The largest deal in history to reduce oil production took place. OPEC + countries, together with G20 members, agreed to reduce daily production by 9.7 million barrels per day, starting May 1, while the United States, Canada, Mexico and Brazil joined the agreement for the first time in history.

It is possible that the reached level of production decline will not be enough due to a strong drop in demand in the last month, however, market stabilization is not far away. It is unlikely that in the wake of increased enthusiasm, oil will consolidate above $ 40 per barrel in the coming months. Therefore, commodity currencies will not be able to get support and will remain outsiders of the currency market. The depth of the fall in global GDP is still estimated fairly approximately, so the most likely scenario for the coming months will be a further decline in risky assets and an increase in demand for gold and other protective instruments.

USD/CAD

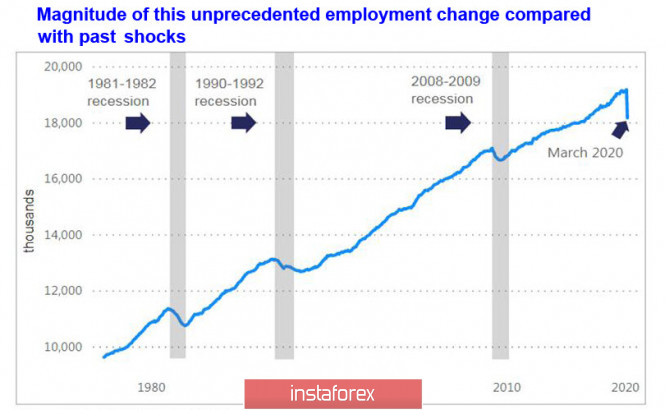

Canada's employment report for March gave impressive results. The number of employed decreased by 1.011 million people, the employment rate declined to 58.5%, which is the lowest since 1997. At the same time, the number of those who were not dismissed, but who did not work a single hour during the control week from March 15 to 21, increased by 1.3 million, and those who worked less than half their normal hours - by 0.8 million.

These numbers mean that at least 2.2 million Canadians are one step away from dismissal, while let's not forget that the population of Canada is just 37.9 million. Unemployment in March grew by 2.2% to 7.8%, this is the largest monthly increase since the beginning of data collection in 1976, and what will we see in April?

Even previous weaker dynamics inevitably led to a recession.

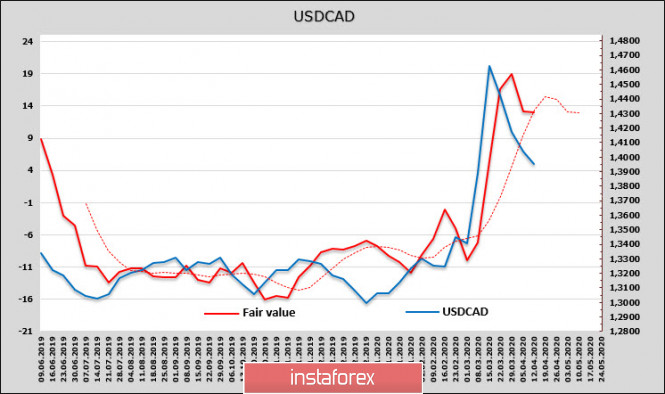

Nevertheless, the currency market practically did not respond to the publication. This is possible only in a few cases - either the upcoming changes were fully considered by the market earlier, or the currency market is in direct control of the six leading central banks led by the Fed, which, taking advantage of the unlimited possibilities of swap lines between themselves, extinguish all market fluctuations, not allowing currencies to go beyond the agreed currency corridors.

The first option is unlikely - forecasted employment levels were noticeably more modest. There remains a cartel conspiracy of central banks – after all, how else to keep the world currency system from collapsing, if not a coordinated devaluation of everything at the same time?

On Wednesday, April 15, the Bank of Canada will hold its next meeting. We should expect expansion of stimulus measures given the failed report on the labor market, which indicates a strong decline in economic activity, as well as the fact that the Bank of Canada is still behind the Fed in aggressive support of the economy. In particular, it is possible to start a direct redemption of municipal debts, direct financial support to the provinces, and the planned scope of initiatives substitutes for intrigue.

The CFTC report reflected a slight increase in the advantage of the short position in Canada, the estimated price is higher than the current one, but the dynamics has slowed significantly.

The USD/CAD pair is just one step away from the support of 1.3920/30, but there is no impulse, in case of breaking through, we can expect a decline to the zone of 1.3760/70, and more likely a slight pullback to 1.4040/60 followed by consolidation.

USD/JPY

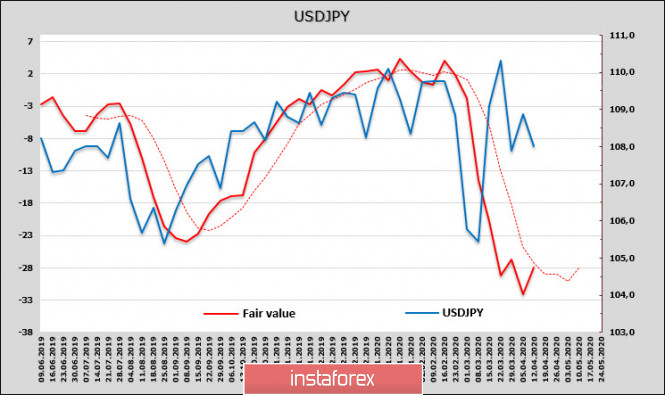

At a meeting on April 7, the Cabinet of Ministers approved a package of emergency measures to support the economy in the amount of 108.2 trillion yen. 80 trillion will be directed to measures to protect employment and maintain business, and another 26 trillion, for the payment of tax and insurance contributions by small and medium enterprises. This means that at least part of the funds from the government package will go directly to the country's budget to finance the deficit, which means that the Cabinet begins to Finance itself, already without the Central Bank, which regularly buys out the government debt without any hope of paying it off.

In fact, the government package is already a receipt that Japan is separated from a sovereign default only by the status of a reserve currency. And how else? – with the growing level of expenditures, the revenue part of the budget continues to decrease. Orders for machinery and equipment fell again in March, falling by 40.8% yoy, and Japan is losing its status as an industrial power.

The yen is still trading too high from the fair level, and thus, we should expect a decline to the support of 106.80/90; however, a strong movement is unlikely. A possible pullback to 10820/30 can be used to enter a short position with a stop at 108.60 and a target of 106.90.

The material has been provided by InstaForex Company - www.instaforex.com