The euro-dollar today has slowed its correction. After a three-day consecutive growth, buyers felt a certain discomfort - during the European session on Wednesday, the pair actually stagnated, showing rare and multidirectional price "delays". This price dynamics is due primarily to the behavior of the US currency. The dollar index suspended its decline, returning to the area of 99 points. But the European currency is not able to independently "pull out" the correction, even with the general phlegmatism of dollar bulls. Coronavirus continues to "walk" around Europe, provoking panic in the markets and putting natural pressure on the euro. The changed fundamental background did not allow EUR/USD buyers to enter the ninth figure and gain a foothold above the resistance level of 1.0920. This fact should alert supporters of long positions - purchases are now quite risky. Today's behavior of the pair suggests that the current corrective growth has almost exhausted itself - but for the next price wave, an appropriate informational occasion is needed.

Let me remind you that the weakening of the US currency was primarily associated with the prospects for the monetary policy of the Fed. Rumors have intensified in the market that the Federal Reserve will lower rates in the foreseeable future - some spoke about the April meeting, others relied on June. Some currency strategists do not exclude a double rate cut (in summer and autumn). Oil was added to the fire and the comments of some representatives of the Fed, who spoke in favor of lowering rates. This is not only about successive doves (for example, Kashkari), but also other members of the Committee, such as Judy Shelton and Christopher Waller (protege of Donald Trump). Representatives of the hawkish wing also talk about the risks of the coronavirus epidemic, but at the same time they urge not to rush into action. In their opinion, now we should take a wait-and-see attitude in order to objectively assess the current situation.

In other words, today there is no definitive confidence in the market that the Fed will announce a rate cut on March 18. The Fed vice president Richard Clarida also sowed certain doubts. Yesterday, he said that the central bank is monitoring the impact of the epidemic on the US economy, but at the same time, "it is too early to say that the epidemic will require changes in monetary policy."

Therefore, the dollar slowed down as well - the probability of a rate cut has decreased, while the key macroeconomic indicators in the US have recently shown good dynamics. In turn, the euro has no arguments for its own growth, especially against the backdrop of increasing panic. To date, coronavirus has been recorded in 15 European countries. Italy has suffered the most - the number of infected has exceeded 300 people, 12 of them have died. Next, in descending order - Germany, France, Britain, Spain, Austria, Croatia and the lowest quantity - in some other countries. The Italian precedent frankly scares investors, including in the context of economic prospects.

Judge for yourself: the measures taken by the Italian government have affected nearly 30 million people. Schools and universities were closed in the north of the country (not only in those regions where an outbreak was recorded). Many factories, bars, restaurants are closed. Government departments operate on a limited basis. According to preliminary data, if a similar situation persists in the coming months, Italy's GDP may decline by 0.5-1%. This will lead to a recession in Italy and an increase in its external debt. If you project the Italian precedent over the entire eurozone, the consequences will look disastrous. And judging by the dynamics of the spread of coronavirus in Europe, this scenario is quite likely.

That is why the further corrective growth of the EUR/USD pair depends only on the "well-being" of the dollar - a single currency will only move in the wake of the greenback.

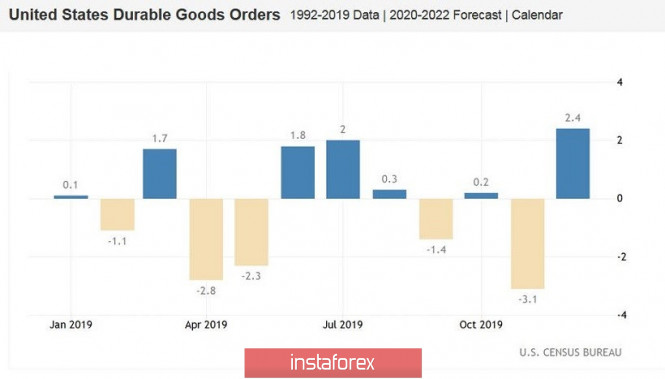

In turn, the dollar will respond to the dynamics of macroeconomic statistics. For example, tomorrow, February 27, we will find out the second estimate of US GDP growth for the fourth quarter of last year. According to forecasts, this indicator will be revised upward from 2.1% to 2.2%. Although this review will be minimal, the very fact of such dynamics will improve the position of the greenback. The price index should remain at the same level, reflecting a slowdown - if in the second quarter of 2019 it reached 2.4%, then in the fourth quarter it fell to 1.4%. Data on the volume of orders for durable goods in the United States will be released on Thursday. The indicator showed positive dynamics in December, having got out of the negative area (similarly, excluding transport). Experts predict contradictory dynamics in January - the overall indicator should slow down to -1.4% (from the previous value of 2.4%), and without taking into account transport, it should grow to a low of 0.2%.

If both indicators collapse into the negative area, the dollar may be under pressure. In this case, the EUR/USD bulls will be able to test the nearest resistance level of 1.0920 (the middle line of the Bollinger Bands indicator is on D1). If the statistics are on the dollar side, the pair will again return to the bottom of the eighth figure.

The material has been provided by InstaForex Company - www.instaforex.com