4-hour timeframe

Technical details:

Higher linear regression channel: direction - up.

Lower linear regression channel: downward direction.

Moving average (20; smoothed) - up.

CCI: 356.0385

A new trading week and a new month begin. Last week ended with a rather strong strengthening of the European currency, which could hardly be predicted. As we already said in previous articles, the euro's current growth can hardly be called justified from the point of view of fundamental analysis. However, technical factors and the stubborn reluctance of the bears to sell the euro/dollar currency pair near the levels of 1.1000 and 1.0900 provokes another upward correction. A new week and Monday may begin with a downward correction, since we have observed a recoilless (and unfounded) upward movement during the last two trading days. In addition, the pair often shows low volatility and movement against the trend on Mondays. The trend has changed to an upward one, as the pair quotes crossed the moving average line.

The macroeconomic calendar is usually empty on Monday. But not on February 3. Indices of business activity in the manufacturing sector of the European Union will be published today, which has recently attracted almost the greatest attention. According to experts, the pan-European rate will remain at 47.8. It is also recommended to pay close attention to the German index, which has a forecast of 45.2 (the same as a month earlier). Thus, if these indices show an increase compared with the forecast values, this may cause additional support for the euro. However, we believe that after the euro's two-day growth, we will see a correction in almost any case on Monday, even if business activity in the eurozone industry increases. It is also worth noting that the growth of business activity is a positive factor, but most of the eurozone countries' indices will still remain below the key level of 50.0. Thus, after tomorrow's publications, most likely, we will again be forced to note the ongoing decline in the EU industry.

Similar indices for the United States will be published in two versions at the US trading session, Markit and ISM. As we have repeatedly said, the ISM index is the most significant. And it is this index that has gone "below the waterline" in recent months and is now at 47.2. According to forecasts, business activity in the US manufacturing sector will grow up to 48.5 according to ISM, and 51.7 according to Markit. Again, it will be necessary to look at what the real value of the ISM indicator will be. In principle, this data is also likely to have a very indirect effect on trading on Monday only if the values of the reports are not a big surprise for traders.

Meanwhile, the US Senate hearing of the impeachment case of Donald Trump is drawing to a close. Most senators came to the conclusion that the investigation listened to a sufficient number of witnesses and examined a sufficient number of documents (about 28,000 pages), so there will be no call for new witnesses, and the final vote for impeachment will be held on Wednesday, February 5. This was stated by the leader of the Republican majority in the Senate, Mitch McConnell. The leader of the Democratic minority, Chuck Schumer, condemned McConell's refusal to call additional witnesses to court and consider new documents. Thus, the whole process ends more than prosaically. In principle, from the very beginning, few believed that Trump would be impeached by the Senate. Now the chances of this are even less than at the beginning. We have repeatedly said that the main point of the whole trial is to pull down Trump's political rating as low as possible. This is precisely the goal that the Democrats pursued after the US president himself unsuccessfully "framed himself" with a conversation with Ukrainian President Vladimir Zelensky, for which he could be charged. It was beneficial for Democrats to drag out the process for as long as possible. This explains their desire to call new witnesses, consider new documents, since on the eve of the November elections, Trump's name should be associated with negative emotions. Far worse than an abuse of office investigation and obstruction to Congress. However, the Senate, in which the majority are Republicans, decided it was time to complete this case and the vote would take place on Wednesday. Basically, on Wednesday we just find out that Trump will remain at his post and that's all.

From a technical point of view, the Heiken Ashi indicator continues to paint the bars purple, so there is currently no correction. However, a reversal may occur during the Asian trading session, and a correction will begin on the European. In any case, it is better to consider long positions, if the upward trend continues, after the pair is adjusted.

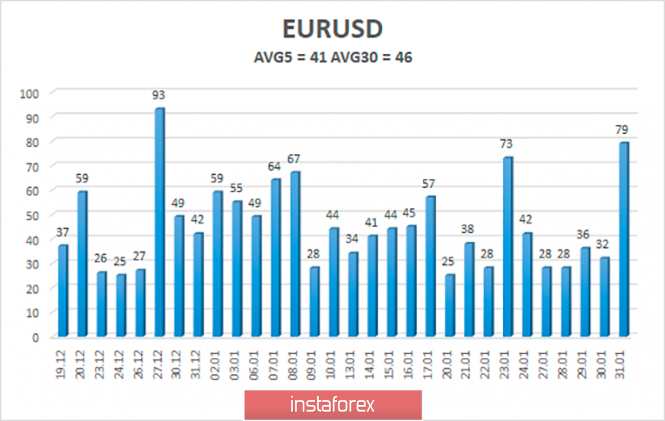

The average volatility of the EUR/USD currency pair increased due to trading on Friday to 41 points per day. However, this is still an extremely low value. Thus, on the first trading day of the week, we expect volatility not to exceed 40 points, and the boundaries of the volatility band will lie at approximately 1.1051 and 1.1133.

Nearest support levels:

S1 - 1.1078

S2 - 1,1051

S3 - 1,1017

The nearest resistance levels:

R1 - 1,1108

R2 - 1.1139

R3 - 1,1169

Trading recommendations:

The euro/dollar may begin to adjust on Monday. Thus, purchases of the European currency with the goals of 1.1108 and 1.1133 are relevant now, but we recommend waiting for the correction, its completion and only then should you start buying. It is recommended to return to selling the EUR/USD pair with the target of 1.1017 no earlier than consolidating the price below the moving average line, which will change the current trend to the downward trend, with targets at 1.1017 and 1.0986.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of illustrations:

The lowest linear regression channel is the blue unidirectional lines.

The smallest linear regression channel is the purple unidirectional lines.

CCI - blue line in the indicator window.

Moving average (20; smoothed) - a blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

Possible price movements:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com