4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - upward.

CCI: 55.9572

For the EUR/USD pair, the penultimate trading day of the week begins with a new round of corrective movement within the upward trend. The Heiken Ashi indicator is directed down, so the pair's quotes may fall to the moving average line in the near future. Despite the fact that the euro has grown by more than 400 points in the last 10 days, there is no strong correction, and there are no signs of the end of the trend. The market seems to be put on pause now and is waiting for new data and events. Since there are a lot of events in the world and a lot of statistics, traders often do not know which news to give priority to. Therefore, some of the news and reports are simply filtered out. In such circumstances, we recommend paying special attention to technical analysis, which best reflects the current trend of the pair. And based on technical analysis, longs remain relevant, However, without correction, it will be difficult for bulls to find new reasons to buy the European currency.

In the past week, the market is just full of various kinds of news, messages and data. Most macroeconomic statistics continue to be overshadowed by news from central banks, governments, and top officials. Today, on Thursday, March 5, no important macroeconomic publications are planned either in the United States or in the European Union. Only the speech of James Bullard, a member of the Fed's monetary committee, which will mean little, since the US regulator has already lowered the key rate. It was lowered by 50 basis points at once, which immediately caused a flurry of questions and a storm of emotions among participants in the stock and currency markets. On the one hand, the Fed went ahead and did not wait for the consequences of the "coronavirus" to become such that the US economy will literally lie down, as it was in 2008. It's good. On the other hand, it was almost possible to localize the virus in China. There have been very few new infections in recent days, and no one has yet been able to determine the consequences for the economy. The IMF and other world organizations have already lowered their GDP forecasts for all quarters of 2020. However, this does not mean that the coronavirus will continue to spread. Moreover, in 80% of cases, this is not a fatal disease, so the extinction of humanity is unlikely to threaten. In general, according to most experts and analysts, the reduction of the key rate could not be rushed so much. It was possible to wait for the meeting on March 18, or at least not to reduce the rate by 0.5% at once. After all, the Fed cannot fail to understand that the more the rate is lowered today, the fewer opportunities there will be to stimulate the economy tomorrow. The American economy has looked really good in recent years, especially compared to the British or European economies. This allowed the Fed to raise the rate to a fairly high level for the current conditions. However, now the rate has been lowered four times in a row and is only 1.25%. To the delight of Donald Trump. It was Trump who was the main opponent and fighter against "high" interest rates. It was the US President who regularly "poured mud" on Jerome Powell and the entire Fed, considering it the main source of all US problems. Then, in the last few months, we haven't heard a single word from Trump about Powell. There was even an impression that the odious us leader was resigned to the independence of the Federal Reserve. However, after the Fed urgently resorted to easing monetary policy, Trump immediately stepped up and again began to declare that the rate should be lowered to zero. "The Fed is lowering the rate, however, it should continue to weaken and match other competing countries," Trump wrote on Twitter. The US leader also said that "the game is not on equal terms", referring to global trade relations, and issued a sacramental phrase about "injustice towards the US". Strangely, Trump did not comment on the Fed's decision to lower the rate precisely because of the "coronavirus" and the fall in US stock markets. That is, it may even seem that the US President used the global epidemic to create pressure on the Fed and Jerome Powell. It sounds wild, of course. It is unlikely that the American President is behind the emergence of the Covid-2019 virus. However, you will agree that the comments of the American President regarding the virus and the actions of the Fed cause slight bewilderment. We will not be surprised if the Fed rate is 0% before November 2020, when the presidential elections are held in the States.

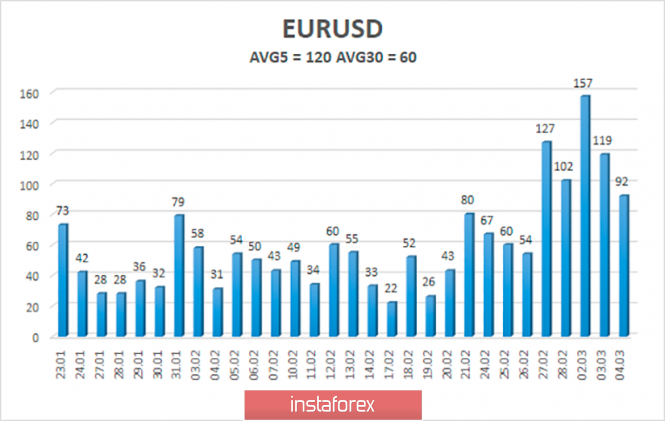

The average volatility of the euro/dollar currency pair rose to 120 points per day, which is just a record value for the euro. We haven't seen such volatility values for a long time. They only once again confirm that the markets are now in a very excited state and can move unexpectedly and sharply in any direction with terrible force. Thus, on Thursday, we again expect a decrease in volatility and movement within the channel limited by the levels of 1.1015 and 1.1255. A reversal of the Heiken Ashi indicator upwards will indicate the end of the downward correction.

Nearest support levels:

S1 - 1.1108

S2 - 1.1047

S3 - 1.0986

Nearest resistance levels:

R1 - 1.1169

R2 - 1.1230

R3 - 1.1292

Trading recommendations:

The euro/dollar pair continues to adjust. Thus, purchases of the European currency with the targets of 1.1169 and 1.1230 remain relevant now, after the Heiken Ashi indicator turns upward. It will be possible to return to sell positions no earlier than fixing the price below the moving average line with the first target of 1.0986, which is still not expected in the near future.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The highest linear regression channel is the blue unidirectional lines.

The lowest linear regression channel is the purple unidirectional lines.

CCI - blue line in the indicator window.

Moving average (20; smoothed) - blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com