The euro/dollar pair showed increased volatility today - if the price updated the low of this week in the morning, declining to the level of 1.0780, then during the American session, buyers were able to update the weekly high, rising a hundred points higher. Now, the eur/usd bulls are trying to consolidate above the level of 1.0850, where the middle line of the Bollinger Bands indicator passes, which coincides with the Kijun-sen line on the daily chart. If they manage to do this, then the probability of price growth in the area of the ninth figure will largely increase, despite the entire array of negative fundamental factors that accompany the European currency. That is, at the moment, the positional struggle between the bulls and bears of EUR/USD is still ongoing.

Today's growth of the EUR/USD pair is not only due to the release of data on the growth of US inflation – the comments of some Fed representatives also worsens the situation, putting pressure on the dollar. However, the main impulse of EUR/USD growth, of course, was inflation.

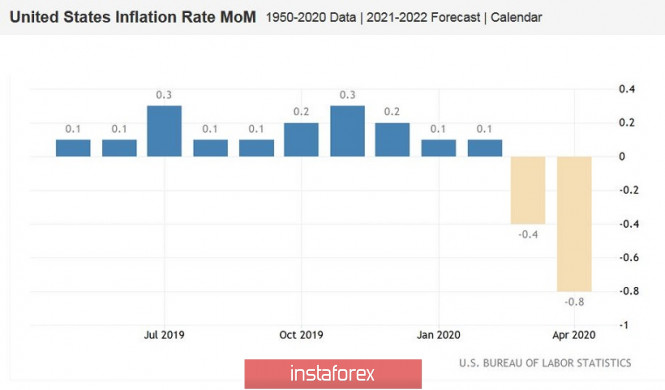

Let me remind you that the previous March inflation indicators already reflected the presence of coronavirus in the US - on a monthly basis, the general index collapsed into the negative area (-0.4%), and it dropped to one and a half percent in annual terms. In April, the negative dynamics continued. The data published today came out in the "red zone" - all indicators were weaker than the rather pessimistic forecast values. Thus, the general consumer price index in monthly terms, while forecasting a decline to -0.7%, fell to -0.8%. On an annualized basis, experts expected to see the general CPI at around 0.4%, while the figure came out at around 0.3%. Core inflation indicators, excluding food and energy prices, showed relative stability in March, but April figures was disappointing. In monthly terms, the core index dropped to -0.4%, in annual terms - to 1.4%. All this suggests that the coronavirus crisis is hitting the US economy more than previously expected, and even quite pessimistic forecasts were not justified – the real figures were still worse.

Amid such a disappointing report, some Fed representatives also spoke, who put additional pressure on the dollar. In particular, Richmond Federal Reserve President, Thomas Barkin, suggested that the recovery of key macroeconomic indicators will most likely be slower than previously thought. A similar opinion was expressed by Neel Kashkari, who, by the way, has the right to vote this year. According to him, the authorities will not be able to stabilize the economy until the epidemic spreads uncontrollably. And although Kashkari opposed the introduction of negative rates, he noted that the regulator has other tools that "can and should be applied." The head of the Dallas Federal Reserve Bank, Robert Kaplan, also spoke about negative interest rates. However, he said he would not vote for this decision, because "the possible advantages of negative rates do not compensate for their disadvantages." At the same time, he also said that the crisis could be prolonged compared to previous forecasts. The consistent James Bullard, on the other hand, stated his pessimistic idea today. He said that further quarantine restrictions would lead to bankruptcies and economic depression.

In other words, the Fed representatives in one interpretation or another say that the crisis is likely to be more prolonged than the initial forecasts, and further quarantine restrictions will only worsen the situation. Meanwhile, the United States continues to rank first in the world in the number of deaths and diagnosed cases of coronavirus – there are more than 1.3 million cases of infection. The incidence is increasing in States such as Mississippi, Minnesota and Nebraska, increasing the risk of a new COVID-19 outbreak. According to some scholars, too hasty actions of the authorities to open the economy can provoke a second wave of the epidemic in the country. It turns out to be a vicious circle: quarantine "kills" the economy, while a hasty lifting of restrictive measures can kill a large number of people, after which the country will return to the quarantine regime.

Thus, the dynamics of US inflation and the pessimistic statements of the Fed representatives put significant pressure on the dollar. But in the context of the EUR/USD pair, we can only talk about a correction so far. For further growth the bulls of the pair, firstly, it is necessary to consolidate above the level of 1.0850 (the middle line of the Bollinger Bands indicator, which coincides with the Kijun-sen line on the daily chart), and secondly, to break through the level of 1.0890 (Tenkan-sen line on the same timeframe). In this case, it will be possible to consider long positions with the first upward target at 1.0950 (the upper line of the Bollinger Bands) and the second target at 1.1010 (the lower border of the Kumo cloud). If EUR/USD traders cannot settle above the level of 1.0850, they will fall back to the base of the eighth figure, with further testing of the seventh price level.

The material has been provided by InstaForex Company - www.instaforex.com