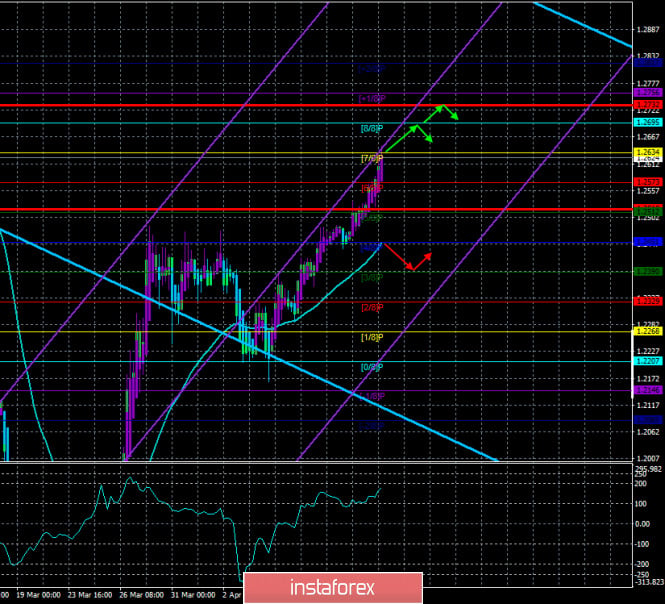

4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - upward.

CCI: 116.3347

The British pound continues its upward movement from the very beginning of the week. At the moment, the Murray level of "6/8"-1.2573 has been overcome and "7/8"-1.2634 has been worked out, and there is not a single sign of the beginning of a corrective movement. Market participants continue to buy the British pound even though there are no fundamental reasons for this now, and the panic can be considered a thing of the past. However, the pair continues to recover from the shocks that have been observed in the past month and a half. Thus, we may still be witnessing movements that are not fundamentally justified for some time.

In the UK, no macroeconomic publications are scheduled for tomorrow. Thus, all traders' attention will be focused on macroeconomic statistics from overseas. As in the case of the euro currency, traders of the British pound do not react too strongly to the macroeconomic background now. To be more precise, they don't react at all. For example, yesterday, the pound dollar pair "plowed" more than 100 points up, without having any reason to do so. Of course, any event that occurred yesterday can be "linked" to this growth of the pair, "concluding" that because of it, the demand for risky assets has increased. However, we believe that if traders do not react to the actions of Central Banks, the US government, do not respond to the scale of the "coronavirus" pandemic, to specific macroeconomic reports, it is unlikely that they are closely watching, for example, the oil market or the OPEC meeting, so that they will rush to buy a riskier pound. Thus, almost the entire fundamental background is now interesting and noteworthy, but no more. It does not help in predicting the movement of the currency pair in any way.

Returning to the OPEC+ meeting, we have already said that the world's largest oil producers managed to reach an agreement to reduce oil production by almost 10 million barrels per day in total. Black gold quotes did not react to these very optimistic results of the meeting. And even began to decline again. However, it should be noted that the agreement will enter into force only on May 1. In other words, it will take only three weeks to start reducing production, reducing supply on the oil market, and, accordingly, only three weeks to expect an increase in oil prices. Market participants, however, can also specifically lower the price of oil to buy it at the best possible price. We are talking primarily about speculators who do not use purchased oil futures but only resell them. Thus, until the end of April, there may even be a drop in quotes, but after May 1, there is a 90% probability that growth will begin. A currency like the Russian ruble has even started to grow in advance. And US President Donald Trump said that OPEC+ wants to achieve a double reduction in oil production, that is, up to 20 million barrels per day. The US President, as always, announced this via Twitter: "OPEC+ intends to reduce production by 20 million barrels per day, and not by 10 million, which is now reported." The American leader also thanked Russia and Saudi Arabia for their cooperation, saying that now the energy industry will recover much faster than previously expected.

Meanwhile, the UK quarantine is being extended until May 7. This was stated by Foreign Minister Dominic Raab on April 14. Soon, Raab will hold talks with the Ministers of Northern Ireland, Wales, and Scotland and agree on all the details. Earlier, Dominic Raab said that the quarantine measures are bringing results and there are the first signs that the spread of the "coronavirus" in the country is being suspended. The government's actions are supported by the population of Great Britain. 74% of respondents believe that defeating the epidemic is now more important than restarting the economy. And according to calculations by the Center for Economic and Business Research in Britain, each day of quarantine costs the economy about 2.4 billion pounds.

But, as in the case of the euro currency, traders now do not pay attention to such calculations. They do not pay attention to the number of infected people in the United States or the UK but continue to trade on pure "technology". And the technical picture is now quite simple. We have at our disposal an almost recoilless upward trend, which is eloquently signaled by the lower channel of linear regression. Only the highest channel of linear regression is directed downward from all trend indicators. The Heiken Ashi indicator, as the fastest, shows the direction of the intraday movement. And it does not differ from the global direction. The volatility of the pound/dollar pair is starting to grow again, but it does not differ much from the average indicators. As in the case of the euro currency, we believe that the British pound can return to the levels where a month and a half ago, the pair began to grow quite strongly, and then a collapse of 1,700 points. Thus, our target level is 1.2800. It was at this level that the pair was located on March 2-3. When this level is reached, which at the same time will equal approximately 76% of the correction from the last fall, the "correction against correction" may begin, in turn, and the pound may begin to fall with goals in the area of 1.19-1.20. As we see, the pair's potential for the coming weeks remains quite strong, and the macroeconomic background does not prevent market participants from trading, according to technical factors.

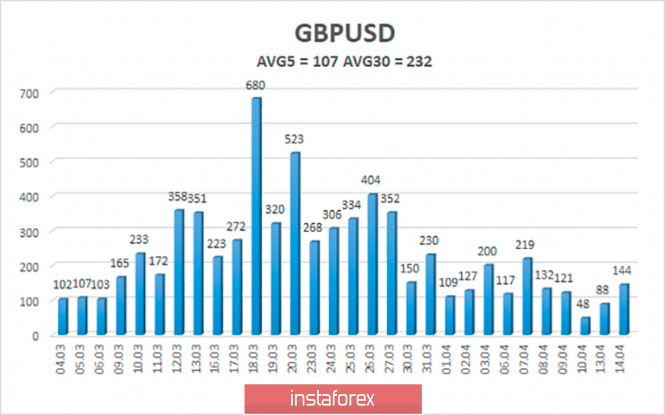

The average volatility of the pound/dollar pair continues to decline and currently stands at 107 points. Just like the euro/dollar pair, the pound is approaching levels of volatility characterized as "average" in strength. The activity of traders continues to fall and this can not but please. On Wednesday, April 15, we expect movement within the channel, limited by the levels of 1.2518 and 1.2732. The reversal of the Heiken Ashi indicator downwards signals a downward correction.

Nearest support levels:

S1 - 1.2573

S2 - 1.2512

S3 - 1.2451

Nearest resistance levels:

R1 - 1.2634

R2 - 1.2695

R3 - 1.2756

Trading recommendations:

The pound/dollar pair continues to trade with an upward bias on the 4-hour timeframe. Thus, it is now recommended to stay in the purchases of the pound with the goals of 1.2695 and 1.2732 until the reversal of the Heiken Ashi indicator down. It is recommended to open sell positions no earlier than when the bears overcome the moving average with the first goal at 1.2390, which is not expected soon since the price is now too far from the moving average.

The material has been provided by InstaForex Company - www.instaforex.com