4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - upward.

CCI: 1.0981

The GBP/USD currency pair is trading this week as simply and clearly as possible. Despite the fact that volatility remains quite high (more than 100 points per day), its current size is not in any way comparable to what it was just two or three weeks ago, when the pair regularly passed more than three hundred points. However, this week, the pair worked out the Murray level of "3/8"-1.2451 as part of the correction after a one-and-a-half thousandth fall and stopped. The level of 1.2451 was worked out at least three times, and each time the pound/dollar pair bounced off it, while not starting a logical downward correction in this case, at least to the moving average. Thus, in fact, we now have an absolute flat, within which you can only trade on small timeframes between the upper and lower border of the side channel. On a 4-hour timeframe, we recommend waiting for the end of the flat and the resumption of the upward movement or the beginning of the downward movement.

Macroeconomic statistics, as we have already found out in the article on EUR/USD and in yesterday's final article, do not play any role for market participants. However, we still can not pass by the macroeconomic reports scheduled for Friday, as this is, in any case, important data that market participants will take into account when opening their positions in the future. Today, on April 3, the UK will publish the index of business activity in the service sector for March, which is likely to fall in comparison with February to a value of 34.8. As in the case of Germany and the European Union, the British index has never fallen to such low value in the past 12 years. But in 2008, there was a time when it also fell down, though then "only" to the value of 40.

In the United States, macroeconomic statistics will be much more interesting and expected. First, we will know the unemployment rate for March, which, according to various forecasts, will grow from 3.5% to 3.8%-4.0%. The report on changes in average wages in March is the least attractive of the entire package of statistics and has the most neutral forecast – 3% in annual terms and 0.2% in monthly terms. But the Nonfarm Payrolls indicator for March is preparing to become the second most important indicator after applications for unemployment benefits. No matter what Steven Mnuchin says, when the number of applications for benefits increases by 6.5 million in two weeks, the report from ADP on the number of people employed in the private sector falls below zero (for only the second time since the 2008 crisis), it is impossible to turn a blind eye to what is happening. And we can't expect any positive report on NonFarm Payments either. According to experts\' forecasts, the number of new jobs created outside the US agricultural sector may fall from -100 to -150 thousand. The last time such Nonfarm cuts were made was during the mortgage crisis. As the "cherry on the cake" in the States, business activity indices in the service sector will be published according to the Markit and ISM versions. The first may decrease to 39.1 from the current 49.4, and the second – from 57.3 to 43.0-44.0. Thus, the entire package of macroeconomic statistics from overseas is projected to significantly deteriorate compared to February. The key question is: will this information be ignored by market participants? The EUR/USD currency pair has a better chance to "react". The pair is in motion. The pound stands still.

But unfortunately, the "coronavirus" epidemic is not standing still, which continues to spread around the world and, in particular, in Britain, taking with it more and more victims. In the UK, the highest daily death rate was recorded yesterday – 393 people. In total, almost 3,000 people died from the epidemic in the Foggy Albion. Meanwhile, even in the economically developed UK, there is a banal lack of artificial ventilation devices. According to the new recommendations of the British Medical Association, doctors can decide which patient to give preference to and provide treatment with deficient devices. Fortunately, such situations have not yet occurred, but given the doctor's expectations for a further increase in the number of infected, these problems may arise. "Medical professionals may be forced to refuse treatment to some patients in order to provide treatment to others with a higher chance of survival." It is also reported that Britain is going to increase the number of daily tests for "coronavirus" to 25,000 in the next two weeks.

And the last thing I would like to tell you. At the end of April 2, the price of all oil brands, including WTI and Brent, jumped. At the moment, WTI rose to almost $27.5 per barrel with a daily low of $20.75. Brent from a low of $25.49 rose to $36.16 per barrel, but then again fell below $30. Nevertheless, there are chances for a recovery in oil prices, which is good news for all markets.

From a technical point of view, to resume the upward trend, you still need to wait for the overcoming of the Murray level of "3/8"-1.2451 or a distinct correction. Both linear regression channels are directed downward, so a downward trend is preferable. However, given the fact that these channels turned down during the panic in the currency market, their values can not be considered completely reliable. Well, the moving average line may soon reach the price itself and turn sideways, which will also indicate a sideways movement of the pair.

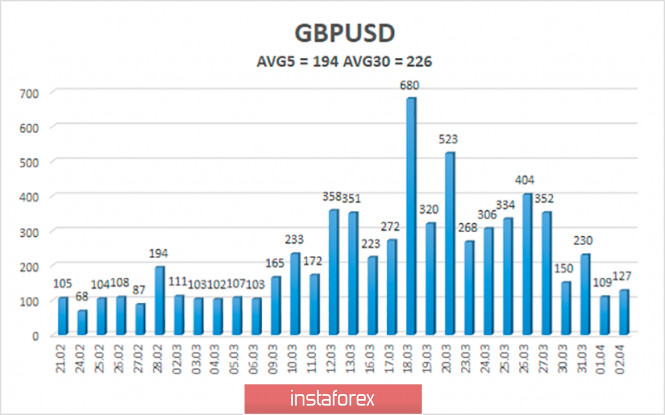

The average volatility of the GBP/USD pair continues to decline. At the moment, the average value for the last five days is 194 points. However, the activity of traders on the pound/dollar pair still remains quite high, which should be taken into account when opening any positions. On Friday, April 3, we expect movement within the channel, limited by the levels of 1.2170 and 1.2558. Although now there is a frank flat with much narrower borders of the channel.

Nearest support levels:

S1 - 1.2207

S2 - 1.1963

S3 - 1.1719

Nearest resistance levels:

R1 - 1.2451

R2 - 1.2695

R3 - 1.2939

Trading recommendations:

The GBP/USD pair on a 4-hour timeframe retains the prospects of an upward movement. Thus, buy orders for the pound with targets of 1.2558 and 1.2695 remain relevant now. It is recommended to open new buy positions if the bulls overcome the level of 1.2451, which now stops further northward movement. It is recommended to sell the British currency with the goal of 1.1963 if the bears manage to gain a foothold below the moving average.

The material has been provided by InstaForex Company - www.instaforex.com