The euro-dollar pair showed a pronounced downward momentum last week, dropping from 1.1119 to 1.0773. The pair fell with small corrective pullbacks, but if you look at the weekly chart, it becomes obvious that the dollar held a clearly dominant position throughout the five-day trading period.

The current week also started with a slight correction. Thanks to the gap, the pair returned to the framework of the eighth figure, but further growth is moving slowly – each subsequent point is given to the EUR/USD bulls with great difficulty. Traders only trust the US currency, considering it a safe haven. And what is interesting is that extremely negative statistics from the US, contrary to obvious logic, played into the hands of the dollar. Market participants were so frightened by the Nonfarms that the greenback again began to enjoy increased demand, reflecting the increased anti-risk sentiment.

It is worth noting that the previous ADP report, which was published last Wednesday, created a false impression of the scale of the disaster in the US labor market. Experts of this agency said that in March, the number of employed people decreased by only 27,000 (with a forecast of a decline of 150,000). Although the abnormally high increase in the number of applications for unemployment benefits suggested the opposite trends, the ADP report gave hope for the best. And for good reason.

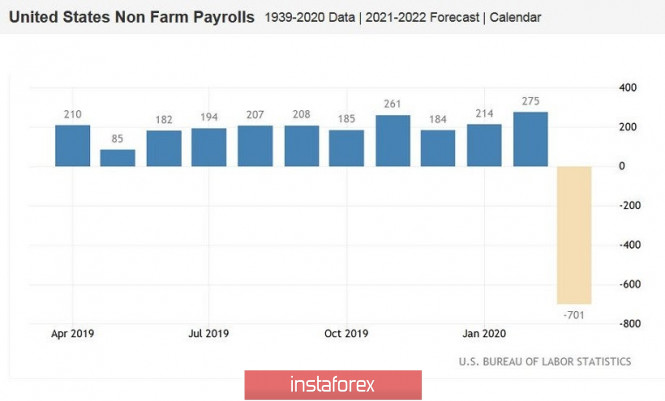

Nonfarms were weaker than even the weakest forecasts. The number of people employed in the non-agricultural sector in March decreased by 700,000, while the forecast of a decline of 100,000. The number of employees decreased by 713,000 in the private sector of the economy, and by 18,000 in the manufacturing sector. The unemployment rate jumped from 3.5% to 4.4%. According to some experts, the real situation is much worse. First, although Nonfarms reflect the situation after the beginning of the epidemic, they are still two weeks behind the report on applications for unemployment benefits. Let me remind you that this figure initially jumped to three million, and then to six million. According to some data, some states do not have time to process requests in time, so even such a huge increase may be understated. According to experts, the dynamics of growth in these applications corresponds to a 10% unemployment rate. So the next can demonstrate more disastrous results.

In other words, Friday's data on the US labor market once again reminded us of the scale of the economic crisis, while the number of infected and dead from Covid-19 continues to grow around the world, and especially in the United States. March Nonfarms provoked a surge of panic, allowing the dollar to regain its position across the market.

Especially since the European currency is under the weight of its own problems. Let me remind you that the leaders of the European Union at the online summit could not agree on the scale and tools to support the economy. At the same time, the press started talking about a serious split between the "South and North" of Europe. The key stumbling block was the so-called "crown bonds" - a common debt instrument for all EU countries that would help finance the response to the coronavirus pandemic. The leaders of Italy and Spain, which are the countries where the most widespread outbreaks of the virus occurred, called for the early introduction of such bonds. In turn, the main opponents of the idea were Germany, the Netherlands and Austria. The German chancellor said that in this case, it is necessary to resort to borrowing from the European stabilization mechanism. As a result, the six-hour online summit ended without result – the parties agreed to continue the dialogue at the level of Finance Ministers, so that in two weeks – that is, this Thursday, April 9 - they will again hold a teleconference.

According to available information, the parties could not come to a compromise – at least, the dialogue at the level of Deputy Finance Ministers also ended without result. Germany and the countries of the "North" that have joined it are against the issue of crown bonds, while representatives of the "South" still insist on this option. A meeting at the ministerial level is due to take place tomorrow, and if the parties do not find a common denominator, a repeat online summit of EU leaders may be in danger of being disrupted.

Yesterday, European Commission President Ursula von der Leyen, following the head of the European Council, said that Europe needs a Marshall plan - in her opinion, in the near future it is necessary to invest billions of euros in the EU budget to prevent an economic disaster. Despite such an ambitious statement, the market reacted coolly to it – apparently, traders doubt that the leaders of European countries will come to a compromise solution, and the split between the "North and South" will only worsen.

Thus, the euro-dollar pair this week will continue to react sharply to macroeconomic statistics from the US (in particular, to the weekly data on the growth in the number of applications for unemployment benefits) – and the worse they are, the more actively traders will invest in the dollar. The situation is anomalous, but the fact remains that as long as the market sees the US currency as a safe haven, it will acquire it in any bursts of uncertainty. But the European currency is waiting for tomorrow's meeting of EU Ministers, and, in fact, the leaders of European countries. If the parties still find a compromise, the euro will receive significant support. Otherwise, dollar bulls will continue to dictate their terms.

Thus, short positions on the pair in the medium term are still a priority. The downward movement is aiming for the 1.0730 mark – this is the lower line of the Bollinger Bands indicator on the weekly chart. But it is advisable to go into sales when the bears return the price to the seventh figure. Now the pair shows a correction that can end at the bottom of the ninth figure (the lower boundary of the Kumo cloud on the daily chart).

The material has been provided by InstaForex Company - www.instaforex.com