Surprisingly, yesterday's dynamics of the EUR/USD pair clearly corresponded to the receipt of information about the deal to reduce oil production. Which, by the way, has already been called the largest deal in history. At first, the lack of specifics about the parameters of this transaction coincides with the strengthening of the dollar. But at the same time, oil was also getting cheaper. And this is extremely interesting, since, in theory, the dollar should have played back Friday's inflation data, which it missed from the holidays in Europe and North America. But it behaved as if this very inflation did not exist. But as soon as certain parameters of the agreement became known, oil immediately began to rise in price, and with it the single European currency. At the same time, in fact, the volume of production is going to be reduced by 9.7 million barrels per day. Although yesterday morning representatives of oil exporting countries assured that the volume of reduction will exceed ten million barrels per day. Some claimed that the reduction would reach 12.5 million barrels per day. Moreover, it turns out that the agreement will be valid for two months. Then, if necessary, the parties can extend it. It is worth noting that the agreement was originally supposed to be valid for two years. Thus, the deal is not as large-scale as they try to present. Nevertheless, the appearance of specifics about the parameters of the deal somehow encouraged the market, and oil went up. Even if it is insignificant.

The macroeconomic calendar is completely empty today. The only difference is that now Europe is coming out after a long weekend. However, in the conditions of essentially quarantine, the exit after the holidays is a kind of convention. Most people still stay at home, and not everyone can work remotely. At the same time, there seems to be a steady decline in the number of new cases of coronavirus infection in the United States. And this has already led to talk that the quarantine measures can be lifted faster than previously expected. Nevertheless, Europe has already passed the peak of the epidemic, but there is no question of lifting any restrictive measures. And to be honest, today they will focus only on reports about the coronavirus, since the macroeconomic calendar was completely empty yesterday.

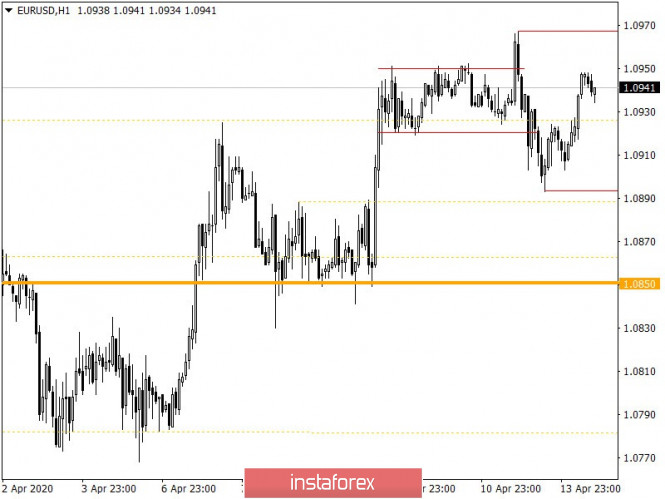

From the point of view of technical analysis, we see a surge in activity, where the Friday range of 1.0920/1.0950 was locally broken both upward and downward. As a result, the quote returned to its original framework of accumulation, where the amplitude of the oscillation can expand. In fact, the emphasis is on increasing trade volumes due to the European's return to the market.

In terms of a general analysis of the trading chart, the daily period, the quote continues to move in the recovery phase from the 1.0775 level for the seventh consecutive day.

It can be assumed that the previous day's range of 1,0893/1,0967 will play the role of a variable range, where the oscillation will be looped in nature, but refers to a local phenomenon. The main trading tactic will be to work on the breakdown of the set boundaries, while at the same time, with moderate risks on the deposit it is possible to consider transactions within a variable range.

We specify all of the above into trading signals:

- We consider purchase positions higher than 1.0970, with the prospect of a move to 1.1000-1.1020.

- We consider selling positions lower than 1.0890, with the prospect of a move to 1.0850.

From the point of view of a comprehensive indicator analysis, we see that due to the long horizontal course, the indicators of technical tools on the hour and day periods have become neutral.