To open long positions on GBP/USD, you need:

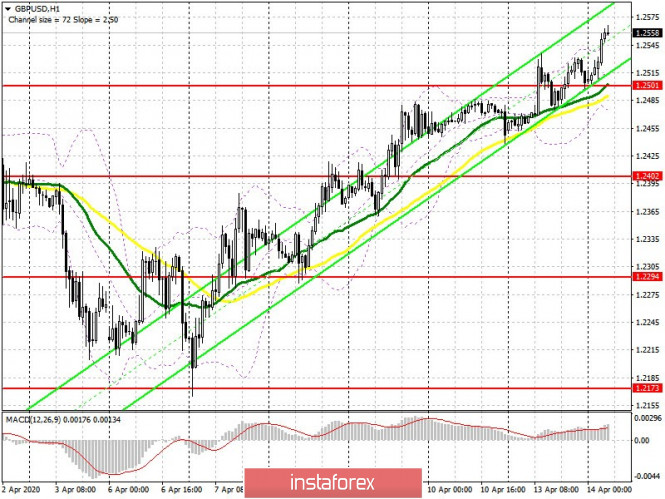

The lack of any news on the UK economy and Donald Trump's statement continues to push the British pound, which may soon lead to a test of new monthly highs. The Commitment of Traders (COT) reports for April 7 showed that there is a lack of desire of traders to go to the current market and take any actions with the pound, which is visible on the chart. A decrease in both long and short positions was noted. According to the data, a short non-profit position decreased from 32,156 to 27,561 during the reporting week, while long non-profit positions also fell from 37,149 to 31,254. As a result, the non-profit net position also fell from 4,993 to 3 693, gradually returning to its zero value, which could be a turning point for the upward correction of the pound in the short term. Given that important fundamental data for the British pound are not expected today, volatility is likely to continue to decline, returning the pound to its normal state. The bulls have already managed to break above the rather large resistance 1.2484 and are now targeting a high of 1.2605, the test of which will keep the upside potential in pair, which will open a direct road to the 1.2686 area, where I advise taking profit. In case GBP/USD declines in the morning, it is best to return to long positions only on a false breakout of support 1.2501, or buy the pound immediately to rebound from a low of 1.2402.

To open short positions on GBP/USD, you need:

Pound sellers should try to return the market under their control, and this will be possible only after consolidating below support 1.2501. A breakthrough of this area, slightly below which the moving averages also pass, will certainly raise the pressure on the pound, which will push it to a low of 1.2402, and quite possibly, to the larger area of 1.2294, where I recommend taking profit. It is worth noting that the bears will not rush to enter the market at current levels, and will wait until updating resistance at 1.2605, where a false breakout will be the first signal to open short positions in a pair. I recommend selling GBP/USD immediately for a rebound only after a test of a high of 1.2686 calculated per rebound of 40-50 points within a day.

Signals of indicators:

Moving averages

Trading is conducted above 30 and 50 moving average, which indicates that the upward trend will continue for the pound.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differs from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger bands

In case the pair falls, support will be provided by the lower border of the indicator at 1.2470.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - Moving Average Convergence / Divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit traders are speculators, such as individual traders, hedge funds and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long nonprofit positions represent the total long open position of nonprofit traders.

- Short nonprofit positions represent the total short open position of nonprofit traders.

- The total non-profit net position is the difference between short and long positions of non-profit traders.