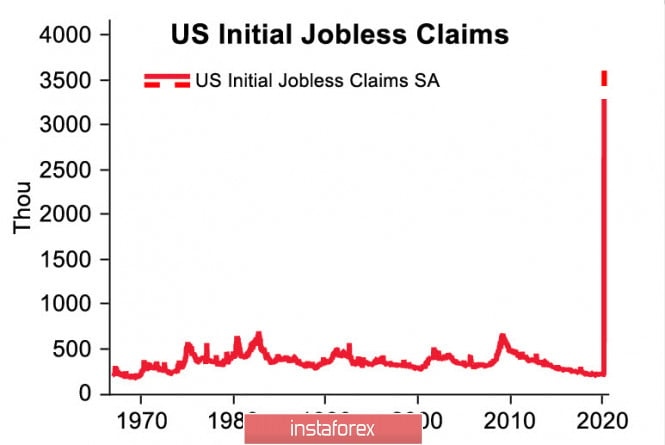

The Congressional Budget Committee said that the US economy will shrink in the 2nd quarter by 7% according to preliminary estimates. The unemployment rate will exceed 10% during the 2nd quarter, which reflects the huge growth rate of applications for unemployment benefits – 6.65 million new applications on April 2, 3.3 million applications a week earlier, in total, the US economy lost about 10 million jobs in just two weeks. These rates are more than 10 times higher than the lowest rates of 2007/2009, which indicates an unprecedentedly high level of threat in recent history.

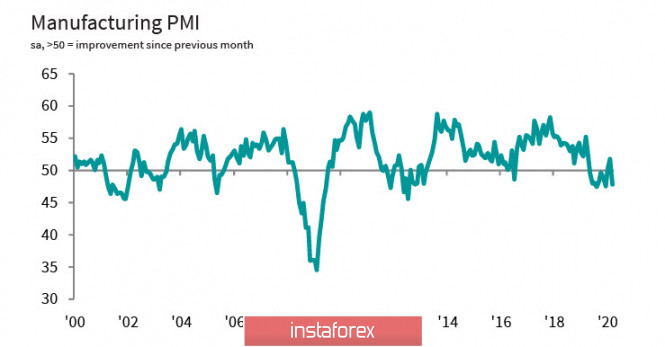

Thus, before the publication of the employment report in March today, expectations are more than gloomy. The manufacturing sector began to decline, which is unlikely to be stopped in the foreseeable future - the ISM new orders index in March declined from 49.8g to 42.2p, while the inflation acceleration index, reflecting business sentiment regarding inflation, declined from 45.9p to 27.4p.

Today, the ISM index for the services sector will also be released along with the employment report. Here, forecasts are extremely negative, and in general, Friday can go down in history as the day with the maximum deterioration in statistics compared to the previous period.

The measures taken by the US financial authorities are a time bomb. The dollar looks strong during the crisis, but only because most of the debt is denominated in USD, so it is in demand when liquidity is reduced worldwide. As soon as the first signs of a decrease in panic appear, for which two conditions must be met - the recession of the coronavirus epidemic and the stabilization of the oil market, as the dollar goes down sharply.

The second condition can be fulfilled earlier than the first - the 3 largest players in the oil market, namely the USA, Saudi Arabia and Russia, have begun to search for a mutually beneficial solution. Now, it's up to the virus.

EUR/USD

Most macroeconomic parameters are gradually declining in the eurozone, and despite the strong increase in panic due to the explosive increase in the spread of coronavirus, the situation does not look threatening.

Moreover, most of the indicators from the European Commission fell within the forecast, inflation in March slowed a little more than expected, but it is still far from deflation. On the agenda is a discussion of measures that can accelerate economic recovery - France initiated the release of "corona bond", with the aim of creating a fund for economic recovery in the EU, which is essentially the same well-known method of monetary stimulation in a new wrapper.

EUR/USD pair retreated 38% from the recent high of 1.1146, but this decline does not indicate a reversal, but only a correctional pullback before a new growth wave. The current level is favorable for purchases, the nearest target is 1.0960 / 70, then 1.1080, in the future 3-5 days we should expect a return to the local maximum and an attempt to go higher to 1.14.

GBP/USD

The pound can not overcome the resistance zone 1.2400 / 80, but the chances are growing every day. Unlike the dollar, the pound has not yet received any sensitive statistical hits - the consumer confidence index from Gfk fell slightly in March from -7p. up to -9p., business activity in the manufacturing sector in March also changed slightly from 48p to 47.8p, which looks amazing against the backdrop of the collapse of PMI in other countries.

In addition, even a drop in output at the fastest pace since July 2012 doesn't look as bad as the ISM drop in the United States.

Today, a report on the PMI in the services sector will be published, but it risks staying in the background amid the expected failure in the US employment market. Negotiations on a trade agreement between the UK and the EU are blocked indefinitely. Both sides are trying to pretend that they are not up to it now, in any case, there is no driver for the pound here.

The bottom line is, the likely growth of oil and a strong hit to the dollar against the background of the exponential growth of the epidemic in the US give the pound a chance to move up from the consolidation zone. Support is at 1.2370 / 80, the goal is to test the psychological resistance of 1.2500 for strength. On Friday, this is the most likely scenario for the pound.

The material has been provided by InstaForex Company - www.instaforex.com