4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - downward.

CCI: -33.4152

The second trading day of the week ended with the development of the moving average line and an unsuccessful attempt to overcome it. Thus, two trading strategies signal the development of "correction" lines at once - Ichimoku and "linear regression channels". In the first case, it is the Kijun-sen line, and in the second - the moving line. From both lines, the price can be said to have rebounded, so we will not be surprised if the downward movement is resumed today or tomorrow. Moreover, macroeconomic statistics continue to have a very weak impact on the currency market and on traders. Yesterday, we can say that the euro currency received some support due to more or less remaining afloat indicators of business activity in the manufacturing sectors of Europe and the European Union as a whole. But in general, macroeconomic statistics in the EU failed. It also failed over the ocean. And along with it, the attempts of Donald Trump and Steven Mnuchin to push through Congress a 1.6 trillion package of aid to the US economy. Thus, we continue to believe that increased attention should be paid to technical factors, high-profile events, and news related to the global epidemic and its control. The most important thing that we would like to note now is a slight recovery in the US stock indices against the backdrop of all the measures taken by the US government and the Fed, as well as stopping the fall in oil prices. There were hopes at least that in the near future there will be no new collapses in the US stock markets and the commodity market. Asian stock indices began to recover on the back of positive results in the fight against the "coronavirus". If the United States and the European Union also manage to contain the spread of infection, then in a month or two, we will be able to declare the recovery of economies in these regions as well.

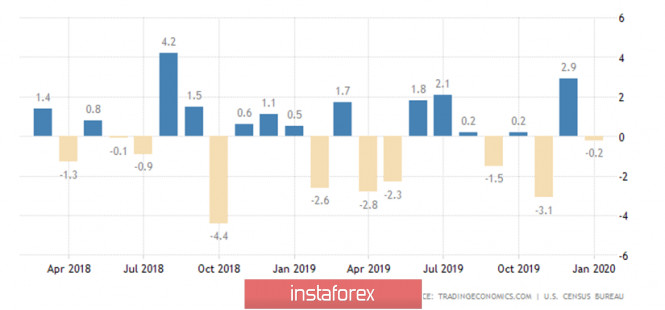

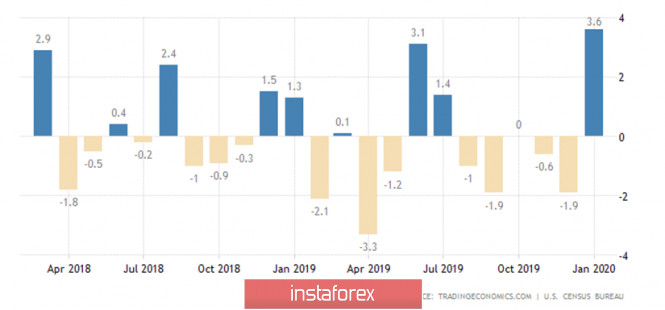

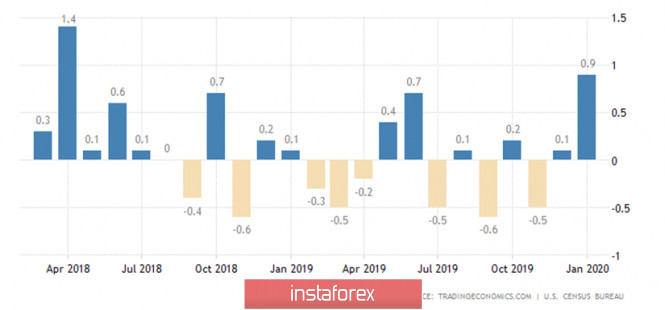

The situation with macroeconomic statistics is generally difficult. We are well aware that there is no reaction from traders to it. At the same time, we cannot ignore important reports. For example, orders for durable goods for the month of February will be published in the United States today. Forecasts for all four variations of the indicator predict a serious reduction compared to January. Again, the question is: will there be a reaction to these reports? After all, orders for expensive goods for February have a certain relation to March, when the epidemic gained momentum. Thus, the decline in indicators may be related to the "coronavirus" epidemic. Accordingly, this important report may still be a little to reassure market participants that the US dollar is invincible, and the economy of the United States - steadfast. As the latest actions and statements of the government, the Fed, Donald Trump personally, as well as representatives of the health sector, show what is happening now across the ocean - just flowers. All the worst is ahead. Thus, investors have already stopped completely mindless purchases of the US currency in recent days, and with each successive failed report from overseas, their desire to buy the dollar may become even less. And the euro currency in this situation, in fact, has nothing to lose. Given how much the euro has fallen in price, any macroeconomic statistics from the eurozone can not create additional pressure on this currency. But let's go back to the data on orders for durable goods in the United States. It is expected that the main indicator will lose 0.7-0.8% m/m by the end of February, which is not so much.

The indicator excluding defense orders is forecast to decline by 0.9-2.7% m/m, which, in principle, is not even surprising, after an overly successful January, in which an increase of 3.6% was recorded.

And excluding transport orders - with a decrease of 0.3-0.4% m/m, which is also normal after a 0.9% increase in January.

As for the "coronavirus" pandemic, the number of people infected in the United States has already grown to 47,000. Almost 600 deaths were recorded. US President Donald Trump expressed hope that the Democrats and Republicans will be able to agree on the adoption of a package of aid measures for almost $2 trillion. "The virus has a negative impact on our country. We are going to take a number of incentives to ensure that workers live their lives. It's not their fault. We want to take care of small businesses. I hope the Republicans and Democrats will come to an agreement," Trump said, ignoring the question of why this package of measures is needed at all if the US plans to end the quarantine and reopen the borders within a few weeks? Also, the US President for the first time in the years of his presidency praised the head of the Federal Reserve, Jerome Powell. "I am happy with the Fed, it's doing the right thing. I told him - Jerome, great job. I'm proud of him," Trump said.

From a technical point of view, everything will depend on how the price and traders behave around the moving average line. If this line is successfully crossed, the euro currency may receive additional support and continue to recover. And there, in the near future, perhaps, the markets will return to normal, volatility will decrease and the macroeconomic background will again matter. However, it is too early to draw such conclusions. The Heiken Ashi indicator is already showing signs of a downward turn, and the development of the moving was not just working out, it ended with a rebound. Thus, we would say that if the downward trend does not resume at this time, the beginning of the upward trend is definitely postponed.

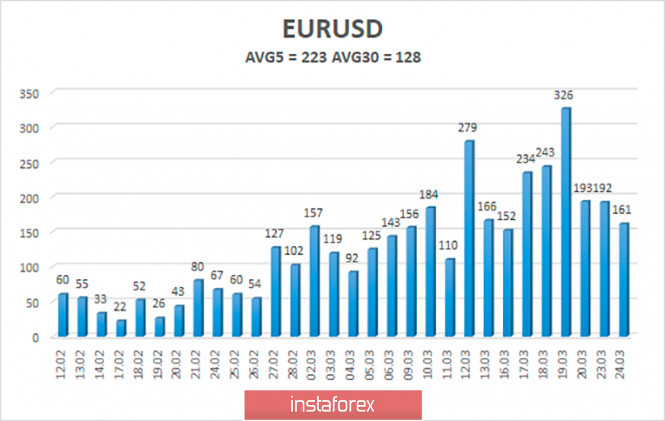

The average volatility of the euro/dollar currency pair remains at record high values but still began to lose growth rates. At the moment, the average value for the last 5 days is 223 points and is decreasing. The last three days have not been as volatile as the previous ones. On Wednesday, March 25, we expect a further decrease in volatility and movement within the channel, limited to the levels of 1.0531 and 1.0977.

Nearest support levels:

S1 - 1.0742

S2 - 1.0620

S3 - 1.0498

Nearest resistance levels:

R1 - 1.0864

R2 - 1.0986

R3 - 1.1108

Trading recommendations:

The euro/dollar pair has completed an upward correction and is ready to resume its downward movement. Thus, traders are still recommended to sell the euro currency with the targets of 1.0620 and 1.0531 after the reversal of the Heiken Ashi indicator down (2 bars of blue color). It is recommended to buy the EUR/USD pair not before fixing the price above the moving average line with the first target of the Murray level of "2/8"-1.0986. When opening any positions, we recommend increased caution, since the market is still in a state of panic.

Explanation of the illustrations:

The highest linear regression channel is the blue unidirectional lines.

The lowest linear regression channel is the purple unidirectional lines.

CCI - blue line in the indicator window.

Moving average (20; smoothed) - blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com