EUR/USD 1H

Quotes of the euro/dollar pair rose yesterday to the Senkou Span B line and the resistance area of 1.0881 - 1.0893 on the hourly timeframe, from which they had already rebounded several times before. And this time the pair rebounded off this strong area and line. Thus, a new round of downward movement began in the direction of the long-term upward trend line, which lies in the area of 1.0780. If the pair once again rebounds off this trend line, then the upward movement will resume again, perhaps even back to the Senkou Span B line. Overcoming the trend line will enable the US currency to continue its downward movement.

EUR/USD 15M.

We see quotes sharply dropping on the 15-minute timeframe during the US trading session on May 13. Quotes are near the lower boundaries of two linear regression channels at once, so the probability of a turn up is high. Along with this, the CCI indicator came close to the critical area of "-200", the entry into which is a strong signal to turn up. Therefore, forming this signal will enable us to expect the euro's growth. The smallest linear regression channel is directed downward, so further reduction is also allowed. An ideal option would be for the CCI indicator to enter the "-200" area near the upward trend on the hourly timeframe.

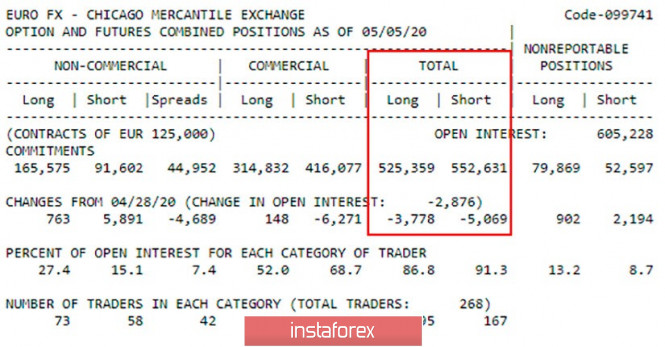

COT report.

The latest COT report of May 5 showed a decrease in the number of transactions for purchase among large traders by 3,778 and a decrease in the number of transactions for sale by 5.069. Thus, the downward mood slightly weakened for the euro. But, since the total number of sales contracts exceeds the number of purchase contracts, the overall trend still remains downward.

As we have repeatedly said in fundamental reviews, market participants are ignoring the entire macroeconomic background. Today, the United States is set to report on applications for unemployment benefits, which is almost guaranteed to usher in an additional few million unemployed Americans. Thus, even if the value of the indicator turns out to be slightly better than the forecast, we do not believe that it will be a reason for joy. This means that in the afternoon we can expect the US currency to fall (the growth of the EUR/USD pair). Again, a reversal is very likely near the upward trend on the 4-hour timeframe. You should also carefully monitor the CCI on the 15-minute timeframe. Good reasons are needed for the pair to fall further. There are not so many planned important events on Thursday; overcoming the trend line is likely to happen on Friday, when a report on GDP is published in the European Union.

Based on the foregoing, we have two trading ideas for May 14:

1) On Thursday, we expect the pair's quotes to fall to the trend line and/or the area of 1.0763 - 1.0775. Those traders who are already in sell-offs after rebounding from the Senkou Span B line can support open sell positions with the target of 1.0780. It is recommended to open sell positions for the pair only in the event of overcoming the trend line. The potential to take profit is about 35 points in the first case, and about 30 points for the target of 1.0745.

2) The second option - bullish - implies a rebound from the long-term ascending trend line. We recommend that you open purchases of the euro in this case with the goal of Senkou Span B line - 1.0893, especially if the CCI indicator on the 15-minute chart goes into the "-200" area beforehand. The potential to take profit in the execution of this scenario is at least 100 points.

The material has been provided by InstaForex Company - www.instaforex.com