4-hour timeframe

Amplitude of the last 5 days (high-low): 111p - 103p - 107p - 103p - 165p.

Average volatility over the past 5 days: 116p (high).

The British pound was at a loss on Wednesday, March 11. In the morning, right after it became known that the Bank of England had lowered its key rate by 50 basis points, the pound/dollar pair fell. However, either large pending buy orders triggered when certain levels were reached, or traders remembered that the pound had fallen 200 points a day earlier, but sales of the British currency stopped very quickly. Thus, the reaction of market participants to the BoE rate cut was approximately the same as to a similar decrease in the Fed. That is very weak. At the moment, GBP/USD quotes fell to the Senkou Span B line, rebounded from it and even tried to resume the upward movement. There was a fresh fall during the US trading session caused by rather strong macroeconomic statistics from across the ocean. As a result, the pair continues to move down after a small upward correction. Once again, we would like to note that the panic has not completely left the markets. For example, yesterday the volatility of the instrument was about 200 points. Thus, the pair can still move in any direction, abruptly and unexpectedly.

So, the BoE lowered its key interest rate. The regulator lowered it when many central banks in the world were doing the same thing. However, it seems that Mark Carney and his successor, Andrew Bailey, were waiting for similar actions from the Fed, and only when this happened did they decide to ease British monetary policy. At a press conference after the emergency meeting, the current and future heads of the central bank said the following:

1) Lowering the key rate is intended to help and support British businesses, firms and households to cope with the effects of the coronavirus. According to Bailey and Carney, the economic shock will be sharp, strong, but short-lived.

2) The measures taken by the BoE are aimed at keeping firms and people in their jobs.

3) In addition to the measures taken by the BoE, Carney and Bailey expect the UK government to take similar measures to support the country's economy.

4) According to the latest stress tests, the UK banking system must withstand a prolonged economic downturn, and commercial banks will be able to continue lending to households and businesses.

It should also be noted that the British regulator has almost reached its lower limit of reducing the key rate. According to both Carney and Bailey, it makes no sense to lower the refinancing rate below the 0.1% mark, since such actions can have a negative impact on the UK banking sector. Thus, the BoE can lower the rate one more time, while the Fed can resort to such a step five more times. The question is whether Jerome Powell and company will take even more serious steps to ease monetary pressure on the US economy. Since a rate cut, especially such a strong one, is always a bearish factor for a currency whose issuer makes such a move, it is not surprising that the pound is now losing positions in a pair with the dollar. However, again, it is extremely difficult to say how long the downward movement will continue. We already said yesterday that the entire situation for the GBP/USD pair has transformed from a "swing" to a "roller coaster". Also, do not forget that if you delete the last two weeks, or simply do not pay attention to them, the British pound's position still causes great concern. We will not talk again about the uncertainty associated with Brexit, the future of the UK, the negotiations on trade deals with the EU and the US. The most banal thing that puts pressure on the pound and will continue to do so is macroeconomic statistics. Here is a simple example. The Fed feared a slowdown in the economy and lowered the rate. However, macroeconomic information from the US was strong and remained firm. Inflation is above 2%, the labor market has shown record growth rates in the last two months (based on reports from ADP and NonFarm Payrolls), and other indicators have at least not failed. What about the UK, whose central bank also feared for a slowdown in the economy and also cut the rate by 0.5%? Data continued to be weak, and remains so. Today, data on GDP was published in Great Britain. According to the first report, GDP in January in monthly terms was 0%. According to data from NIESR, the growth rate in January is also zero. Forecasts were higher. And that's not all. Data on industrial production for January was released today, which also failed. In annual terms, the decline was 2.9%, and 0.1% in monthly terms.

From a technical point of view, the pair is again approaching the Ichimoku cloud, which they could not overcome the first time. Given the fact that the indicators did not even have time to react to a small correction, there were no new sales signals.

A 24-hour timeframe

But on the 24-hour timeframe, there is a strong signal in the form of an unsuccessful attempt to overcome the Senkou Span B. line. It was followed by a rebound with the resumption of the downward movement. At the moment, the quotes of the pair have returned to the area below the Kijun-sen line, so the prospects for further movement downwards are quite good.

Recommendations for short positions:

The pound/dollar pair resumed a strong downward movement on the 4-hour timeframe. It was very inconvenient to sell the British currency during the day today, as there were a large number of different fundamental and macroeconomic events. However, those traders who remain in sell positions can hold them with targets at 1.2838 and 1.2753.

Recommendations for long positions:

Buying the GBP/USD pair is recommended only when quotes return to the area above the critical line with the goal of the first resistance level of 1.3150. When opening any positions, it is recommended to act as carefully as possible and remember about the increased risks.

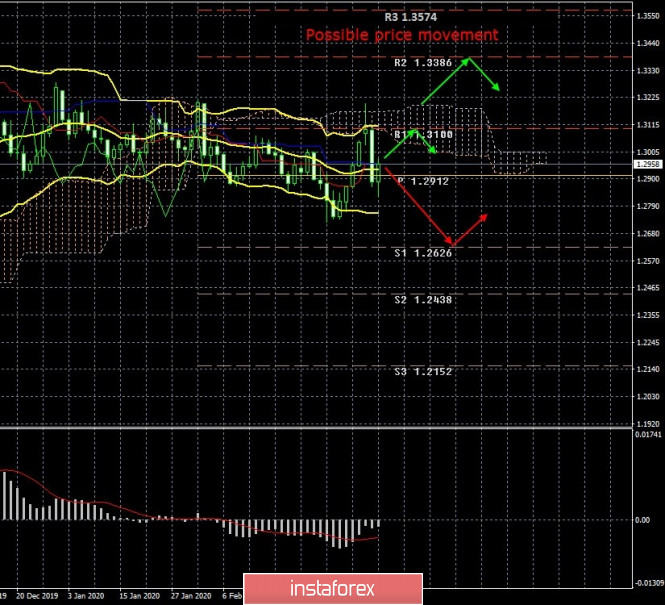

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicators window.

Support / Resistance Classic Levels:

Red and gray dashed lines with price symbols.

Pivot Level:

Yellow solid line.

Volatility Support / Resistance Levels:

Gray dotted lines without price designations.

Possible price movements:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com