4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - sideways.

CCI: -33.0384

According to the "linear regression channels" system, the EUR/USD currency pair continues to adjust against the upward trend. Yesterday, March 11, the moving average line was worked out, and now the future movement will depend on whether there will be a consolidation below the moving average or a rebound. Unfortunately, it is still impossible to say that the panic on the world markets has definitely passed and the auction has returned to its usual course. For example, yesterday, macroeconomic statistics from overseas were ignored in the form of an inflation report. At the end of the trading day, the US currency slightly rose in price and the reasons for its strengthening lie with a 95% probability in the "technique". After such strong growth, sooner or later a downward correction should have started. And it began not yesterday when an interesting and important report was published. And a day earlier, the quotes went a much longer way down than yesterday, when there were fundamental reasons for the decline in quotes.

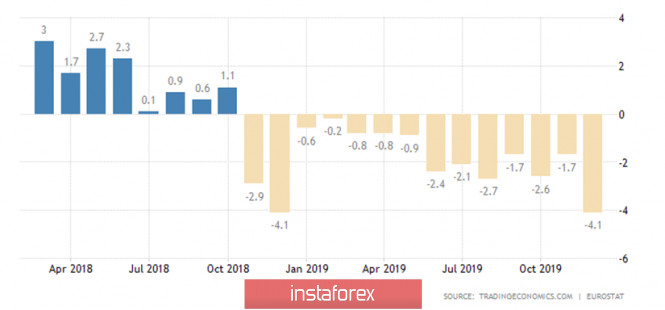

On Thursday, March 12, the situation may remain the same in the currency market. Important events in the European Union are planned for this day. Everything will start with the publication of the report on industrial production for January, which, with a high probability, will fail again. According to experts' forecasts, the reduction in volumes may amount to 3.1%. A month earlier, the value was -4.1% y/y. Thus, in principle, it does not even matter what value is recorded, in any case, it will be negative. In annual terms, the indicator should also be understood as an important feature. The current value is compared with the value of the same month last year. However, a year earlier, there was a drop of 4.1%. Thus, we are witnessing an absolute decline, not a relative one. In monthly terms, the indicator should add about 1.4%. However, after a series of failed months, a one-and-a-half percent increase is almost nothing.

An even more important event is the regular scheduled meeting of the European Central Bank. Recall that the Bank of England and the Fed lowered its key rates by 50 basis points. They did it at emergency meetings. As you can see, the ECB has waited for the previously scheduled date and there is only one question open: what decisions will be made by Christine Lagarde and the monetary committee of the regulator? It is worth noting that both the British Central Bank and the Fed had room for maneuver. That is, both central banks had a lot to lower rates. In the case of the ECB, rates are already negative. That is, it is unlikely that the European regulator will lower the rate by 50 basis points, which is now -0.50%. However, you can't keep the rate down. You need to resist the "coronavirus" and you can only choose from monetary instruments to reduce the rate or expand the asset purchase program. We believe that both tools will be applied. Most likely, the QE program will be expanded from the current 20 billion euros per month. And the deposit rate will be lowered. It should also be noted that immediately after the meeting and the announcement of its results, a press conference will be held by Christine Lagarde. However, the head of the ECB did not wait for the meeting itself and today, during a conference call with the leaders of the alliance countries, made a statement that literally shocked the markets. Although the word "shocked" would be acceptable if the markets were not in a panic all last week. Now every high-profile news or statement is no longer something discouraging. Lagarde said that Europe will face a serious economic shock, which will be comparable to the 2008 crisis if EU countries do not take measures to curb the spread of the "coronavirus". However, Lagarde believes that economic shock will not be avoided in any case. It can only be minimized and limited in time. According to Lagarde, European governments should encourage banks to lend to companies that have been affected by the coronavirus. Thus, if Lagarde's rhetoric continues to be "dovish" tomorrow, and the regulator goes for monetary policy easing, the US dollar will gain new strength to strengthen in tandem with the euro currency.

From a technical point of view, the pair continues to adjust. Tomorrow, much will depend on the fundamental and macroeconomic background. And the most important thing depends on whether market participants are ready to work out the incoming information. If not, the pair will continue to move according to the technical rules until (and if) the panic returns to the currency market.

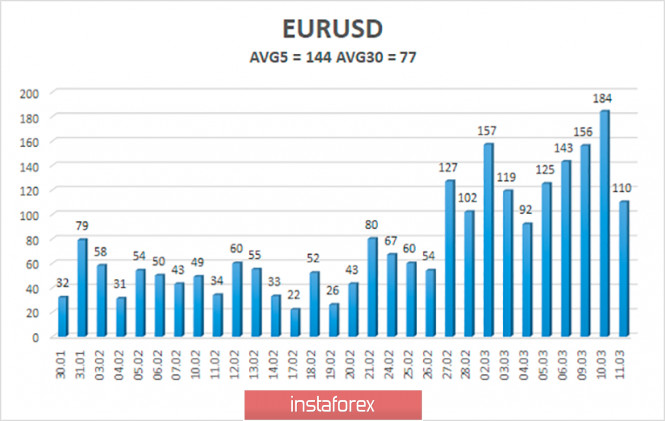

The average volatility of the euro/dollar currency pair remains at record values for the euro currency and rose to 144 points per day. This value once again confirms the fact that the markets remain in a very excited state and can move unexpectedly and sharply in any direction. It is enough to just compare the values of volatility in early to mid-February. Thus, on Thursday, we again expect a decrease in volatility and movement within the channel, limited by the levels of 1.1123 and 1.1411.

Nearest support levels:

S1 - 1.1230

S2 - 1.1108

S3 - 1.0986

Nearest resistance levels:

R1 - 1.1353

R2 - 1.1475

R3 - 1.1597

Trading recommendations:

The euro/dollar pair continues its downward correction. Thus, now it is still recommended to trade "on the trend", that is, to buy the European currency with the targets of 1.1353 and 1.1411, in case of a rebound in the price from the moving average. You can sell the pair after fixing the price below the moving average line with the first target of 1.1123.

Explanation of the illustrations:

The highest linear regression channel is the blue unidirectional lines.

The lowest linear regression channel is the purple unidirectional lines.

CCI - blue line in the indicator window.

Moving average (20; smoothed) - blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com