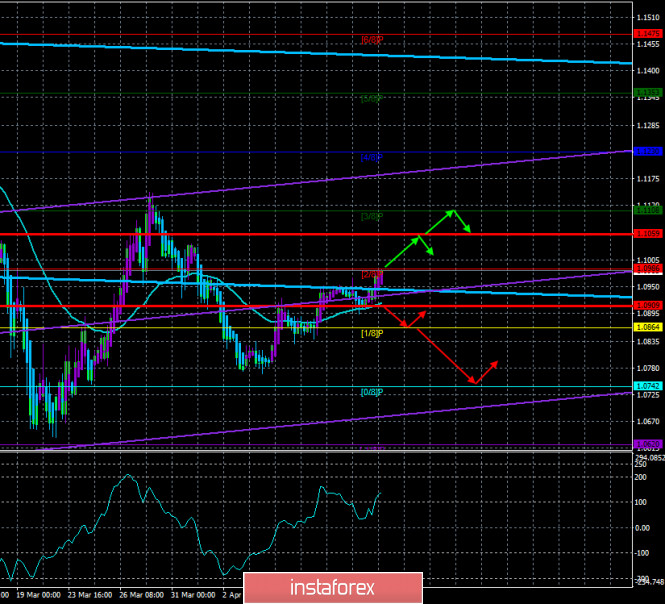

4-hour timeframe

Technical details:

Higher linear regression channel: direction - sideways.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - upward.

CCI: 135.6467

The EUR/USD currency pair starts the third trading day of the week with the continuation of the upward movement and testing the Murray level of "2/8"-1.0986. No important macroeconomic statistics were published the day before, and in principle, there were few important news. Thus, traders continue to trade the pair, relying mainly on the technical picture. Markets continue to calm down, which is reflected in the volatility indicator. Now the main thing is not to have any new outbursts of emotions and waves of panic. Then the trading mode will return to its usual course.

Several macroeconomic publications are scheduled for Wednesday, April 15. All in the United States. We are talking about reports on retail sales for March, as well as derivatives of this indicator, as well as industrial production for the same period. We believe that these reports will be interesting in any case, but the reaction of market participants to them again is unlikely to follow. In these conditions, reports like inflation, retail sales, and industrial production have almost zero value for currency traders. However, it will be possible to draw certain conclusions about the real contraction of the US economy, and traders may still work out these data since volatility has decreased significantly in recent weeks and traders may already need certain impulses to move the pair. As for the conclusions about the state of the American economy, we already clearly understand the state of the labor market and the unemployment rate in the United States. Now it remains to deal with consumer spending during the epidemic, crisis, and quarantine. According to experts' forecasts, retail sales in monthly terms may decrease by 6.5-8.0%. This is a huge loss. Changes are usually plus or minus 1%. Retail sales excluding cars could lose between 3.0% and 4.8%. Industrial production is expected to fall from 3.8% to 4.0% monthly. Again, we would like to note that these are only forecast values. Recall that the forecasts for applications for unemployment benefits, NonFarm Payrolls, and inflation in the US were also much better than the actual values. Thus, today's reports may be much worse than the traders' expectations.

Given such severe cuts in the country's economy, it is not surprising that Donald Trump wants to restart it as soon as possible. The problem, as we have already said, is the danger of the second wave of pandemics, new infections, new deaths. After all, sick people can't work. Thus, the removal of quarantine measures may lead to a spike in the incidence of diseases and an even greater drop in the country's macroeconomic indicators. However, while no concrete decisions have been made yet, it doesn't make much sense to talk about what might happen. Donald Trump himself believes that the epidemic has already been localized and slowed down. During a regular press conference at the White House, the head of state said: "Over the weekend, the number of new infections registered per day decreased throughout the country." Thus, Trump believes that the strategy of fighting the "coronavirus" works, and the Americans followed all the rules of quarantine. The US leader also thanked the medical staff and noted that "the situation is developing better now than previously imagined."

In Italy and Spain, there is also a slowdown in the spread of "coronavirus" infection. Health Minister Salvador Illa made an official statement that the "peak" of the pandemic has passed and the number of new infections is decreasing. Approximately the same situation is observed in Italy. Since April 14, the country has partially lifted quarantine measures, allowing the operation of stationery stores, children's clothing, bookshops, and laundries. There was also a list of production operations that are out of the ban on work. At the same time, all retail outlets must comply with the rules of distancing and disinfection.

At the same time, as the "coronavirus" slowly begins to loosen its grip on Europe, calculations begin to show how much the EU economy will decline, as well as when it can be expected to recover. Vice-President of the European Central Bank, Luis de Guindos, believes that Europe may experience a stronger economic downturn than the rest of the world. According to de Guindos, the French economy will decline only in the first quarter by 6%, Germany - by 10%. The recovery of economic activity, according to the Vice-President of the ECB, will begin no earlier than 2021. Also, Luis de Guindos noted that additional public spending on countering the epidemic could amount to 1.5 trillion euros.

However, the European currency does not react in any way to the statements of the ECB Vice-President, who predict a strong economic downturn in the Eurozone. This is because there will be a strong economic downturn in the United States as well. Thus, at the moment, we have no reason to assume that the balance of power between the euro and the US dollar has changed in any way. Thus, to draw such conclusions and make long-term forecasts, we need macroeconomic reports from both the US and the European Union, and we have not yet received most of the figures for March. Thus, only by the end of April will it be possible to make more or less accurate conclusions about the scale of economic losses in Europe and abroad. And based on these data, it will be possible to conclude which economy is waiting for more serious cuts. And based on this conclusion, it will be possible to predict the further movement of the euro/dollar pair in the coming months. At the moment, the upward movement is not too strong, as evidenced by the purple bars of the Heiken Ashi indicator. Thus, the euro currency is steadily moving towards the area of the 1.1000 level, which we called the target, based on the "correction against correction" scenario. After working out this level, we expect a decline in the European currency quotes. Both linear regression channels have turned sideways in recent days, but the lower channel has already started to turn up, indicating the formation of an upward trend.

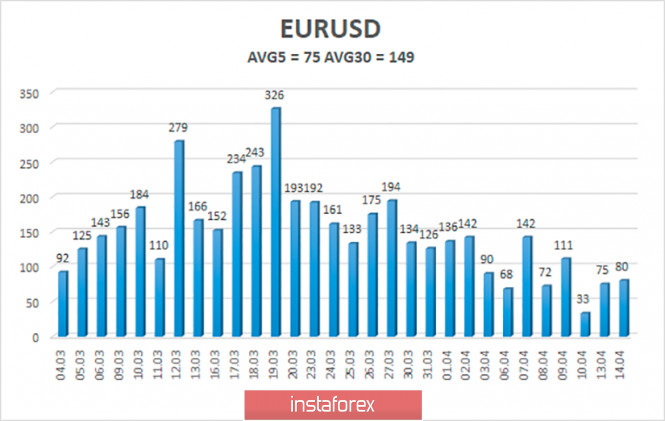

The volatility of the euro/dollar currency pair continues to decline and is already 75 points as of April 15. Thus, the markets continue to calm down and return to normal. The current value of volatility can no longer be called "strong". Today, another decrease in volatility is possible due to not very important macroeconomic statistics. We expect the price to move between the levels of 1.0909 and 1.1059 on April 15. Turning the Heiken Ashi indicator down will indicate a new round of downward correction.

Nearest support levels:

S1 - 1.0864

S2 - 1.0742

S3 - 1.0620

Nearest resistance levels:

R1 - 1.0986

R2 - 1.1108

R3 - 1.1230

Trading recommendations:

The euro/dollar pair resumed its upward movement. Thus, traders are now recommended to trade for an increase in the euro currency with the goals of the Murray level of "2/8"-1.0986 and the volatility level of 1.1059, before the reversal of the Heiken Ashi indicator down. It is recommended to sell the euro/dollar pair not before fixing the price below the moving average line with the goals of 1.0864 and 1.0742.

The material has been provided by InstaForex Company - www.instaforex.com