It seems that the market continues to behave inappropriately, ignoring any macroeconomic data and reacting only to the news background regarding the coronavirus. However, if you look more closely,it becomes clear that the result is exactly what it should be if market participants relied on macroeconomic statistics. It may be a little strange to react to each specific indicator, but in general, the result completely fits into the macroeconomic logic. And yes, of course, the market is so overheated that the pound simply has nowhere to go, and it has nothing else to do but grow. The rate of spread of coronavirus in the United States is really impressive and clearly makes investors think. In any case, the growth of the pound was not groundless.

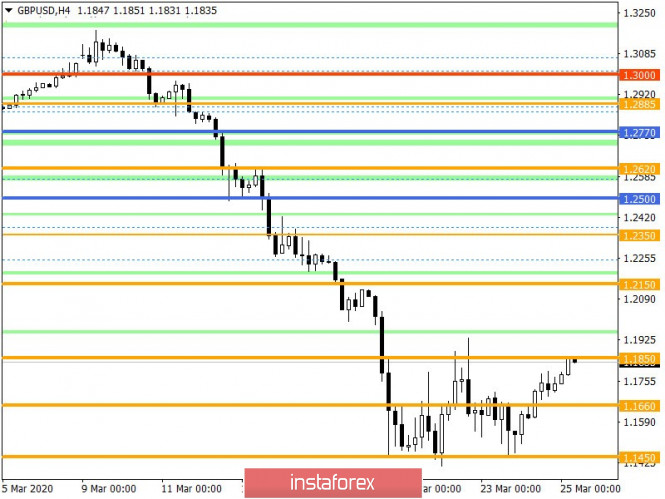

The fact that the market, to put it mildly, reacts strangely to individual macroeconomic data, is perfectly demonstrated by the reaction to the preliminary data on business activity indices in the UK. The record drop in the index of business activity in the service sector from 53.2 to 35.7, to put it mildly, did not greatly impress market participants and did not affect the growth of the pound. At the same time, another record low was set by the composite index of business activity, which collapsed from 53.0 to 37.1. The only thing that could be clung to in any way was the index of business activity in the manufacturing sector, which fell from 51.7, only to 48.0. They predicted a decrease to 45.0. But let's admit that this is clearly not enough. So the pound was largely growing due to elementary oversold prices.

Index of business activity in the service sector (great Britain):

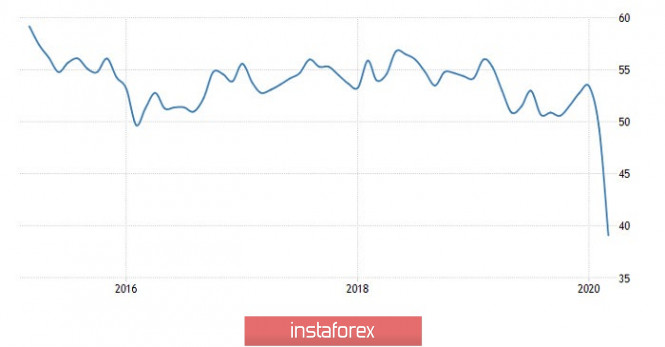

At the same time, there was nothing for the pound to go down, since in the United States, similar preliminary data on business activity indices also turned out to be incredibly weak. The same index of business activity in the manufacturing sector performed best, falling from 50.7 to 49.2, while they expected a decline as much as 42.0. The index of business activity in the service sector decreased from 49.4 to 39, setting a new anti-record. The composite index of business activity in the end, decreased from 49.6 to 40.5. So on both sides of the Atlantic, the index of business activity overlapped each other. But sales of new homes in the United States had nothing to brighten up, and their decline of 4.4%, which was more than the forecasts of 3.7%, really justifies the growth of the pound. Just like the incredibly rapid rate of spread of the coronavirus across the United States.

The index of business activity in the services sector (United States):

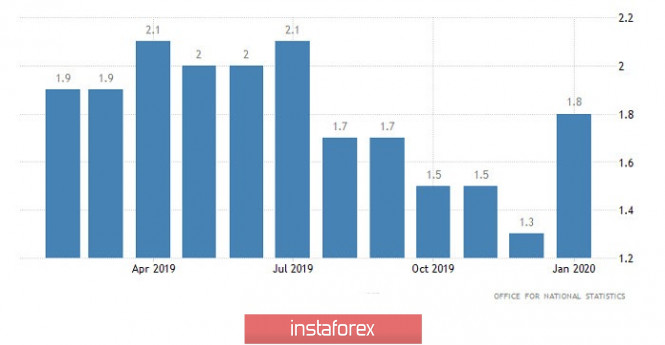

However, today the pound may suffer due to its own macroeconomic statistics , as inflation in the UK should fall from 1.8% to 1.5%. Further decline in inflation against the background of the coronavirus epidemic may force the Bank of England to take more drastic measures. The pound itself has been growing for several days, often completely unfounded. So a rebound in the opposite direction will not be something strange.

Inflation (UK):

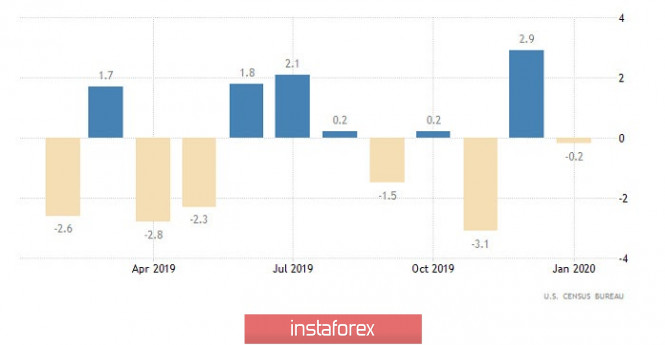

Moreover, US data will not be able to offset the negative data for the United Kingdom. With all due respect to orders for durable goods, they are not as significant as inflation. However, these same orders could fall by 0.7%. However, this will mean that the reduction in orders lasts for the second consecutive month.

Durable goods orders (United States):

In terms of technical analysis, we see a local upward movement relative to the low of 1.1446 towards the 1.1850 level, thus repeating the amplitude built at the end of the past week. In fact, we see a kind of slowdown in the relatively rapid downward movement, during which the levels of thirty years ago were touched. The key coordinates in this case are the levels 1,1450//1,1660//1,1850.

Looking at the trading chart in general terms, we see an inertial downward move with a scale of more than 1,600 points, in the structure of which there were no corrections and pullbacks. In fact, this is the first significant slowdown since the moment of inertia.

It can be assumed that the pattern of March 20 with a conditional development of the 1.1850 level could be repeated, where it is worth considering the initial slowdown with a subsequent downward move.

It is worth considering that the amplitude of the fluctuation within the level of 1.1180 can reach 100 points.

From the point of view of a comprehensive indicator analysis, we see that technical instruments, against the background of the price returning to the 1.1850 level, have turned upward in relation to short-term and intraday periods. At the same time, daily periods invariably keep a sell signal.