4-hour timeframe

Technical details:

Higher linear regression channel: direction - up.

Lower linear regression channel: direction - sideways.

Moving average (20; smoothed) - up.

CCI: 234.0011

The GBP/USD currency pair begins February 3 with the continuation of the upward movement, which began on Friday. However, as we said in recent reviews, the flat continues in the long term (24-hour timeframe), which lasted all January. The pair tried to stop moving in the side channel on Friday, but there were no good reasons for the pound to strengthen. The growth of the British currency in the last two days of January is usually identified with the Bank of England's meeting and its results. More precisely, with the absence of these, which was a surprise for most traders. But if we examine the situation more closely: why is the pound growing if the BoE has not changed anything in its monetary policy and even the mood of the monetary committee has not changed? Is the pound appreciation caused by Brexit? Then this reason is even more doubtful, since Brexit itself did not change anything on January 31 in relations between the UK and the European Union. The "transition period" officially began, which should end on December 31, 2020, and just then it can be considered that Brexit has taken place and is fully completed.

We have already discussed the fact that nothing is changing for Great Britain. Today I propose to recall all the reasons why Britain wanted to leave the EU. These reasons will help to determine if any other countries will follow the path of Great Britain. Firstly, a migration policy that did not suit the British. Since the EU has no borders within itself, labor migrants penetrating into its territory had the opportunity to travel as they please. Of course, from the point of view of the level of earnings, migrants chose the countries with the strongest economies, which means that such a flood of people wishing to earn a flood in the UK that the social infrastructure could hardly cope with it. The second reason is that it is difficult for the British government to make a decision and the long process of agreeing any decision with Brussels, that is, with all EU member states. Thirdly, contributions to the treasury of the EU are not equal for all its members. The UK, as a country with one of the strongest economies, is larger than many other participating countries, while not receiving higher dividends from participation in the EU. At least, ordinary Britons thought so, and in fact the fate of Brexit in 2016 depended on their opinions. Although in fact, the UK did not pay the most, Italy, France and Germany ranked first in terms of contributions. Fourth, London's fierce desire to independently decide with whom to trade and on what terms. A few decades ago, the EU was really attractive in terms of ease of trade and access to markets. Now these problems are not so acute, especially since the UK will be able to trade again with the EU, the main thing is to agree on a deal, but in addition to the EU, London will be able to trade with other partners on terms that will be beneficial to it, and not to Brussels. There were other, less significant reasons, such as British traditions or the work of the UK judiciary, which also depended on EU law.

From our point of view, we will now become witnesses of the next part of the "Marleson ballet". Now Boris Johnson and Michel Barnier will conduct complex negotiations on trade relations, which will operate after 2020. The UK is set to publish an index of business activity in the manufacturing sector on Monday, February 3, which may finally come out of the recession zone. Experts' forecasts indicate a value of 49.8, however, such a value was recorded last month, so theoretically it can be exceeded. If this is so, then perhaps the BoE's mood, which expects to see the economic recovery without its intervention, will gain some fundamental confirmation. As for the prospects for the pound in the coming days, it is most logical to see a correction, as well as in the case of the euro. We are waiting for the Heiken Ashi indicator to turn down today.

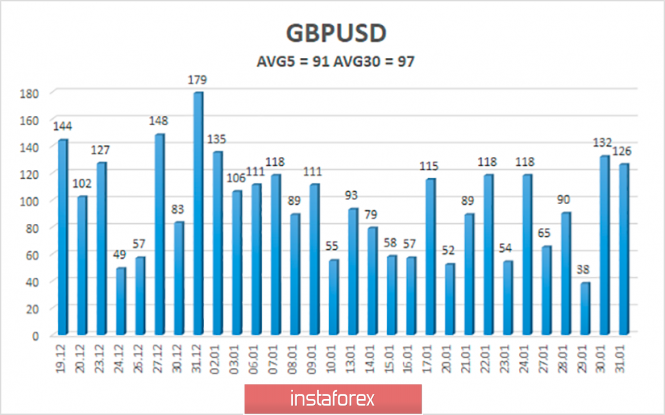

The average volatility of the pound/dollar pair has grown to 91 points over the past five days. According to the current level of volatility, the working channel on February 3 will be limited to 1.3112 and 1.3396. Corrective movement will be very logical for Monday, as the pound has strengthened quite a bit in the last two trading days.

Nearest support levels:

S1 - 1.3184

S2 - 1.3153

S3 - 1,3123

The nearest resistance levels:

R1 - 1.3214

R2 - 1,3245

Trading recommendations:

The GBP/USD pair continues the upward movement, which can be very short. Thus, traders are now advised to remain in pound sterling purchases with targets 1.3214 and 1.3245 until the Heiken Ashi indicator turns down. It is recommended to return to selling the British currency after the pair is re-attached below the moving average line with the first targets of 1.3031 and 1.3000.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of illustrations:

The highest linear regression channel is the blue unidirectional lines.

The smallest linear channel is the purple unidirectional lines.

CCI - blue line in the indicator regression window.

Moving average (20; smoothed) - a blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

Possible price movements:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com