implement their plans. It will be enough to return the price to the area below the Kijun-sen line and the area of 1.2196-1.2215 to resume sales of the pair while aiming for the low of May 18 at 1.2073 and the support level of 1.1987. In this case, take profit will be about 105 and 190 points.

The material has been provided by InstaForex Company - www.instaforex.com