What do traders expect in the new trading week? We have already described all possible options for the movement of the currency pair. Thus, we can only consider all the macroeconomic events that are planned for this week and hope that they will cause at least some reaction from market participants.

So, let's start with Monday. No important economic data will be available to traders on April 6. And, from our point of view, this will be a good opportunity to start a correction. The euro/dollar pair began to show signs of a corrective movement at the end of Friday. However, they were so weak that they cannot be taken seriously. Perhaps, the euro currency will get a little support on Monday, as we have already talked about a new round of consolidation of the currency pair up.

On Tuesday, Germany will publish an industrial production indicator for February. And even taking into account the fact that in February there was no such scale of the epidemic as in March, and the quarantine has not yet been introduced, the production rate may still fall by 3.9% in annual terms, and by 1% in monthly terms. However, looking at the long-term chart of changes in the indicator, it becomes clear that almost two years ago, the rate of production growth began to decline, and then slow down. Thus, the cause is not the coronavirus epidemic. But thanks to the help of coronavirus, the growth rate of industrial production in the country - the locomotive of the European economy can decrease even more. But this will become clear by the end of March.

There will be no publication of economic reports on Wednesday, April 8, but in the evening there will be the publication of the minutes of the last meeting of the US Federal Open Market Committee. It is rare for the minutes to have a serious impact on the currency market. Most likely, even now it will be ignored by traders.

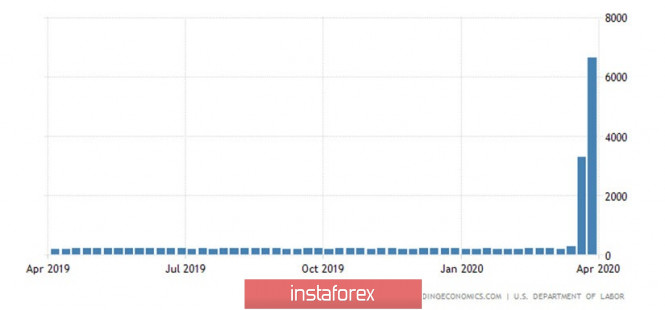

The next report on applications for unemployment benefits in the United States is scheduled on Thursday, which has recently become one of the most important reports. The last two weeks showed that the number of applications initially increased by 3.3 million, and then by 6.6 million. According to experts' forecasts, in the week up to April 4, the number of new applications for unemployment will be another 5-5.15 million. Thus, the labor market is highly likely to continue to shrink, but we should also recall the words of US Treasury Secretary Steven Mnuchin who urged not to pay too much attention to this indicator, as the Fed and the US government provided unprecedented assistance to the economy, which should stop its decline. However, it takes at least three weeks to feel the positive effect of the measures taken. As these three weeks have not yet passed, we are still seeing it with the decline of the US economy and the decline of the labour market.

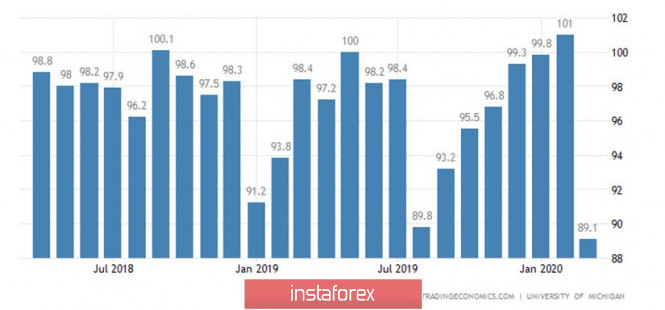

Also scheduled for this trading day is the University of Michigan's consumer confidence index, which fell from 101 to 89.1 in March, and could decline further in April, to a value in the 70-75 range.

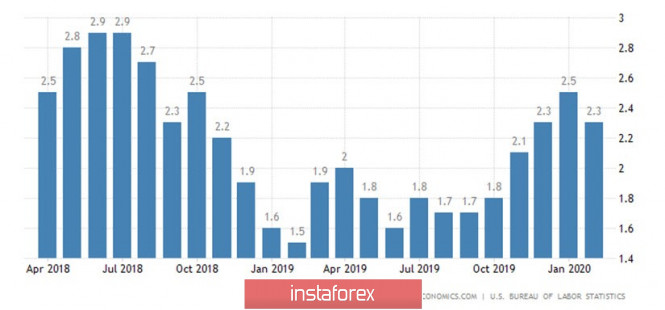

The release of inflation for March is planned on the final trading day of the week, which, according to experts' forecasts, should slow down from the current 2.3% to 1.5-1.6% in annual terms.

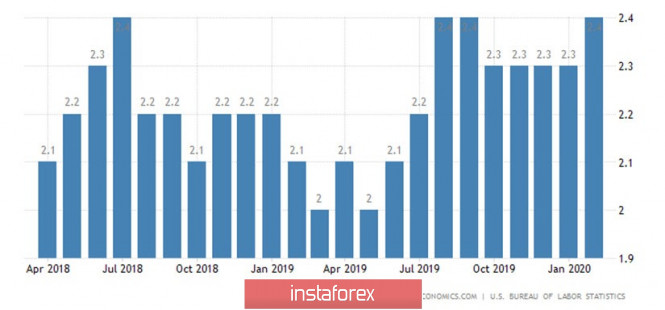

The core consumer price index is likely to remain unchanged from February at 2.3% YOY. Thus, according to these two indicators, all goods and services in the United States, except for consumer and energy resources, will not change the growth rate of their rise in price. But inflation, taking into account consumer goods and, most importantly, oil, will slow down its growth rate.

The package of macroeconomic information in the new week will be quite small. And if you reject all the news, which is 90% likely to be ignored by traders, then there is only one report - on applications for unemployment benefits. It is possible that a virtually zero macroeconomic background will lead to an even greater decrease in volatility, which we will consider as another step towards stabilizing the situation in the world. However, the OPEC+ meeting can also significantly help stabilisation, as part of which a decision can be made to reduce production volumes by key market players. The meeting was originally scheduled for April 6, and oil prices soared on Friday amid upcoming talks. However, today it became known that the summit participants decided to postpone the meeting to April 8 or 9, which will give additional time to agree on the terms of future agreements. Recall that due to the coronavirus pandemic, the demand for oil around the world has significantly decreased, which negatively affected the prices of black gold. However, in addition, the OPEC countries could not agree on changing the parameters of the deal to reduce the volume of oil production, or on its extension. Russia wanted to maintain the existing conditions, and Saudi Arabia insisted on further reducing oil production. As a result, all previous agreements ceased to operate and Saudi Arabia increased production on April 1, which finally finished off the price of oil of all varieties.

Even on weekends, US President Donald Trump continues to be the main news-maker in the world. At a time when the pandemic has taken over the whole world, and the largest number of infected citizens is observed in the United States, Trump believes that wearing a mask is "just a recommendation". He said that wearing a mask in the White House does not correspond to the status of the president. "I feel good. I just don't want to do it. Sitting in the oval office at a beautiful, large desk and wearing a mask, greeting presidents, prime ministers, dictators, kings... This is not for me, " Trump said. It should be noted that opinions among doctors about wearing a mask in order to reduce the spread of infection are divided. Some doctors believe that there is no special sense in masks, since they should not be used for more than two hours in any case, after which they should be thrown out. That is, an ordinary citizen may need from 1 to 5-6 masks per day. Such a number of masks simply does not exist and it makes no sense to produce them, given the fact that the coronavirus is spread not only "through the air". People can become infected when they come in contact with the surface which was previously touched by an infected person. However, most doctors still agree that wearing a mask reduces the rate of growth of the pandemic.

Recommendations for the EUR/USD pair:

We believe that the influence of the fundamental background next week will not be too strong. Thus, more attention should still be paid specifically to the technical picture of 4-hour timeframes. On both trading systems that we represent, short positions are currently relevant with targets near 1.0742 and 1.0673, but there are no signs of the beginning of a correctional movement. Nevertheless, a reversal to the top of the MACD or Heiken Ashi indicator may indicate a round of upward correction.

The material has been provided by InstaForex Company - www.instaforex.com