Over the past week, the single European currency has been doing nothing but getting cheaper. But to be honest, just on Friday it became clear that something incredible was needed to further weaken it.

Everyone expected that the market would be quiet and calm before the publication of the report of the United States Department of Labor; however, the single European currency rushed down from the very opening of the European session. The reason was the extremely weak data on industrial production in Germany and France. So, in the largest economy of the euro area, the decline in industrial production accelerated from -2.5% to -6.8%, which can be called a complete disaster. In France, industrial production growth of 0.9% gave way to a decline of -3.0%. Nevertheless, things are a little better in Spain, where industrial production is still increasing, although it slowed down from 1.6% to 0.8%. On the other hand, retail sales in Italy, whose growth rates slowed down from 1.0% to 0.9%, only added to this terrifying picture. As a result, everything is bad in Europe, and this is visible to the naked eye, which caused the further decline of the single European currency.

Industrial production (Germany):

At the same time, the market practically did not react to the content of the report of the United States Department of Labor, which turned out to be incredibly good. Yes, the unemployment rate increased from 3.5% to 3.6%, but the share of physically fit in the total population increased from 63.2% to 63.4%. Thus, the unemployment rate was supposed to increase stronger. The whole point is 225 thousand new jobs created outside agriculture, while they were expected to be only 148 thousand. In addition, the growth rate of average hourly wages accelerated from 3.0% to 3.1%. However, the average working week remained unchanged. So, the content of the report is really very, very good, but the dollar could not develop its success.

Unemployment Rate (United States):

Apparently, the reason lies in the fact that the market was already preparing for the fact that the labor market data would turn out to be pretty good, but European statistics came as a complete surprise, although the content of the report was better than expected. Nevertheless, it was no longer enough that the dollar continued to strengthen further. This means that its growth potential is extremely limited. So now, any negative news for the dollar will be a great reason for correction. However, only politicians will be able to give the market a similar reason today, since the macroeconomic calendar is completely empty. And if there is no scandalous news, then the single European currency will either stand still or grow slowly, almost insignificant at least because of the overbought dollar.

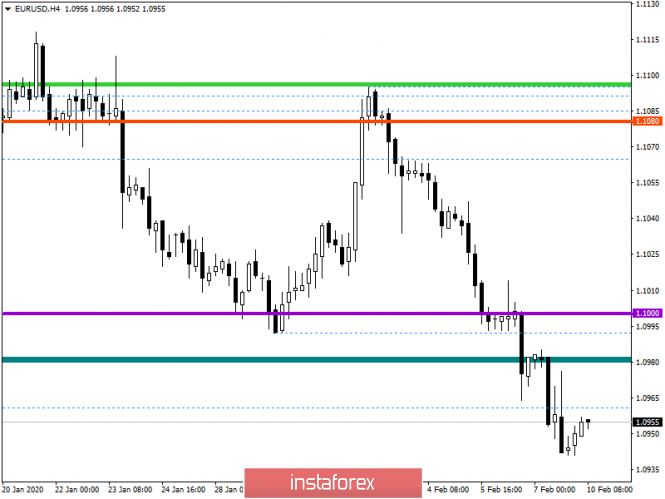

From the point of view of technical analysis, we see a continuous downward interest, which led to a breakdown of the psychological level of 1.1000 and consolidation of quotes within the level of 1.0950. In fact, we managed to return to the autumn 2019 region, while the downward move has been held for more than five weeks.

In terms of a general review of the trading chart, we see not just an attempt to restore quotes, relatively elongated correction, but a full-fledged process, with a value of more than 80%.

It is likely to assume that downward interest will continue in the market, but due to local overheating of short positions, a rebound towards 1.0980-1.0990 may occur. Further downward trades will be considered if prices are fixed lower than 1.0940.

Concretizing all of the above into trading signals:

- Long positions are considered in case of price fixing higher than 1.0960, with the prospect of a movement to 1.0980-1.0990.

- Short positions are considered in case of fixation lower than 1.0940, with the prospect of a movement to 1.0890.

From the point of view of a comprehensive indicator analysis, we see a downward interest in hold, where a buy signal began to appear for relatively shorter periods against the background of local stagnation.