A new trading week begins, which promises to be quite boring. To our great regret, the coronavirus epidemic continues to spread in the world and as of April 12, the total number of infected people is already 1.8 million. About 108,000 deaths were also recorded. Thus, if the pandemic continues to spread at this rate, the quarantine will continue indefinitely, the economy of many countries of the world will continue to stand still, but its volume will not remain in place, which will contract at a very high rate. As we said earlier, the governments and central banks of the European Union and the United States are doing everything in their power to reduce the rate of slowdown in their economies. However, we cannot conclude how effective their actions are, since there is nothing to compare with. The reduced volatility of the EUR/USD pair is a pleasing fact in the current situation. The indicator fell to 33 points a day by the end of the previous trading week. It is clear that such a low value is associated with Good Friday. All banks and markets in the United States and the European Union were closed on this day, so all major players were outside the markets. Approximately the same situation will be observed on April 13, as Easter Monday is celebrated on this day. The calendar of macroeconomic events is completely empty on Tuesday, April 14. Thus, trading could be extremely boring and uninteresting during the start of the new week. Every day we hoped that volatility would subside, panic would leave markets, and traders would calm down for a month and a half now. But, it seems, the time has come to hope for the receipt of at least some information not related to the coronavirus and the growth of activity of market participants.

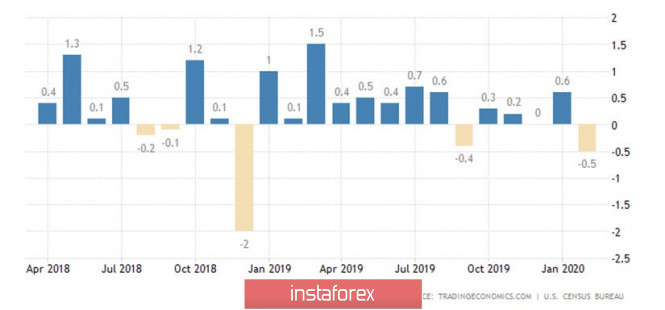

Important information will only be available to traders on Wednesday. Retail sales and industrial production for the month of March in the United States will be released on this day. The first indicator is expected to decrease by 6.5-7.0% on a monthly basis. As you can see from the chart above, this will be a record reduction over the past two years. And for the last five years. And for the last ten years. Retail sales excluding car sales may fall by 3%, which is also quite a lot.

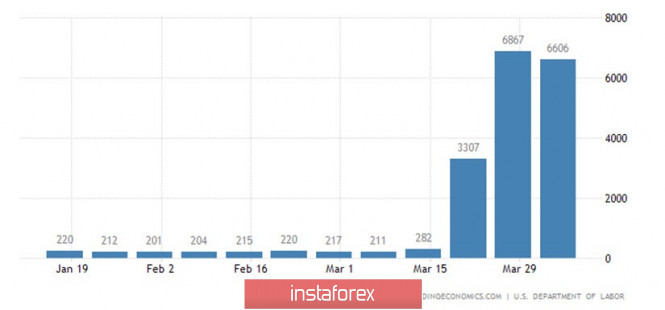

Industrial production is likely to lose 1.5% on an annual basis and 3.8-4.2% on a monthly basis. And I must say that such losses will not be considered high yet. The main thing is that these reports do not work out the same way as it did with the applications for unemployment benefits. Recall that initially experts expected an increase in the number of applications by one million, but in fact the number of new applications was 3.3 million in the first week of the epidemic, then 6.6 and again 6.6. The same could be said for the indicators of retail sales and industrial production. The more these indicators fall, the more likely it is that the US currency will continue its decline. In previous articles, we have already said that the US dollar has lost its advantage over the euro in the form of a strong monetary policy of the Federal Reserve. Now, therefore, the main question is: how much will the EU and US economies contract as a result of the crisis? If the rate of decline is approximately the same, then the euro and the dollar will remain approximately in the same position. If the economy of one of the countries will shrink at a higher rate, then it is its currency that could begin to feel pressure on market participants and in the long term begin to fall in price. Also, now a lot will depend on the emotional and psychological state of market participants. If there are no more new waves of panic, then we can count on reasonable and logical trading. If not, strong movements in different directions and panic could return to the market.. And it will depend only on the further spread of the COVID-2019 virus. More than 530,000 diseases have already been recorded in the United States, and most of them are in New York – the financial center of the United States. The total number of people infected with coronavirus in New York is 160,000. People who had no relatives or money for funerals were being buried in mass graves on Hart island. According to the mayor's office, this island has always produced burials of poor people, but previously the work was carried out no more than once a week. Now it stops only on weekends.

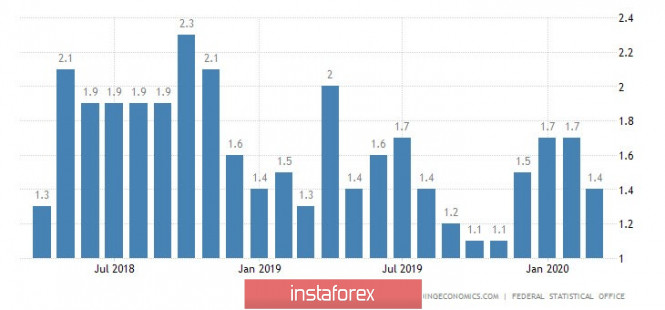

German inflation for March will be released on Thursday, which experts predict will slow from 1.7% to 1.4% in annual terms.

Furthermore, EU industrial production will be published with a forecast of 2.0-2.2% in annual terms. It is worth noting that such a reduction in the indicator does not even look like a crisis. EU industrial production has declined at a faster pace over the past two years. Thus, traders are likely to ignore these reports.

The most important report, from our point of view, will be published last: applications for unemployment benefits in the US for the week of April 11. According to experts' forecasts, this time we should expect another 4.6-4.7 million new applications. Accordingly, the total number of people who lost their jobs over the past month could reach almost 22 million. Recall that the economically active population in the United States is 160 million.

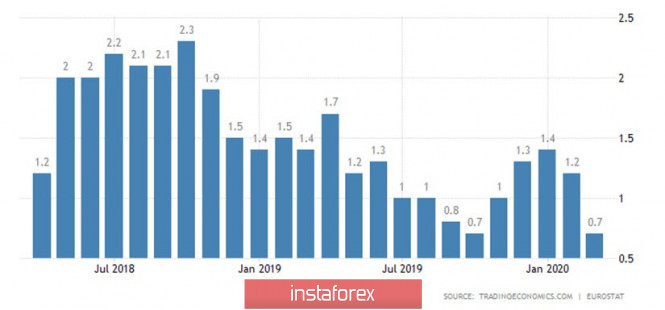

One report is set for release on Friday, the EU consumer price index for March, which, as predicted, will fall to 0.7% y/y. The core consumer price index may slow to 1.0% y/y. However, this report may also not be of interest to traders.

What can we say about the result? Traders' attention will be drawn again to the US data. Currently published indicators from Europe and Germany are not that important (for example, inflation), or indicators with fairly neutral, completely non-crisis forecasts(for example, industrial production). But the US economy continues to experience a shock, if only based on figures on the state of the labor market and the unemployment rate. However, this week we will still be able to understand how much industrial production and retail sales have decreased, and by these two indicators we will understand at the same rate the US economic indicators will fall, and at what rate unemployment is growing?

As for the technical picture, volatility could remain low in the first two days, while the euro/dollar pair could remain near the Senkou Span B line of the Ichimoku indicator. Thus, trading will be difficult these days. At the same time, given the general situation in the world, we do not believe that the markets have calmed down so much that now every day we will see a 30-40-point flat. So far, our "correction versus correction" scenario continues to be executed. The immediate goal is still $1.10.

Recommendations for the EUR/USD pair:

We believe that the fundamental background's influence for next week is not that strong. The exception is literally one or two reports. No important speeches or events are planned in the upcoming week. Thus, as before, more attention should be paid precisely to the technical picture. Monday and Tuesday may be flat, so the technical picture will change very slowly. In general, we are waiting for the Senkou Span B line to be overcome and continuing upward movement with targets at 1.1000 and 1.1037 (level of volatility).

The material has been provided by InstaForex Company - www.instaforex.com