4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - sideways.

CCI: -57.8991

The GBP/USD currency pair resumed its downward movement despite the complete absence of macroeconomic statistics in the United Kingdom and the United States. Nevertheless, the pair continues to show quite high volatility, as well as pronounced "swings". There is no trend movement as such since market participants are openly waiting for information about trade negotiations between London and Brussels or at least some important statistics. Since none of this is currently available, traders trade in different directions.

As we said in the next article on EUR/USD, all traders' attention will be focused on American statistics today. No significant report is expected from the UK this week, and the pound itself continues to throw and toss from side to side amid complete uncertainty about the prospects of signing trade agreements with the States and the European Union. However, let's return to the general outlook for the British currency and the outlook for today, Thursday, February 27. The general outlook has been clear for a long time. There is no reason for the British currency to grow and strengthen. This does not mean that the pound is 100% likely to start falling today. You should always consider the "market factor". In the currency market, there are not only speculators who aim to get the exchange rate difference and profit. Accordingly, those who carefully monitor all news and messages on important topics for a particular currency. There are also large companies that buy a particular currency in large volumes to conduct their activities and their transactions also affect the exchange rate. However, these companies are not guided by a fundamental or macroeconomic background when making transactions in the foreign exchange market. They need the currency to conduct import-export transactions or hedge risks. Thus, in theory, the pound from the current positions can start to get more expensive, even if the fundamental background is against it.

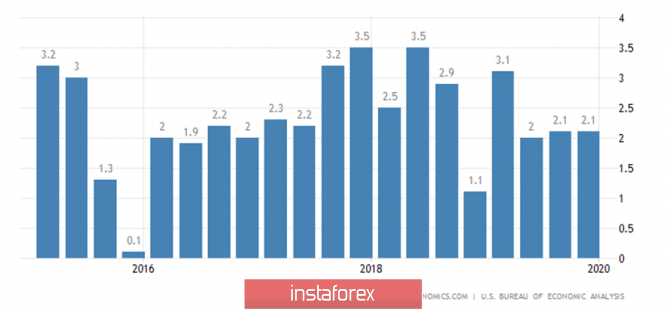

However, let's return to the shorter-term prospects. The most interesting and at the same time predictable indicator is the US GDP for the fourth quarter. However, this is only a preliminary value, so even if the actual value differs from the forecast value, it is not a fact that traders will decide to work out this report. According to economists' forecasts, the increase will be 2.1% in the fourth quarter, which coincides with the value of the third quarter.

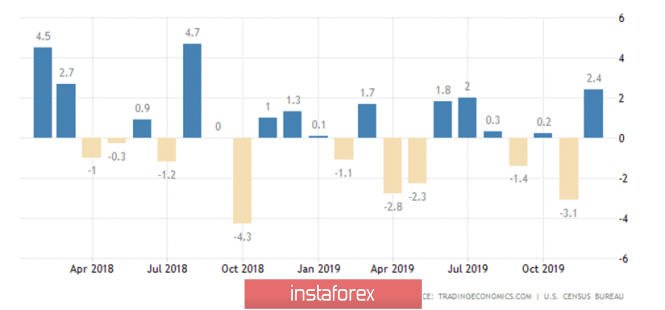

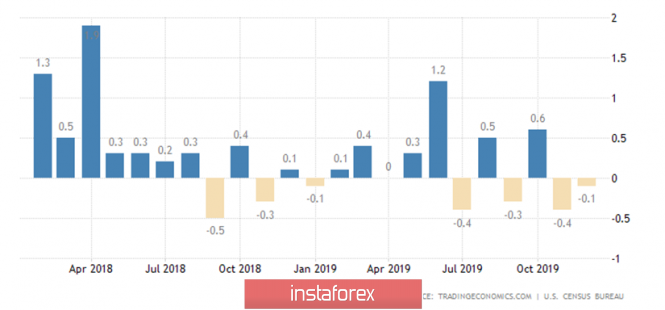

More important, from our point of view, is the indicator of orders for durable goods, in all four of its variations. The overall indicator, according to the chart, jumps up and down every month or two, showing an increase or fall. Today, the forecast is -1.5% m/m, which is negative for the dollar, but it fits into the usual behavior of the indicator.

Another significant indicator is "excluding transport orders", which more often shows the positive trend and an increase of 0.2% m/m is planned in January. In addition to the two indicators already described, orders will be published "excluding defense and aviation" with a forecast of +0.1% m/m and "excluding defense" with a forecast of +1.3% m/m. Thus, it is expected that the main indicator of orders will be reduced from one and a half percent, and all others will show minimal growth. However, we are almost certain that the actual figures will differ greatly from the forecast values, and in different directions. Accordingly, it will be necessary to draw conclusions on these indicators after their publication. Data on the GDP price index and applications for unemployment benefits are also planned for today. However, these reports are secondary.

Thus, it is even difficult to say what to expect from macroeconomic statistics from the United States. The pound has resumed falling but has been moving in recent days with absolutely no fundamental support. How will traders react to any kind of statistics from overseas is difficult to say. From a technical point of view, the downward trend again prevails in the market, but at the same time, the pound/dollar pair continues to have a frank "swing". Therefore, the best advice for traders in the current situation is to be more cautious. The pound is not the most attractive tool for trading right now.

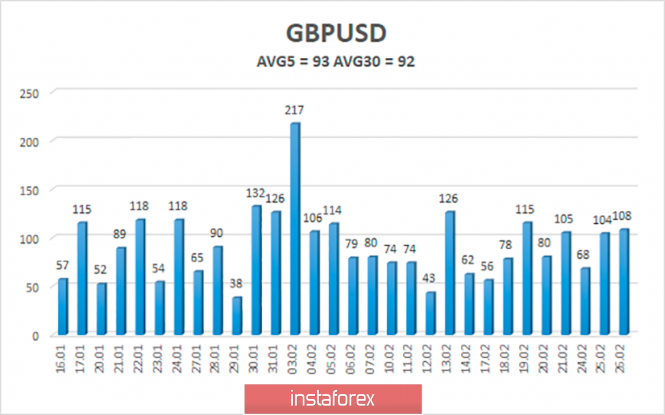

The average volatility of the pound/dollar pair over the past 5 days is 93 points and is still characterized as "average" in strength. According to the current volatility level, the working channel on February 27 will be limited to the levels of 1.2814 and 1.3000. A reversal of the Heiken Ashi indicator to the top will indicate a possible resumption of the upward movement, within the "swing".

Nearest support levels:

S1 - 1.2909

S2 - 1.2878

S3 - 1.2848

Nearest resistance levels:

R1 - 1.2939

R2 - 1.2970

R3 - 1.3000

Trading recommendations:

The GBP/USD pair resumed its downward movement. Thus, it is now recommended to sell the pound with targets of 1.2878 and 1.2848, before the Heiken Ashi indicator turns up. It will be possible to buy the British currency with the targets of 1.3000 and 1.3031, but in small lots, if traders again fix the pair above the moving average line.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The highest linear regression channel is the blue unidirectional lines.

The lowest linear regression channel is the purple unidirectional lines.

CCI - blue line in the indicator window.

Moving average (20; smoothed) - blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com